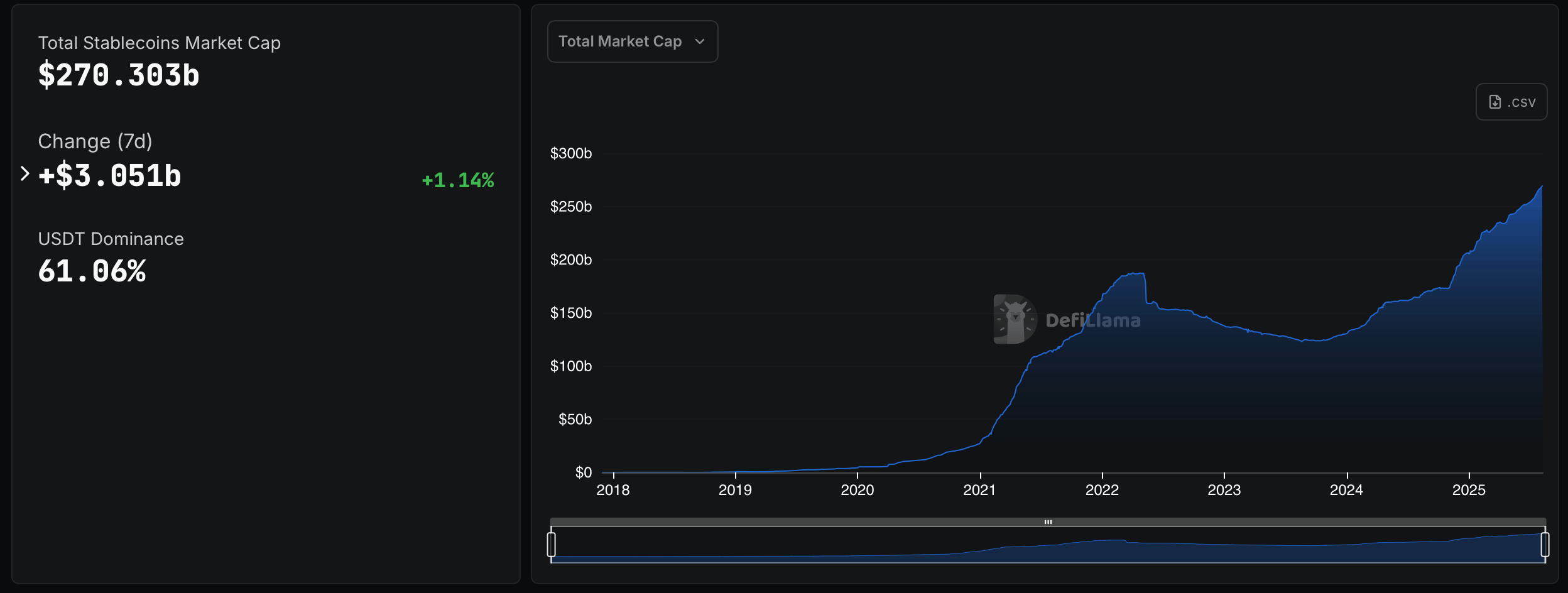

Statistics collected by Defilama.com and Artemisanalytics.com present that the overall worth of the Stablecoin Market is over $270 billion, marking a brand new milestone for the sector.

The stubcoin financial system rises as exercise expands

Over the previous seven days, Stablecoin Capitalization complete has elevated by $3.051 million, a revenue of 1.14% per Defillama dashboard. The brand new Whole will place the asset class within reach of earlier peaks, extending the steady climb that shall be carried by 2024 and 2025. This quantity displays round provide multiplied by the value and focuses on tokens lined in {dollars}.

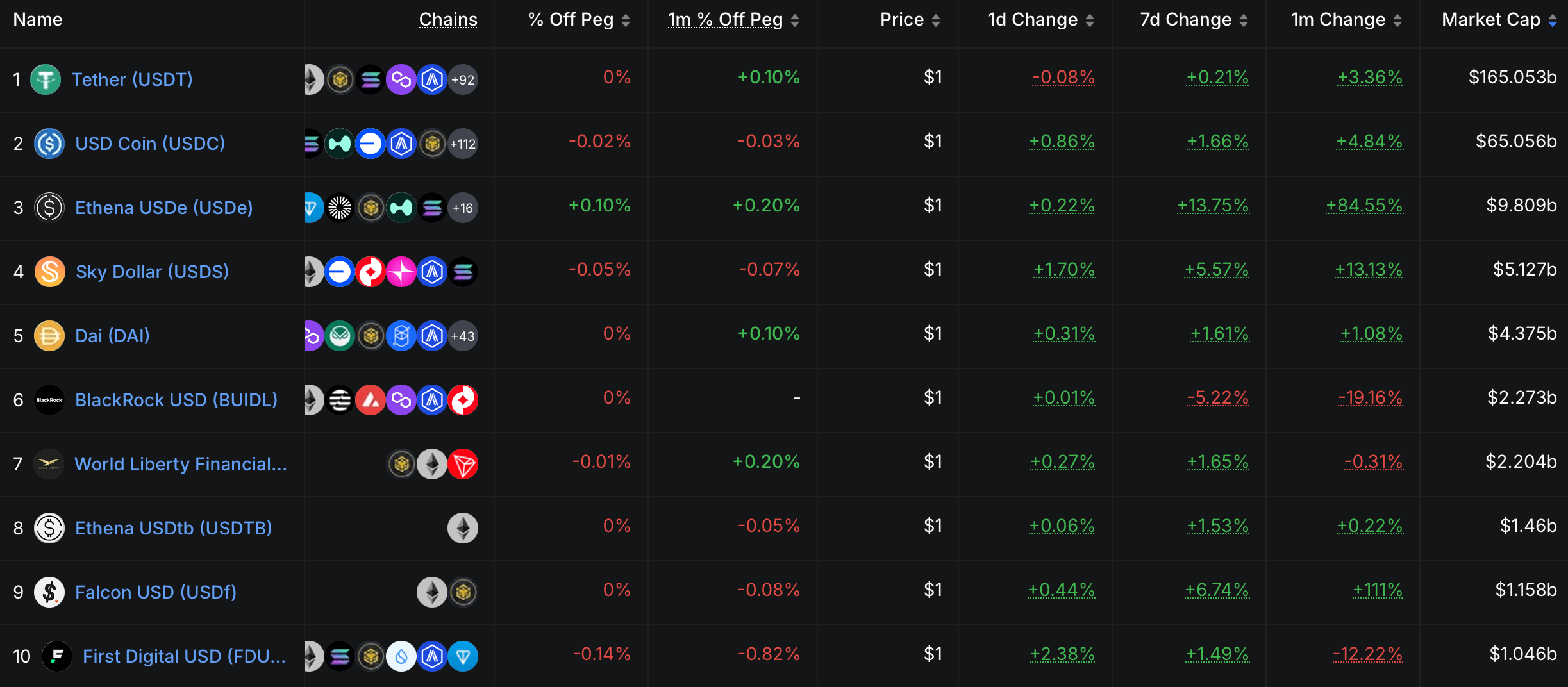

At present, Tether (USDT) stays a market chief with a 61.06% benefit. USDC is the second largest part, however a single-digit stake is a mixture of opponents akin to Ecena's USDE, Sky's USDS, Dai and BlackRock's Buidl. The Artemis Terminal market share chart exhibits that USDT held a large lead in 2025, with the USDC portion trending increased than this yr.

Supply: Defilama.com

Actions stay extensive. Artemis stories that addresses of 42.8 million individuals interacted with Stablecoins final month, down 15.2% from the final 30 days, however near the high-end vary of 5 years. Handle exercise per chain has expanded, with notable participation in BNB chains, Tron, Bass, arbitrum, Solana and OP Mainnets becoming a member of Ethereum.

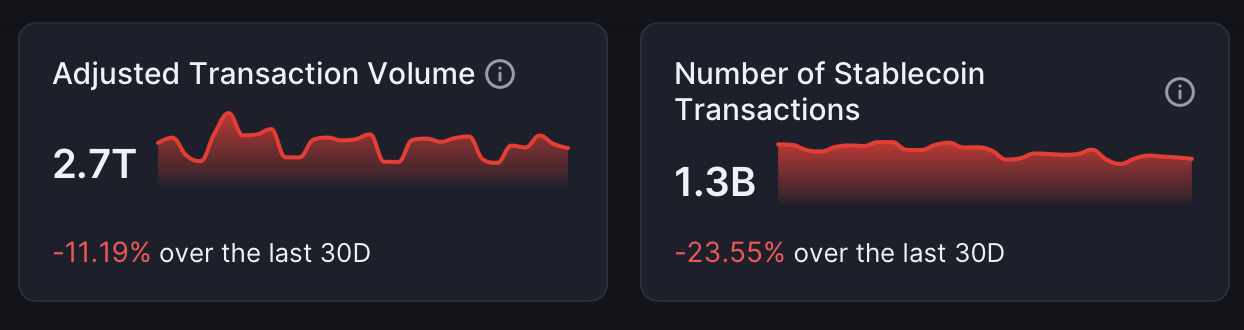

Gross sales are heavy. Artemis figures estimate $2.7 trillion within the quantity of stability transferred adjusted over the previous 30 days, even after a month-to-month decline of 11.19%. A multi-year view of the terminal exhibits a rolling adjustment quantity of $1 trillion for many of 2024-2025. That is typically nearer to visa ranges, far exceeding the overall PayPal and world remittances.

Supply: Artemis Terminal

Transaction counts remained up at 1.3 billion during the last 30 days, down 23.55% from the earlier interval. That tally factors to repeated use for funds, settlements, transactions and pockets financing throughout main networks and at centralized and on-chain venues.

The availability composition is decisively distorted by the US greenback. The collapse of Artemis' foreign money exhibits overwhelming issuance on USD phrases because the euro, pound and different fiat pegs characterize very skinny slices of complete provide. US Greenback Token continues to lock in crypto pricing and collateral practices throughout main trade and lending platforms.

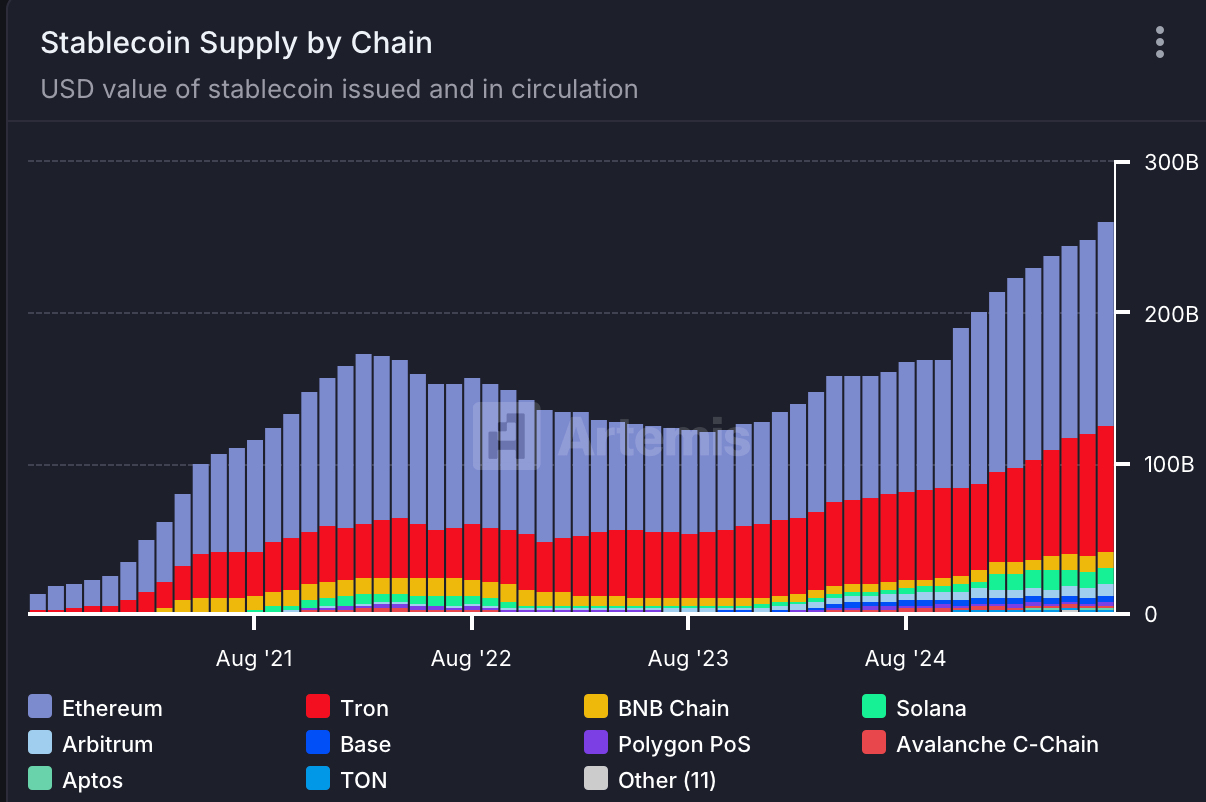

Chains are vital. Artemis' provide bi-chain chart exhibits that Ethereum and Tron maintain the most important excellent balances ever, with BNB chains, Solana, Bases and arbitrum persevering with. A five-year perspective on web provide change ranks Ethereum by absolute development first, and Tron is second. Elevated contributions from the bottom and Solana spotlight further venues for issuance and distribution.

Supply: Artemis Terminal

In tokens, the 5-year netchange desk shall be a lot additional than the USDT's further provide, and USDC shall be equipped subsequent. The USDE and USDS are smaller and contribute to a noticeable improve, whereas Dai and Buidl add an incremental quantity. The combination means that regardless that new tools targets Onchain Money Administration or Delta-Impartial Ivel Methods, incumbents nonetheless dominate the problem.

Regional traits are diversified. Utilizing Ethereum and Solana's TimeZone-based strategies, Artemis will attribute the vast majority of the adjusted transactions to North America and Asia, beginning in 2024, with sharelifting in Europe. Latin America, Southeast Asia and Africa sign adoption by each retail and institutional customers.

Energetic deal with charts by tokens spotlight USDT and USDC as major drivers, with deal with counts and interactions hitting new highs in 2025. Smaller publishers, together with PYUSD and different area of interest pegs, present restricted however steady engagement. Handle participation width refers back to the function of stubcoin as a crypto gateway and cost medium.

Each Defillama.com and the Artemis terminal knowledge confer with bigger, extremely energetic, and geographically distributed methods. The $27.030.3 billion headline determine retains constant growth durations, however liquidity is targeting a small variety of issuers and blockchain. Asset lessons function a bridge between buying and selling venues, wallets and conventional finance, together with centralized exchanges and on-chain protocols.

Supply: Defilama.com

As soon as the float complete reaches the $270 billion threshold, the liquidity situations of exchanges and distributed finance (DEFI) are carefully associated to greenback peg belongings. Though the rhythms of every month differ, the mix of dominant issuers, multi-chain distributions, and deep deal with exercise signifies sustained demand for tokenized {dollars} throughout transactions, remittances, and settlements.

For context, Defillama lists a historical past of total market capitalization, from beneath $10 billion in 2019 to over $250 billion by 2021, from beneath $10 billion to over $250 billion, then step by step recovering in 2025.