S&P International Scores says stablecoins, primarily these pegged to the U.S. greenback, might acquire a fair bigger share in rising market economies, with holdings in 45 nations doubtlessly reaching $730 billion, up from about $70 billion at present.

The report, launched this week, says the function of stablecoins within the monetary system is “rising in tandem with the speedy growth of issuance.”

Nonetheless, analysts say that even when stablecoin adoption reaches the anticipated excessive finish, it’s “not important sufficient to have a cloth affect on the function of banks in intermediation or the effectiveness of financial coverage.”

Stablecoin introduction simulation. Supply: S&P International Scores

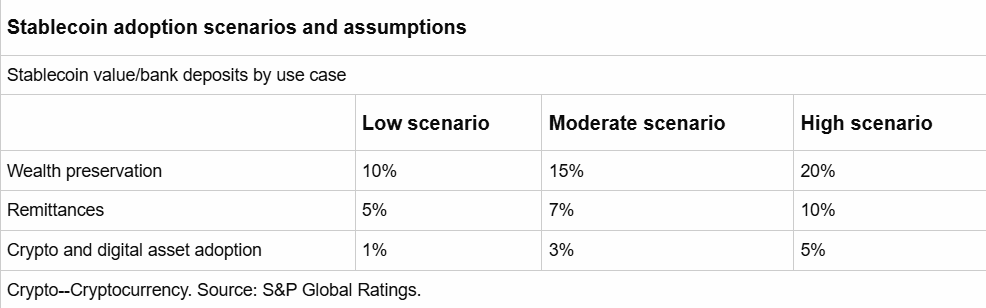

The New York-based ranking company bases its forecasts on three most important components: stress on native currencies, demand for cross-border remittances and widespread use of digital belongings.

“Adoption will likely be pushed, so as of significance, by wealth safety, remittances and worldwide commerce, and normal enthusiasm for digital belongings,” the report says.

Key markets for stablecoin adoption

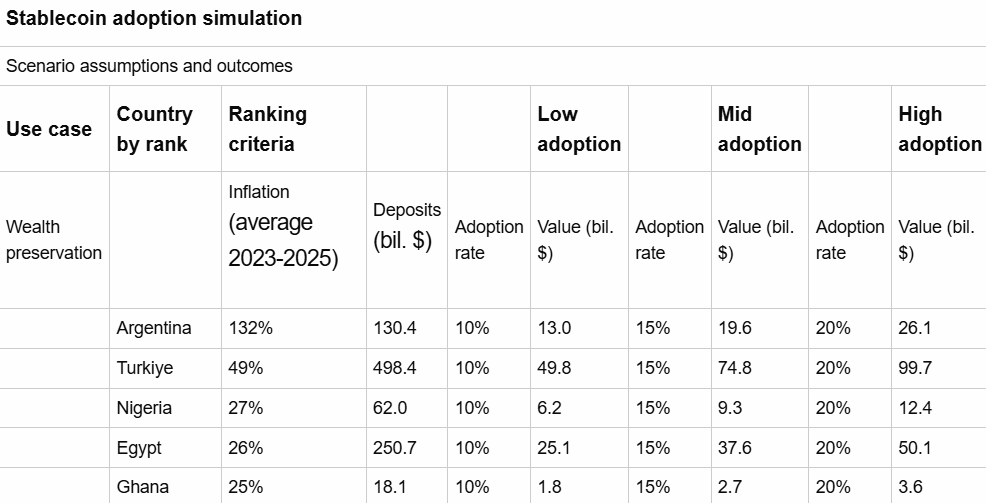

As S&P International argues, nations with excessive inflation charges have the best potential for stablecoin adoption. In probably the most aggressive state of affairs, the corporate predicts that stablecoins might attain a major share of the worth of conventional financial institution deposits in some markets, the place stablecoins are used to protect wealth in nations the place the buying energy of logical currencies is eroding.

“We assume stablecoin adoption might attain 10-20% of financial institution deposits within the prime 15 nations the place wealth preservation (buying energy) is an important issue,” the report stated.

The forecast is predicated on financial institution deposit knowledge for the second half of 2024, with Argentina and Turkey main the listing by way of common inflation over the previous two years.

Stablecoin introduction simulation. Supply: S&P International Scores

In early January, blockchain analytics agency Artemis estimated that Visa card spending linked to stablecoins will attain $3.5 billion yearly within the second half of 2025, a rise of about 460% year-on-year.

A geographic breakdown of stablecoin utilization exhibits India and Argentina to be “true world outliers,” with USDC accounting for 47.4% and 46.6% of utilization, respectively. By comparability, knowledge exhibits that USDT dominates stablecoin exercise in most different markets, together with Turkey, China, and Japan.