It took virtually a number of weeks within the second half of 2025, and it’s truthful to say that Bitcoin and the worldwide monetary market have virtually seen this yr. From the World Commerce Battle to the actual disputes between international locations (together with severe navy motion), the market has undergone numerous varieties of exterior strain all year long.

Consequently, the world has a direct relationship with a major correlation between the normal monetary market and the encryption market. The US inventory market and Bitcoin haven’t moved in current months, however they don’t deny the existence of the connection between the asset class.

What does the normal volatility of BTC imply?

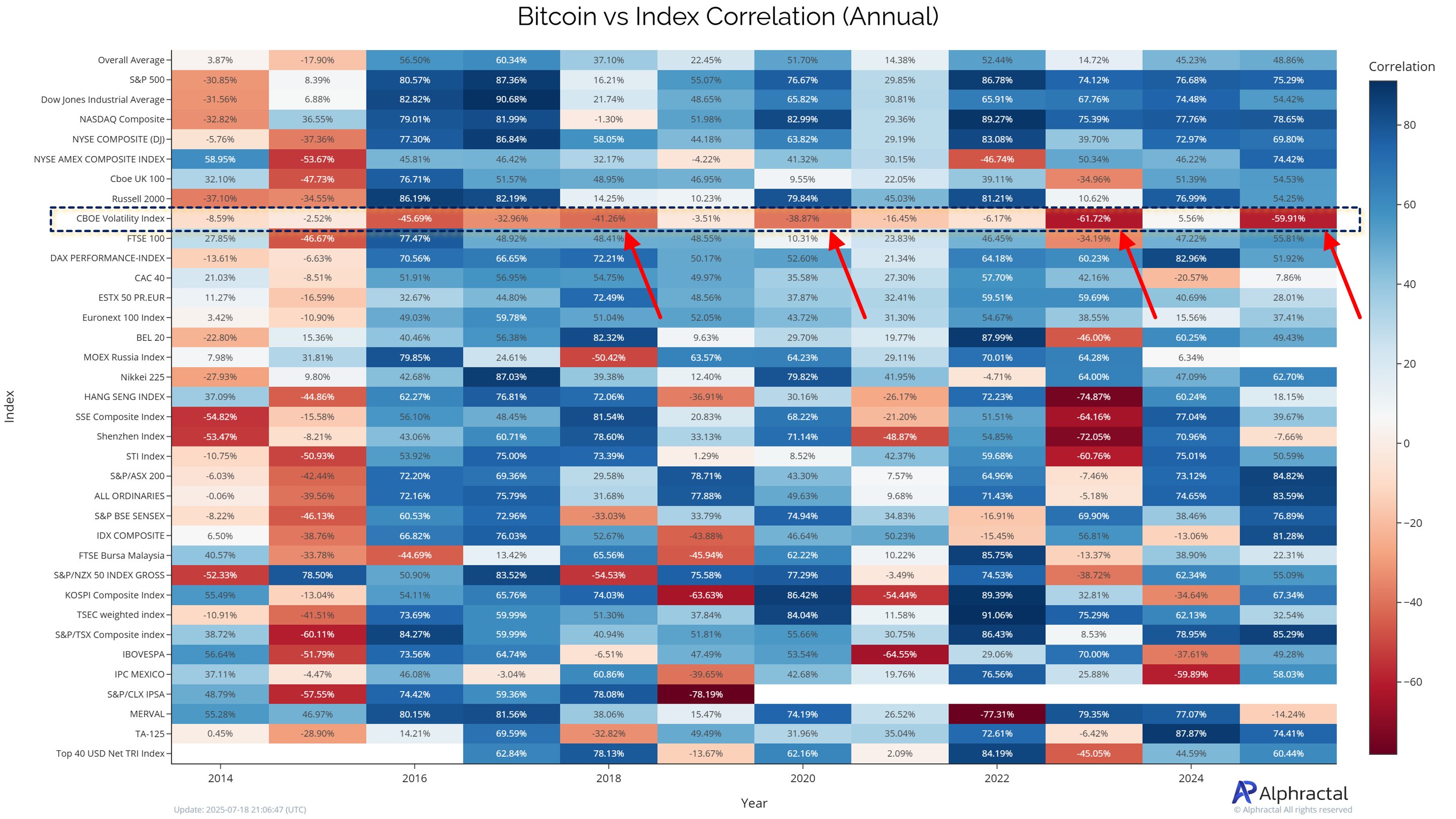

Within the new put up of Social Media Platform X, Alphractal CEO and founder Joao Wedson explored the connection between Bitcoin and US Equities Market (via the S & P 500 Index). In accordance with Crypto Knowledgeable, Premier Cryptocurrency has a low correlation with the CBOE volatility index (VIX), which tracks the market expectations for the volatility of the S & P 500 index.

Within the context, volatility signifies how briskly the worth adjustments in a brief time period. It’s usually thought of a option to measure market sentiment. WEDSON talked about that the VIX index, also referred to as Worry Index, is broadly used as a harmful thermometer amongst conventional monetary market members.

In accordance with WEDSON, the worth of Bitcoin tends to be extra unbiased and bigger within the low VIX interval, particularly every time there’s a unfavorable correlation with the S & P 500 index. In accordance with the analyst, this improve has usually been transformed to a major value improve.

Wedson stated:

In different phrases: Don’t waste time to investigate the BTC vs. S & P 500 when the correlation between BTC and VIX is low or unfavorable. That is usually when BTC is prone to enter the explosion stage.

Supply: @joao_wedson on X

Quite the opposite, when the VIX is excessive, it’s value trying on the relationship between Bitcoin and the US inventory market. The latter worry might have an effect on the previous habits. Nevertheless, WEDSON is at the moment lowering VIX, and the S & P 500 index might not assist to investigate the following motion of Bitcoin.

WEDSON concluded that the extra BTC is separated from conventional volatility (VIX), the extra highly effective as an unbiased asset. In the end, this could be a constructive signal of bitcoin costs and may supply new alternatives for buyers to enter the market.

Bitcoin value at a look

On the time of this text, BTC is about $ 117,888, which doesn’t mirror important value motion over the past 24 hours.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Istock's most important picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing customary and every web page is diligent within the prime know-how specialists and the seasoned editor's staff. This course of ensures the integrity, relevance and worth of the reader's content material.