Fuel utilization is a proxy indicator of financial exercise in some main chains. Tethers seem as the highest gasoline burner for Ethereum and main EVM appropriate chains.

Conduit analysis tracked financial exercise Fuel utilization Over the previous 12 months, we now have profiled a few of our main chains. The Ethereum ecosystem, together with L1 chains, L2 networks and EVM appropriate chains, has emerged as a serious hub for tether actions. Tether sensible contracts are near most of those chains.

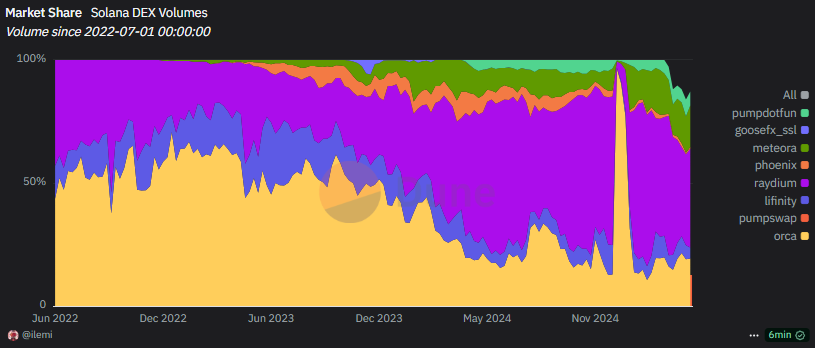

Conversely, Solana has emerged as a sequence of dex buying and selling, with Raydium burning probably the most gases within the final 12 months.

Conduit Report tracks EVM networks comparable to Ethereum, Solana, high L2 chain gasoline, and Avalanche. All of those chains use a gasoline calculation format. That is the price of the person and the supply of the validator's revenue.

Tethers are key gasoline burners for a number of chains

Tether issued USDT tokens as native belongings throughout a number of chains. At Ethereum, USDT Sensible Contract burned greater than $70 million in gasoline for the 12 months resulted in April 2025. The Stablecoin sensible contract is second solely to the Uniswap router, which burned greater than $189 million in gasoline at Ethereum.

Uniswap and Tether usually change places as high gasoline burners relying on the time, person exercise, and the presence of different busy contracts. Within the quick time period, USDT is on hearth 6.8% Of all Ethereum gasoline, nevertheless, the share has elevated to 11.75% over the previous 12 months.

The contract model of Tether can be Tron, OP Mainnet's foremost gasoline burner, and is the second most energetic contract within the Avalanche and BNB Sensible chain. Within the case of BNB chains, using USDT is related to small transactions for funds and transactions. The contract will burn greater than 30% of the chain's gasoline for the previous 12 months.

Fuel burners dissipate assets from the shopper aspect, reflecting the true emotions of the person. For Ethereum, which means that Stablecoins is among the high use instances, even when the community has comparatively low site visitors.

The next apps embrace Dex Router Contracts, Buying and selling Bots, and aggregator apps comparable to 1inch and Cowswap. The selection of gasoline burner apps is generally restricted to Defi, with no different use instances like gaming or NFT.

Solana turns into a sequence of DEX actions

The highest app for Solana of the noticed interval is Raydium, the principle DEX. Raydium burned 41.81% of all Solana gasoline.

Raydium was Solana's high gasoline burner as a result of its standing as a serious Dex. |Supply: Dune Analytics

The photon buying and selling bot consumed greater than 20% of Solana's gasoline. Pump.Enjoyable and Jupiter Aggregator consumed an extra 33% of the community's gasoline.

Solana nonetheless carries over 87.2% Buying and selling bots Customers are up from 86% prior to now few weeks. The Solana Ecosystem confirmed divergence from the EVM appropriate chain and has been reworked right into a excessive pace community for DEX swap.