Capital of South Korea's retail traders is driving ether worth momentum and company ether financing corporations, in response to trade insiders, because the world's second-largest cryptocurrency buying and selling is simply 7% under its all-time excessive.

In response to Samson Mow, CEO of Bitcoin Know-how Firm Jan3, the “solely” that maintains ether (ETH) costs and ether finance corporations at present ranges is Korean retail capital value round $6 billion.

“ETH influencers are flying to Korea to get to the market only for retail. These traders have zero ideas in regards to the ETHBTC chart and are shopping for the following strategic play.”

sauce: Samson Mo

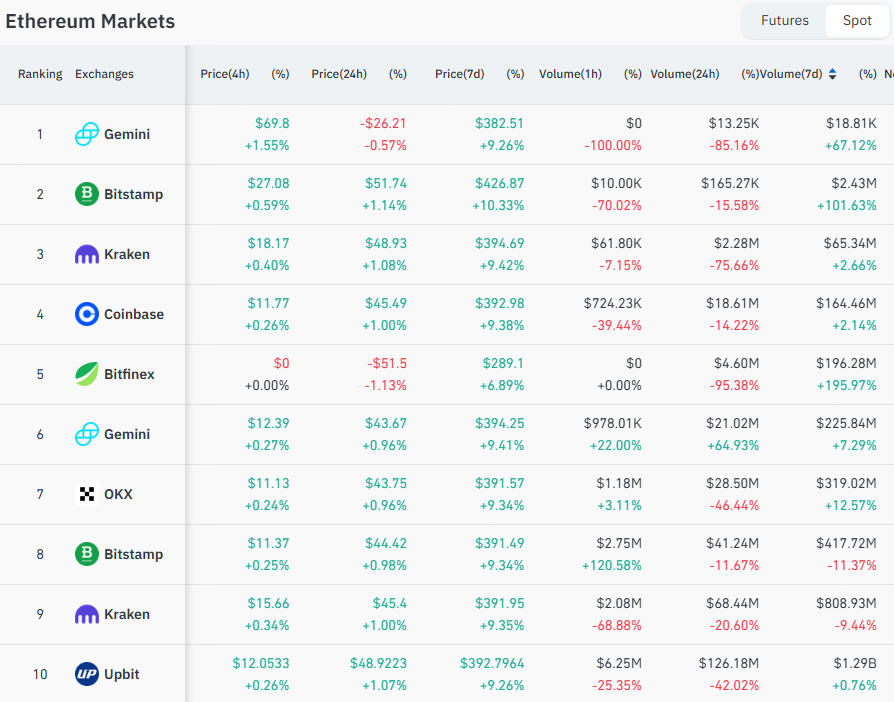

Upbit and Bithumb are two main centralized exchanges (CEX) utilized by Korean retailers.

futures knowledge, Upbit ranks because the tenth largest CEX for Ether futures buying and selling, incomes a buying and selling quantity value $129 billion, in response to Coinglass knowledge.

CEXS by Ethereum futures buying and selling quantity. Supply: Coinglass

Crypto futures buying and selling sometimes exceeds the quantity of spot buying and selling, which has a significant affect on the worth of the underlying asset.

Associated: Japan's new PM could possibly be a boon for threat property, crypto markets

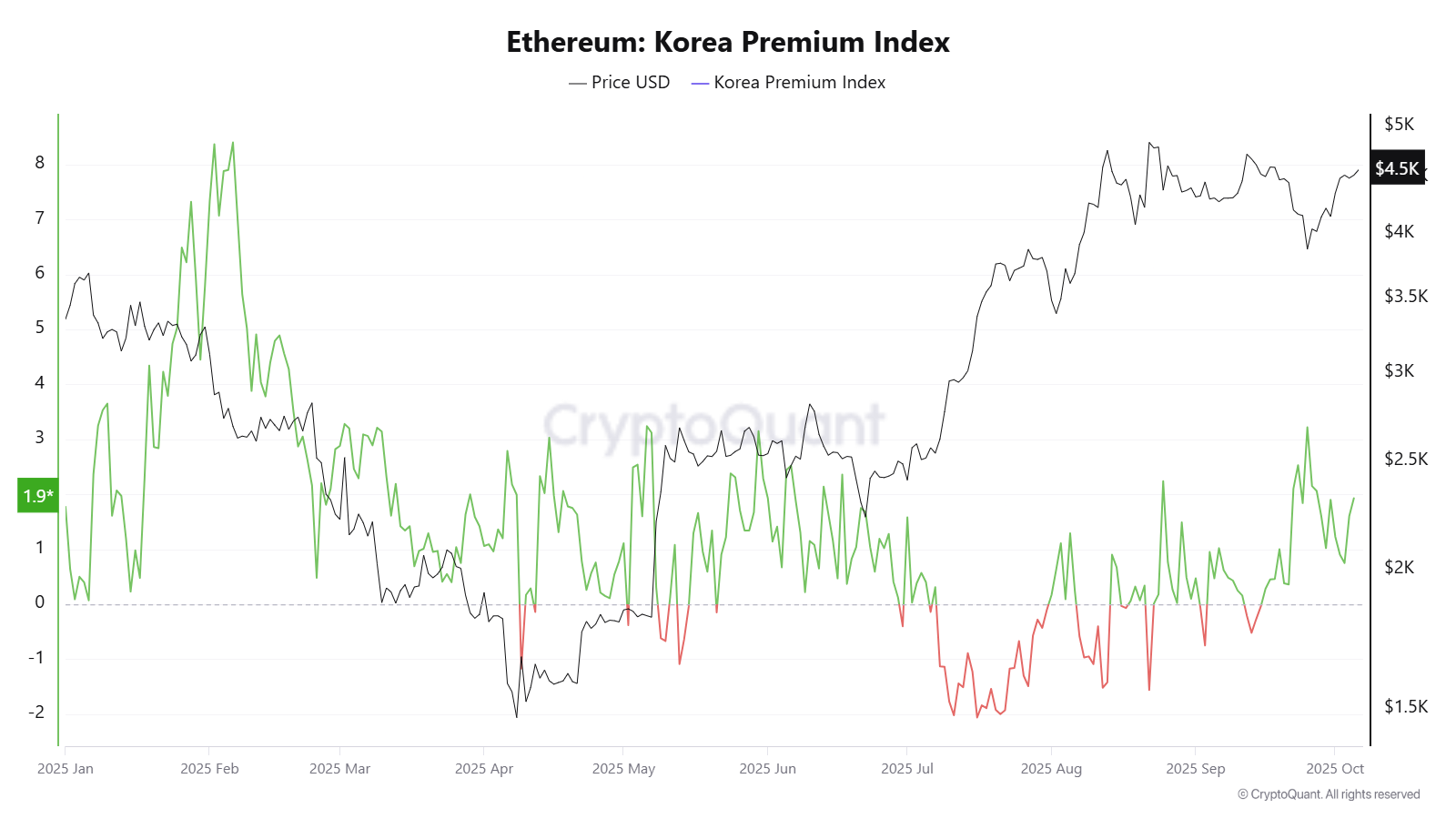

Ether's Kimchi Premium is growing engagement with retail traders in Korea

Ether's Kimchi Premium additionally exhibits rising demand from Korean retail traders. This explains how cryptocurrency costs are larger on Korean exchanges than on different exchanges.

In response to blockchain knowledge platform Cryptoquant, Ether's Kimchi Premium rose to 1.93 on Sunday.

Ethereum: Korean Premium Index, chart with age. sauce: Encryption

This indicator measures the worth hole for ether between Korean exchanges and different exchanges.

Blockchain Oracle In response to Marcin Kazmierczak, co-founder of Oracle Agency Redstone, Korean retail traders are key members within the crypto market, as mirrored in Ether's “Kimchi Premium.”

Nonetheless, Kazmierczak mentioned that is solely a small a part of the general momentum of the ether.

“Characting them as key help for Ethereum makes the community's numerous international capital base, together with substantial US investments, considerably extra modestly and modest by the huge rebellious ecosystem that depends on ETFs, the Company Treasury and ETH.”

Kazmierczak added that Ethereum's energy lies in its “boundary-free nature” that mixes Korean retail with international institutional participation.

Associated: Boomers aged till 2100 and international wealth

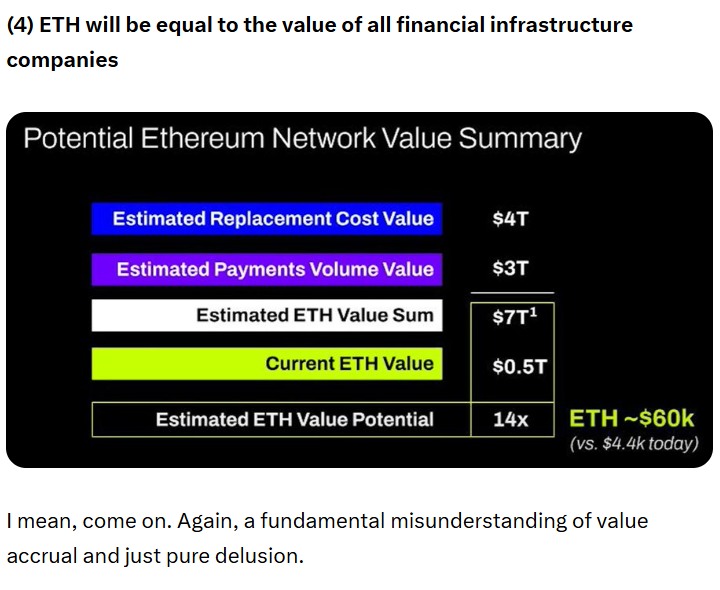

Mow's perception comes from many different trade watchers questioning the sustainability of ether financing corporations.

In September, Mechanism Capital founder Andrewkan criticized Bitmine's founder Tomley's etheric paper, claiming that the worth of ether is exaggerated from stubcoins and real-world asset (RWA) tokenization.

sauce: Andrew Kang

“The Ethereum valuation comes primarily from monetary illiteracy. To be honest, we will create a correct, large-scale market capitalization,” Kang mentioned in X-mail on September twenty fourth, including that “the evaluations derived from monetary illiteracy aren’t infinite.”

“Wider macrofluidity” maintains ether costs momentum, however “main organizational adjustments” are wanted to put it aside from “indefinitely low efficiency,” Kang mentioned.

journal: Few customers, intercourse predators kill Korean metaverse, 3AC sues Terra