Ethereum (ETH) faces comparatively low costs and elevated utilization. The community has transactions which are near the extent of the community, whereas over 30% of the provision is locked.

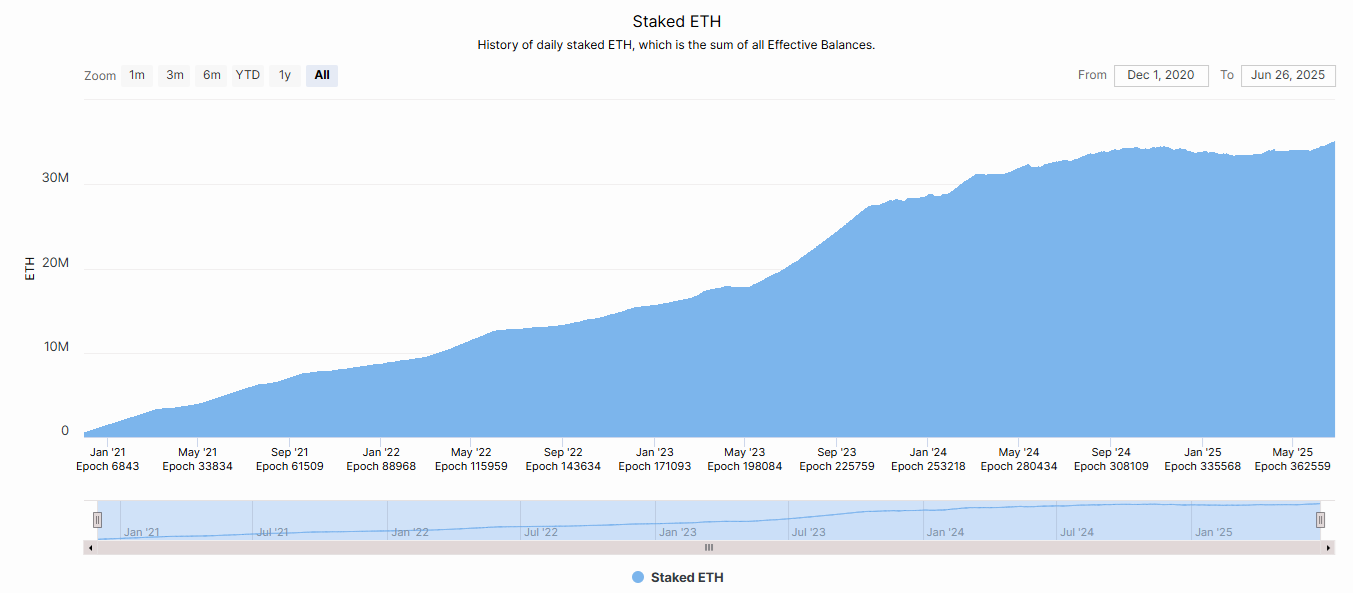

Ethereum (ETH) continues to construct provide crunches primarily based on elevated whale holdings and staking. Presently, about 30% of the provision is staked, and it has been inflowing very actively over the previous few months. Over 35m of ETH has soaked into the beacon chain, making it the perfect ever. The staking development might proceed as ETFs are additionally allowed to incorporate staking for passive earnings.

ETH staking was featured once more within the second quarter, resulting in document values with ETH above 35m or about 30% of obtainable provide locked. |Supply: Beacon Chain

After a number of spills from staking contracts throughout market panic in March and April, Ethereum staking has returned to peak ranges that haven’t been seen since September 2024. ETH staking has develop into one of the crucial dependable markers that may be trusted in the long run for community worth.

Following the Pectra improve, staking has additionally accelerated as giant whales might deposit extra ETH without delay to construct shares. Consequently, the overall bets at Ethereum are the best ever.

The Ethereum community will likely be taken over $6.1 billion Loans, liquid staking, DEX liquidity swimming pools and extra are locked to Defi protocols. ETH is effective as collateral, and whales aren’t in a rush to promote.

Extra ETH is wrapped in a number of protocols and is out of the open market. Whales additionally present elevated exercise on common and added on common 800k ETH Solely 16k of recent ETH will likely be produced each week per day of the earlier week. The whales have proven unprecedented ranges of accumulation, boosting the much-anticipated worth breakout story.

Eth Trade reserves are nonetheless missing at round 19M tokens. ETFs are additionally actively buying, and BlackRock has not too long ago absorbed the piles bought by Grayscale. ETH has develop into enticing to company consumers as a collateral asset.

The Ethereum Community can also be ready for one thing new Improveit might velocity up transactions additional. Regardless of its comparatively excessive costs in comparison with different networks, Ethereum stays Defi's vital platform. Based mostly on good contract exercise, the principle use case for the community is ETH forwarding, with USDT and USDC nonetheless being a few of the busiest good contracts.

ETH is undervalued for unstable buying and selling

The present state of affairs at ETH is to boost expectations for a catch-up rally. Trades beneath $2,500 are thought-about undervalued regardless of the height chain exercise. Transactions proceed to rise in Ethereum all through 2025, reaching the next baseline with occasional days of surprising document exercise.

Nonetheless, costs within the ETH market remained close to low and crashed after every breakout. In June, ETH did not retrieve the $3,000 stage. Tokens fell about 5% in June, however the second quarter might finish with vital internet earnings. Expanded ETH 31.8% The second quarter is pushed primarily by peak achieve in Could.

A number of bulls in ETH aren’t enough to trigger extra definitive gatherings. There are nonetheless hopes for a breakout in June that might enhance ETH by $10,000. Even with no assembly, Ethereum confirmed it was not a useless chain. Lately, the community has drawn over $334 million day-after-day Web influx After we return from the bridge to the liquidity hub with the best worth.