With Bitcoin (BTC) regaining $120,000 in assist, the long-term worth construction of the asset signifies a potential breakout of $200,000 within the coming months.

This chance was shared by in style cryptocurrency analysts Commerce shotBitcoin has expanded its rebounds from its 50-week transferring common (MA), noting that it has lately been strengthened by short-term bounces on the each day MA50.

August twelfth TradingView Posts, analysts famous that this up to date momentum will convey the technical focus again to macro traits. In macro traits, the subsequent essential hurdle is on the 0.5 Fibonacci retracement degree.

Traditionally, this 0.5 FIB degree has been a horrible zone of resistance, with the final rejection of Bitcoin on December 16, 2024, serving as a cap since Could 2022.

Nonetheless, the earlier cycle high is just not solely damaged above 0.5 FIB, but in addition reached ranges above the 0.786 Fibonacci mark, approaching the higher boundary of the channel.

A break above the 0.5 FIB might probably ship Bitcoin in the direction of the 0.618 degree, probably testing $200,000 close to the subsequent cycle peak later this yr. This locations Meyer's a number of bands within the higher crimson zone, however inside the scope of historic norms, and the second half of 2025 may very well be essential for worth discovery.

Watch the Bitcoin Key Assist Zone

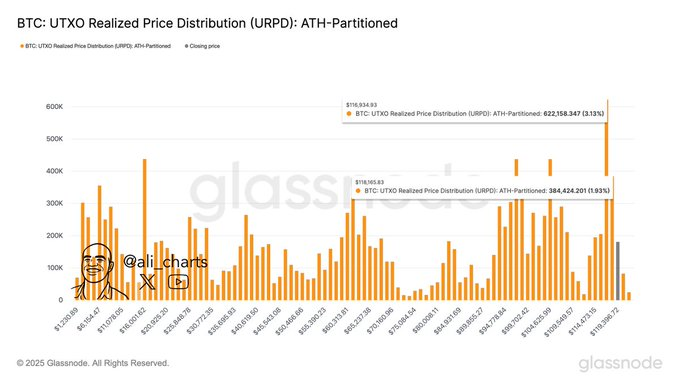

In the meantime, as Bitcoin is seeing a excessive new document, buying and selling professional Ali Martinez reveals costs that present two fundamental assist zones exhibiting information on GlassNode's UTXO worth distribution (URPD).

Based mostly on his August twelfth information, 384,424 BTC (1.83% of provide) was acquired at almost $118,163, whereas 622,158 BTC (3.13% of provide) was bought round $116,934, creating a robust technical and psychological flooring that might assist future pullbacks.

Bitcoin worth evaluation

By press time, Bitcoin had grown by 2.3% over the past 24 hours, buying and selling at $120 and $920 at 6.6% on the weekly chart.

The truth is, Bitcoin has proven bullish sentiment, suggesting that technical might push past $120,000. The asset is nicely above the 50-day Easy Transferring Common (SMA) $114,109 and the 200-day SMA $92,926, confirming a powerful long-term uptrend. Quick-term SMAs additionally function the first degree of assist.

On the identical time, Bitcoin's 14-day relative power index (RSI) stands at 59.57, suggesting average upward momentum with none indicators of overheating.

Featured Pictures through ShutterStock