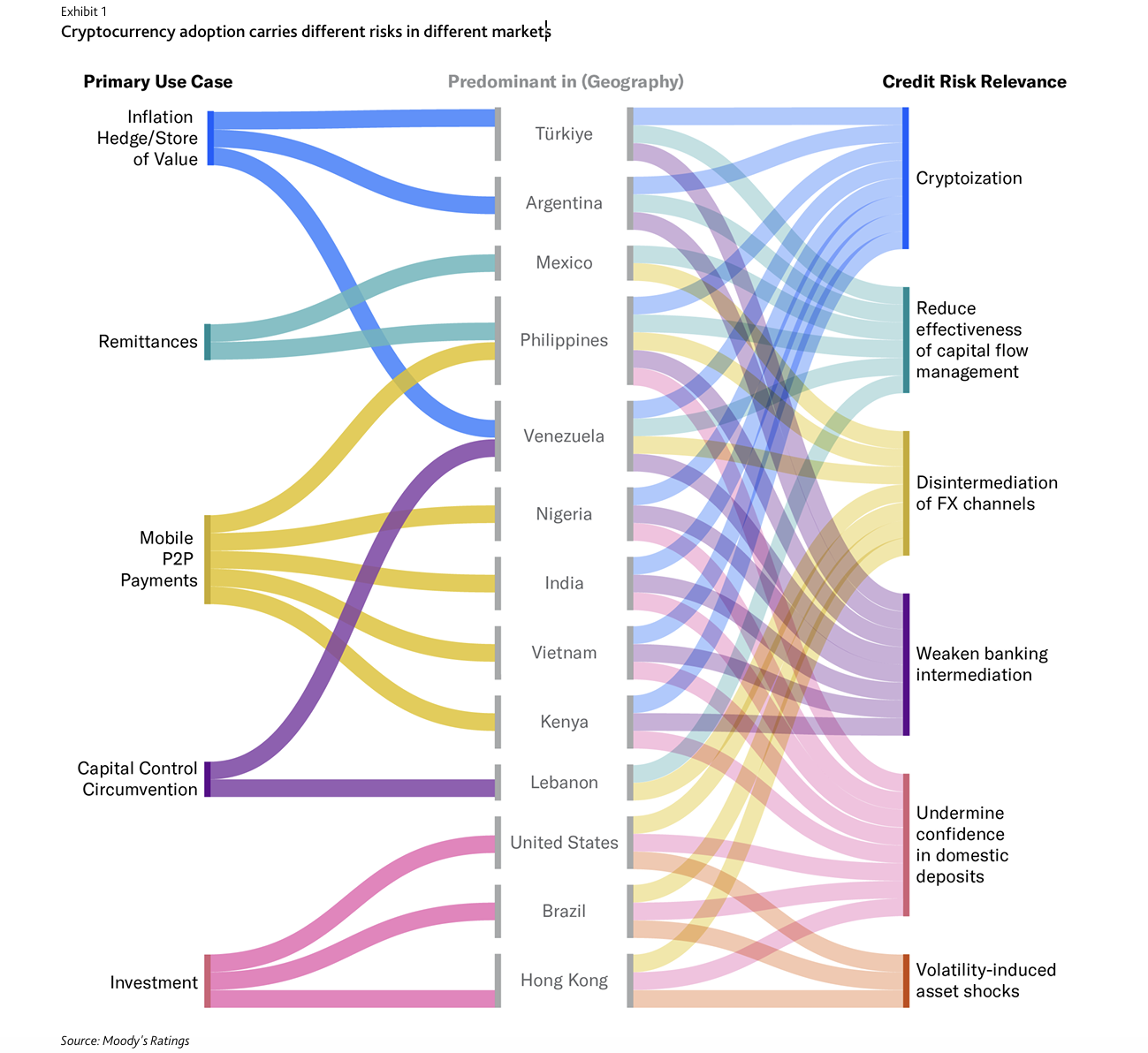

As Stablecoin and Cryptocurrency adoption accelerates worldwide, rising markets face growing dangers to monetary sovereignty and financial stability, in line with a brand new report from Moody's rankings.

The credit standing service warned that widespread use of Stablecoins (the place the token has mounted 1:1 in one other asset, often Fiat foreign money, such because the US greenback) might undermine central banks' management over rate of interest and trade fee stability, a pattern often known as “cryptologies.”

Banks additionally “can face deposit erosion when people switch financial savings from home financial institution deposits to stubcoin or crypto wallets,” the report stated.

Danger of adoption of crypto in varied markets. sauce: Moody's

Moody's has left digital asset laws world wide nonetheless fragmented, with lower than a 3rd of nations implementing complete laws being fragmented, and plenty of economies are uncovered to volatility and systematic shock.

Whereas readability of laws and strengthening funding channels typically drive adoption in developed economies, Moody's stated the quickest progress is going down in rising markets, significantly in Latin America, Southeast Asia and Africa.

“The speedy progress of (…) Stubcoin brings systematic vulnerability regardless of their perceived security. Insufficient surveillance might trigger reserves to run and drive pricey authorities aid if PEG collapses,” Moody stated.

The company stated the boundaries spotlight not solely the potential for monetary inclusion, but in addition the chance of monetary instability if surveillance fails to take care of the tempo.

In 2024, international possession of digital property reached an estimated 562 million folks, a rise of 33% from the earlier yr.

Associated: New Crypto Guidelines in Singapore: $200K High-quality, Jail Danger

Laws in Europe, the US and China are accelerating

Though a lot of the world nonetheless lacks clear guidelines that cryptocurrencies and silly currencies, Europe, the US and even China have made progress during the last yr.

On December thirtieth, 2024, after a gradual deployment, the remaining provisions for the EU market of the crypto property (MICA) regime have been applied. MICA is a Crypto Rulebook from Bloc, standardizing service supplier licensing and establishing reserve and disclosure necessities for Stablecoins.

In america, the Genius Act grew to become legislation on July 18th, establishing enforceable requirements for issuing and supporting steady cash.

China seems to be altering programs as Europe and the US are implementing Steady Coin laws.

After banning crypto buying and selling and mining in 2021, Beijing expanded its pilot for digital yuan, weighing the yuan-controlled yuan stubcoins, in line with a current report in August 2025.

On Thursday, the Folks's Financial institution of China (PBOC) opened a brand new operation centre within the digital yuan Shanghai, aiming to concentrate on blockchain providers and cross-border funds as Stablecoin improvement continues.

Journal: There’s a threat that different nations are “entrance run” with Bitcoin reserve – Samson Moh