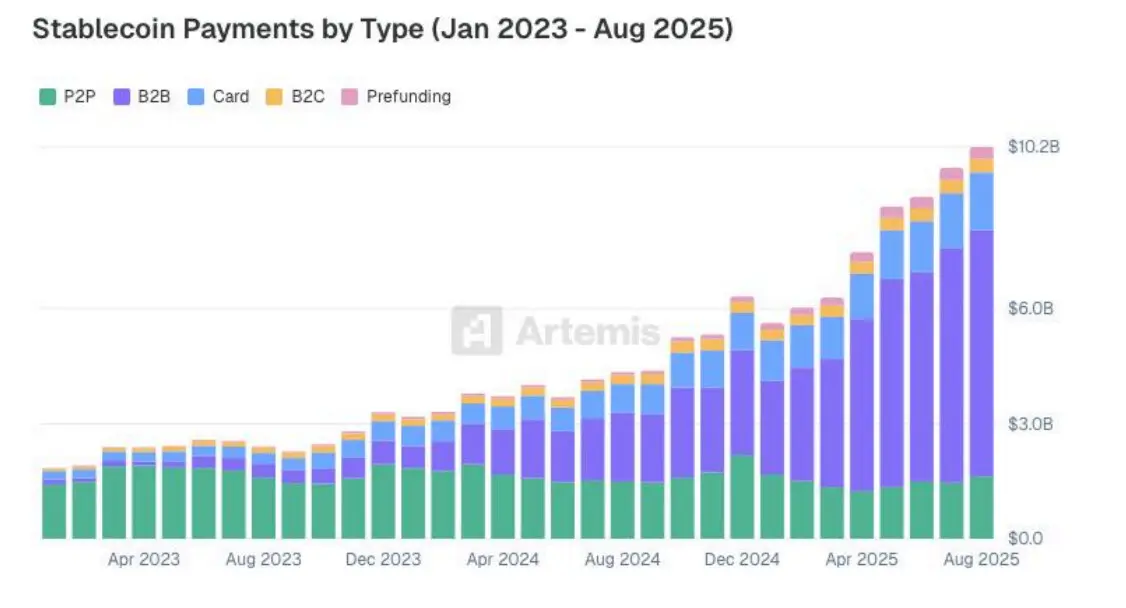

Stablecoin funds will develop in 2025, with an growing proportion of B2B transfers. In response to Artemis, the usage of the token as a fee software has elevated by 70% since February.

In 2025, stablecoin funds have expanded by greater than 70% since February. Markets pegged to fiat currencies have advanced and funds have develop into one of many foremost vectors of growth, with Circle's USDC main the pattern.

Artemis, one of many main crypto information hubs, collected information from 22 crypto fee corporations to estimate the precise utilization of stablecoins. An extra 11 startups have been interviewed for added information from B2B, P2P, B2C, card funds, and pre-funding.

This information assortment tracked $136 billion in funds between companies settled between January 2023 and August 2025. This era has already proven the evolution of the stablecoin market, with the pattern persevering with into the third quarter attributable to development in provide and energetic customers.

B2B funds dominate the market

Artemis has discovered that B2B funds are the largest driver of exercise, as they’re the property that allow large-scale, permissionless funds. This kind of fee reached $76 billion per yr, with P2P funds coming in second at $19 billion per yr.

B2B funds have been essentially the most energetic phase in stablecoin utilization. App and card funds will develop in 2025, marking mainstream adoption in retail shops. |Supply: Artemis

Crypto playing cards adopted swimsuit, with annual transaction quantity reaching $18 billion. B2C funds have been $3.3 billion, whereas pre-funding options had $3.6 billion in funds.

Regardless of USDC’s rising affect, Tether’s USDT remained the preferred token utilized by companies. USDT captured 85% market share by way of quantity, with Circle in second place. TRON held essentially the most stablecoins, adopted by Ethereum, BNB Chain, and Polygon.

The USA, Singapore and Hong Kong recorded the very best quantity of remittances.

Cost options enhance the usage of stablecoins

One of many components behind the elevated use of stablecoins was fee apps constructed by centralized exchanges. Most notably, Bybit Pay and Binance Pay emerged as exercise hubs, leveraging the trade's prospects with further cash switch instruments.

BVNK has additionally emerged as a fee gateway with the infrastructure to attach banks and blockchain. BVNK focuses on enterprise scalability points. BVNK's strategy is to permit companies to make use of fiat currencies and full stablecoin transactions on the backend utilizing quick, borderless infrastructure.

Stablecoin playing cards have been one other issue driving mass adoption. With clearer rules, card utilization has expanded from the 2023 baseline stage. As of August 2025, month-to-month crypto card fee quantity exceeded $1.5 billion.

Playing cards linked to stablecoin balances search to supply a seamless expertise primarily based on regular card utilization patterns. The expansion of crypto playing cards has introduced fee suppliers like Exa and Gnosis Pay according to the usage of conventional credit score and debit playing cards. Common Exa funds have been corresponding to US debit card spending.

No main modifications or new developments have been noticed in P2P funds. These kind of funds had smaller common transaction sizes. The common measurement of P2P funds was decrease in comparison with Zelle and Venmo. General, P2P is likely one of the riskiest makes use of for stablecoins, as customers flock to pick apps.

Stablecoins are nonetheless broadly used for fraud, and solely a small share of stolen funds are frozen or returned.