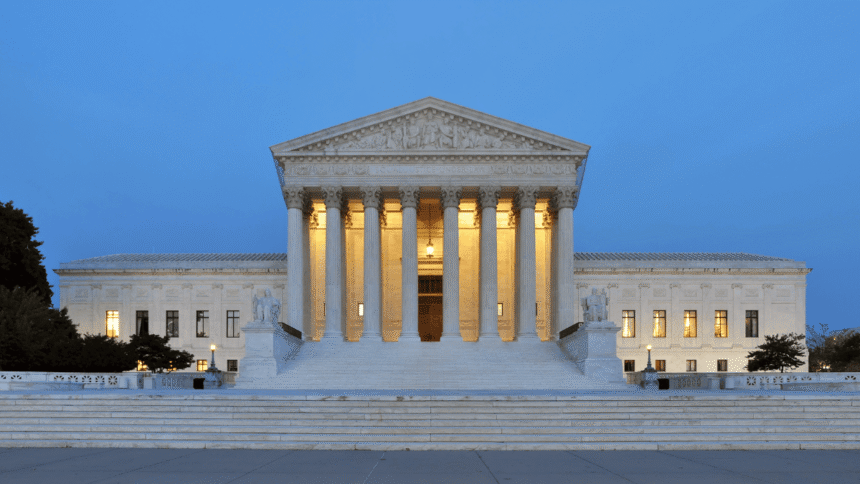

In a 6-3 determination, the U.S. Supreme Courtroom this Friday, February 20, 2026, invalidated the worldwide tariffs imposed by President Donald Trump.

The courtroom held that The administration used the Worldwide Emergency Financial Powers Act to exceed its authority. (IEEPA) introduces import taxes with out express approval from Congress.

The information precipitated hassle Rapid response of monetary markets; S&P 500 and Nasdaq 100 reached session highs; Bitcoin and cryptocurrencies react to volatilityNevertheless, as of this publication, there are nonetheless no clear developments.

Chief Justice John Roberts wrote the bulk opinion, noting that: For the president to train these financial powers, he wants “clear legislative authority.''.

Mr. Roberts emphasised that there’s the power to manage imports. doesn’t grant limitless energy to set costs Unilaterally.

The decision immediately impacts the ten% world “Emancipation Day” tariff, in addition to sure taxes which have collected greater than $175 billion, based on estimates from the Penn Wharton price range mannequin reported by Reuters, and that quantity might now be eligible for refunds.

Eliminating these commerce boundaries tends to ease inflationary pressuresare elements that the Federal Reserve System (FED) carefully screens for financial coverage choices.

On this context, Bitcoin may benefit from its excessive liquidity and low geopolitical danger atmosphere. Recall that the imposition of duties on imported items had a unfavourable affect on the worth of Bitcoin, as defined by CriptoNoticias in April 2025.

Alberto Cárdenas, a Venezuelan dealer and monetary market knowledgeable, commented in November 2025 that the courtroom's ruling in opposition to President Trump's tariffs “may create a short-term weak greenback impact as a result of america must repay all of the tariffs it has imposed to this point.”

For Cárdenas, that will be “a state of affairs the place the costs of belongings which are negatively correlated with Bitcoin, gold, and the greenback go up.”

The market will proceed to pay shut consideration to the White Home's response.