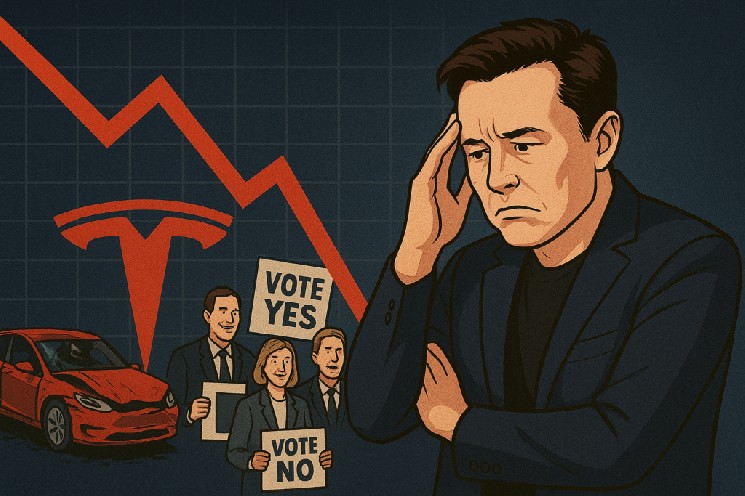

Tesla shares fell in early buying and selling on Tuesday as investor uncertainty grew over CEO Elon Musk's proposed $1 trillion compensation proposal.

The decline, which got here simply days earlier than shareholders had been to vote on the plan, has divided opinion amongst main institutional buyers and reignited debate over Mr. Musk's affect on the electrical automobile maker.

Shares fell 2.6% to $456.40 in early buying and selling. S&P 500 futures fell 1% and Dow Jones Industrial Common futures fell 0.7% because the broader market weak point intensified strain.

Coming into buying and selling on Tuesday, Tesla shares have risen 16% because the starting of the yr and 93% over the previous 12 months, reflecting continued optimism concerning the firm's long-term development story regardless of short-term disruptions.

Norwegian authorities fund rejects Musk's compensation

Copy hyperlink to part

The most recent headwind comes from Norway's sovereign wealth fund, which stated it could vote in opposition to the package deal.

The $1.9 trillion fund, which is considered one of Tesla's largest institutional shareholders with a 1.2% stake, cited issues concerning the “complete quantity of awards, dilution and lack of danger mitigation for key gamers.”

“Whereas we respect the numerous worth created underneath Mr. Musk's visionary position, in line with our views on government compensation, we’re involved concerning the dimension, dilution, and lack of danger mitigation for key people in complete compensation,” the fund stated in a press release.

This rejection created some uncertainty concerning the consequence of the Nov. 6 shareholder vote.

Mr. Musk's plan would give him about 425 million incentive-linked shares and enhance his voting management to 25%, a stage he stated is important to supervise Tesla's synthetic intelligence efforts.

The fund additionally opposed Musk's earlier compensation package deal in 2024. Earlier this yr, leaked messages revealed tensions between Musk and the fund's chief government, Nikolai Tangen, after Musk despatched a curt message saying “mates are like mates.”

Divided investor base

Copy hyperlink to part

The Norwegian fund is the most important institutional investor to publicly announce its vote for Musk's package deal.

Different main stakeholders, together with CalPERS and the New York State Retirement Fund, have additionally voiced opposition.

Proxy advisory companies Glass Lewis and Institutional Shareholder Providers (ISS) have really helpful that shareholders reject the plan, and Mr. Musk inspired Tesla to label shareholders “company terrorists” throughout Tesla's current earnings name.

Not all main buyers share this view. It has help from the Florida Board of Supervisors and ARK Make investments's Cathie Wooden, each of whom help Musk's management and the corporate's AI ambitions.

The 2 largest shareholders, Vanguard and BlackRock, haven’t but disclosed their voting rights.

Market sentiment stays tense forward of the final assembly of shareholders. Wedbush analyst Dan Ives expects buyers to approve the plan, calling it “a wise transfer by the board to provide you with these incentives/wage packages at this essential time, as Tesla's largest asset is Mr. Musk.”

Ives charges Tesla inventory a “purchase” and has a value goal of $600.

Tesla's gross sales proceed to be underneath strain

Copy hyperlink to part

Tesla's gross sales of electrical autos in China fell 9.9% year-on-year to 61,497 models in October, reversing the two.8% enhance in September, based on information launched by the China Passenger Car Affiliation on Tuesday.

Gross sales of the Mannequin 3 and Mannequin Y, that are made at Tesla's large Shanghai manufacturing facility, together with exports to Europe, India and different markets, fell 32.3% from September.

The corporate's international gross sales momentum has slowed amid weak demand in Europe and uncertainty within the U.S. market as a result of expiration of tax credit that supported file deliveries within the third quarter.

In Europe, Tesla's gross sales via September fell 28.5% from a yr earlier as competitors intensified from conventional automakers and rising Chinese language manufacturers.

Analysts level to Tesla's ageing mannequin lineup and restricted automobile vary as key components in Tesla's current struggles in an more and more crowded market.