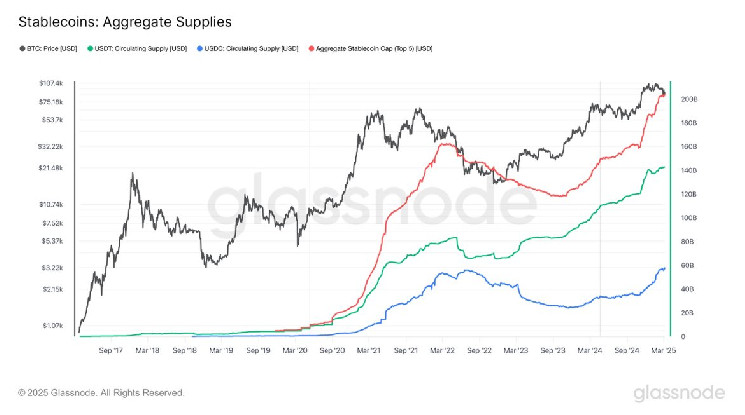

The overall market capitalization of the 5 largest stubcoins handed $200 billion for the primary time on Friday after Treasury Secretary Scott Bescent pledged to assist preserve international reserves utilizing digital property.

Based on GlassNode information, the market capitalization of high-value cash, that are valued in actual world, such because the US greenback, has risen excessive. Demand was supported by traders searching for aid from the slippage of cryptocurrencies similar to Bitcoin (BTC) and Ether (ETH).

Stubcoin's market capitalization has elevated by $40 billion since President Donald Trump received the US election. With cryptocurrency and US shares struggling in latest weeks, Steady Coin has emerged as a transparent winner.

Market chief Tether's USDT has maintained a market capitalization of round $140 billion since December, whereas Circle's second-largest USDC is approaching $60 billion. This is a rise of $25 billion for the reason that election.

On the Digital Belongings Summit on Friday, Bescent stated, “We intend to maintain the US because the dominant reserve forex and can use stablecoins to try this.”

Bessent's remarks spotlight issues about macroeconomic and geopolitical uncertainty, which might result in a decline in international demand for US debt and push Treasury yields. Over the previous 12 months, two largest holders of the US Treasury, Japan and China, have diminished their holdings.

For the greenback to stay a world reserve forex, there have to be a constant demand for US debt. The administration has recognized Stubcoin as the perfect associate on this technique.

By holding US debt as reserves, Stablecoins will assist decrease Treasury yields whereas additionally rising the worldwide attain and dominance of the greenback. Stablecoins have to be obtainable to repay traders' money outs. Tether is already one of many largest house owners of the US three-month Treasury.