Important highlights

- STBL founder Avtar Sehra introduced that STBL will start share buybacks by October.

- “Stablecoin 2.0” capabilities as “TCP/IP of cash”

- Introducing. A multi-factor staking (MFS) mannequin that permits buyers to extend their returns by way of staking.

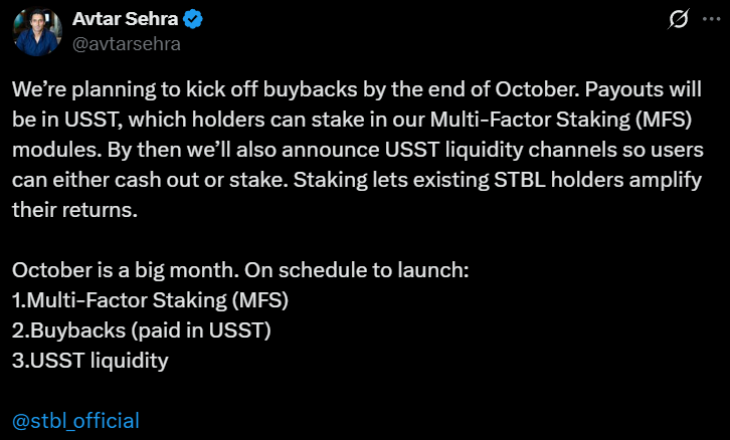

On October 13, Avtar Sehra, British monetary engineer and CEO of STBL, shared an replace on the corporate's plans to start STBL's share buybacks by the tip of October.

(Supply: Avtar Sehra of X)

STBL share buyback particulars

In a thread posted on X, Avtar Sehra revealed that STBL will start shopping for again tokens utilizing STBL's new stablecoin, USST, which was co-founded by one of many Tether founders.

This program reduces the variety of tokens out there and should assist keep or improve the worth of the tokens. Funds are made in USST, giving holders a transparent option to spend or save their tokens.

Avtar Sehra additionally introduced a system known as Multi-Issue Staking that permits customers to lock USST tokens and earn rewards. This method is “multi-factor”. Technically talking, this technique makes use of good calculations to distribute rewards. This MFS mannequin helps buyers improve their income just by staking and supporting the community.

Avtar Sehra spoke in regards to the USST liquidity channel in a tweet. Flip stablecoins into money. These liquidity channels give the USST extra flexibility to spend and commerce.

“We’re not “one other stablecoin.” We’re constructing TCP/IP for cash: an open, decentralized, and sturdy infrastructure. As soon as we're achieved, the peg will maintain as a result of the market is ensuring it holds. The collateral is evident. Rights are enforceable. Privateness is a function, not an afterthought. That was the idea then, and that is the product we have now now,” Avtar Sehra wrote in a put up about X.

“As soon as accomplished, STBL would be the base layer on which different stablecoins are constructed,” he added.

Sehra shares “Stablecoin 2.0” roadmap

In one other put up, Sehra defined the aim of STBL and why it’s completely different from different stablecoins like Tether and USDC. He formally known as STBL “stablecoin 2.0.” His assertion pertains to a analysis paper he wrote in 2017 titled “On Cryptocurrencies, Digital Belongings, and Non-public Cash.”

7 years later: From principle to stablecoin 2.0

Practically eight years in the past, I revealed a paper on cryptocurrencies, digital belongings, and personal cash. Studying it again now, I can see why I designed STBL the best way I did. The core proposition nonetheless holds true. Our execution has matured. … pic.twitter.com/rYIcB6jhnv

— Avtar Sehra (@avtarsehra) October 13, 2025

Sehra defined that STBL is a real-world model of his earlier imaginative and prescient for a type of digital cash that’s decentralized, guided by market forces, and constructed with privateness in thoughts.

He made the comparability, calling STBL the “TCP/IP of cash” and suggesting that STBL may turn into a elementary constructing block of the way forward for digital finance, simply as TCP/IP is the basic protocol of the Web.

He identified that the primary wave of stablecoins nonetheless has main weaknesses. These embrace dependence on central authorities, excessive worth fluctuations, and lack of personal commerce.

It’s constructed solely on a public blockchain, which means that every one actions from creating new cash to settling transactions are dealt with by clear good contracts quite than hidden central servers.

This makes the system open and straightforward to hook up with different monetary functions.

Each STBL coin in circulation is backed by a bigger quantity of bodily money belongings to maintain its worth secure. Sehra clearly rejects this unsubstantiated mannequin.

he mentioned:Value stability requires dependable reserves. Mounted/inelastic provides and speculative flows alone can not help retailer of worth, medium of trade, and per-account performance (SoV/MoE/UoA) with out volatility management. Dependable collateral is non-negotiable. Purely algorithmic or artificial “cash” alone doesn’t result in market stability. ”

The third precept consists of an automatic system to keep up the worth of the coin, which is predicted to be pegged to the US greenback. As a substitute of handbook intervention by corporations, good contracts mechanically modify the availability of STBL based mostly on market demand.

STBL additionally incorporates a distinctive “three-token mannequin” to reinforce compliance and readability. One token is used for spending, one other is used to earn income, and the third is used for group governance.

STBL has a composable design that works seamlessly throughout completely different blockchain networks with privateness layers.