Bitcoin (BTC) costs have been offering larger electrical energy in latest weeks, briefly exceeding $95,000 per coin. The surge is steep, with a rise of round 9% over the previous seven days, setting a bullish stage for Bitcoin value prediction.

In a report in late April 2025, Geoff Kendrick's Crypto Analysis workforce at Customary Chartered expects Bitcoin to achieve round $120,000 within the second quarter of 2025 and $200,000 by the top of the 12 months.

These targets are repeated even when Bitcoin was buying and selling round $93,700 on the time, reflecting the financial institution's perception that latest gatherings might final by the summer season.

Supply: Customary Chartered

Spring was usually the strongest season for Bitcoin. Knowledge exhibits that Bitcoin's common return within the second quarter (April-June) was traditionally about +26.9%), making it the best performing quarter on common.

Specifically, April tended to be bullish. One evaluation exhibits that the common acquire in April is about 34.7%. For instance, between 2016 and 2020, Bitcoin costs rise on common by round 30% in April annually.

Nonetheless, seasonality will not be assured. There have been notable exceptions, equivalent to Bitcoin falling by round 15-17% in April 2022 and April 2024.

Briefly, Bitcoin has ceaselessly closed its second quarter in constructive territory, however merchants are noting that previous patterns could not repeat annually.

Customary Chartered Bitcoin Worth Prediction and Efficiency

The brand new goal for Customary Chartered marks the newest in a sequence of bold Bitcoin forecasts from banks. In September 2021, Jeffrey Kendrick's workforce predicted that Bitcoin might “slash $100,000 by the beginning of subsequent 12 months” (2022), reaching a long-term $175,000.

By April 2023, the financial institution had raised its view to $100,000 by the top of 2024 because the “winter” of code had been unzipped. A number of months later (July 2023), Customary Chartered as soon as once more raised its value goal to $120,000 by the top of 2024.

Every revision follows a robust Bitcoin rally. Presently, in April 2025, Kendrick's Notice forecasts $120,000 within the second quarter of 2025 and $200,000 by 2025, roughly double the present stage.

These evolving targets counsel that banks' outlook grew to become extra bullish as Bitcoin costs and demand on the chain recovered.

- September 2021: Bitcoin projected to achieve ~$100,000 by the second half of 2021/early 2022.

- April 2023: Forecast $100,000 by the top of 2024 as curiosity was returned.

- July 2023: In gentle of latest income, we raised our 2024 goal to $120,000.

- April 2025: ~$120,000 for the second quarter of 2025, $200,000 by the top of 2025

Every forecast cites a mixture of market drivers and emotional modifications. Bitcoin is already scathingly gathering this spring, so Customary Constitution believes its momentum will work out in 2025.

Kendrick highlights some key components that may drive Bitcoin in the direction of these lofty targets. A handy method to view these is as a listing of catalysts.

Geoffrey Kendrick's customary constitution report outlines key drivers poised to push Bitcoin to new heights.

The evaluation identifies 4 catalysts that drive this optimistic prediction. First, traders are shifting capital from US shares and bonds in the direction of various belongings like Bitcoin.

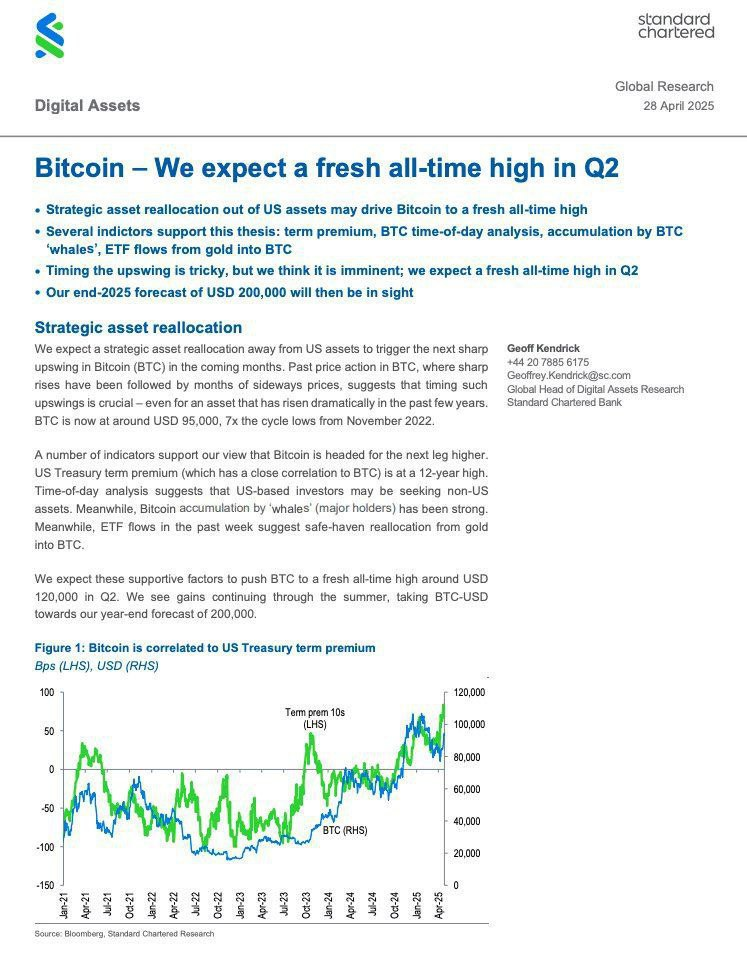

Second, the US Treasury's further yield in comparison with short-term debt, the US Treasury's long-term premiums, is at a excessive of 12 years, traditionally tied to Bitcoin rallies.

Third, the numerous inflows into Bitcoin ETFs, coupled with the outflow from gold funds, point out conventional secure shelter to crypto reassignment, based mostly on latest ETF knowledge, labeled “Gold to Gold to Gold to BTC Safe Relocation.”

Lastly, based on Kendrick's findings, massive Bitcoin holders, or massive Bitcoin holders with over 1,000 BTC, or “whales” with over 1,000 BTC are steadily shopping for throughout market dips, lowering the out there provide and supporting larger costs. These components convey collectively Customary Chartered's daring value forecasts.

Collectively, these drivers draw footage of elevated demand and constrained provide. They echo factors from different analyses. For instance, the US Treasury Time period Premium within the buy of a excessive and highly effective whale in 12 years was one of many components that made Bitcoin look like a greater hedge than gold.

Bitcoin value forecast: a broader market context

The outlook for Bitcoin additionally depends on broader macroeconomic circumstances. On the one hand, Bitcoin's spring rally coincides with hopes to ease commerce tensions and decrease rates of interest.

For instance, on April 5, 2025, the White Home introduced non permanent tariff exemptions for Mexico and Canada. That is information that helped free the belongings and codes.

World liquidity stays adequate, with main Bitcoin ETFs drawing inflows. Bloomberg analyst Eric Balknas famous that Bitcoin was one of many top-performing belongings in early 2025, surpassing Laguards just like the US Treasury.

This means that many traders view Bitcoin as a beautiful risk-on asset and even an inflation hedge that begins the 12 months.

In the meantime, a robust US greenback or Treasury yield rise might ease the progress. Analysts usually observe that surges {dollars} make dollar-price belongings like Bitcoin dearer for overseas consumers.

In reality, in November 2024, the greenback index reached 13 months (roughly 107.15), even when Bitcoin hit a brand new excessive of almost $99,000.

Some strategists who see Bitcoin as declining correlation with shares over time warn that it stays delicate to international threat sentiment.

BTC/USDT Worth Chart | Supply: TradingView

Just like the Singapore-based QCP Capital Notice, Crypto nonetheless tends to maneuver together with shares, saying, “crypto is intently associated to shares, and there’s value motion that displays wider financial modifications.”

In actuality, which means that modifications within the Fed's insurance policies, commerce information, or sudden drops in liquidity might put the brakes on Bitcoin's execution.

In abstract, Customary Chartered's Bitcoin value forecast is on the confluence of constructive components, together with anticipated turnover from US belongings, supportive bond market alerts, heavy whale accumulation and strong ETF inflows.

Historic seasonality additionally supplies a constructive background, and in lots of instances the second quarter is a robust quarter for crypto. Nonetheless, the end result is determined by whether or not these drivers outweigh conventional headwinds like greenback power and excessive yields.

As at all times, there’s uncertainty in forecasting. Nonetheless, the financial institution's evaluation supplies a transparent story about why some analysts see Bitcoin on a steep upward trajectory in 2025.