Bitcoin derivatives information nonetheless reveals heavy exercise throughout the long run and choices market, altering open curiosity and positioning.

Heavy futures buying and selling has emerged at $110K as the utmost ache stage for Bitcoin choices

Bitcoin traded at $110,894 on Saturday, September 6, 2025, falling 1.8% over the past 24 hours, with an intraday vary of $110,339 to $113,142. Coinglass.com metrics present that open curiosity in futures is 717,980 BTC ($7.963 billion). CME led by 136,380 BTC ($1.512 billion), accounting for 18.98% of the market adopted by a 126,540 BTC ($140.3 billion, 17.62%) vinance and a 89,280 BTC ($99 billion, 12.2%) bibit.

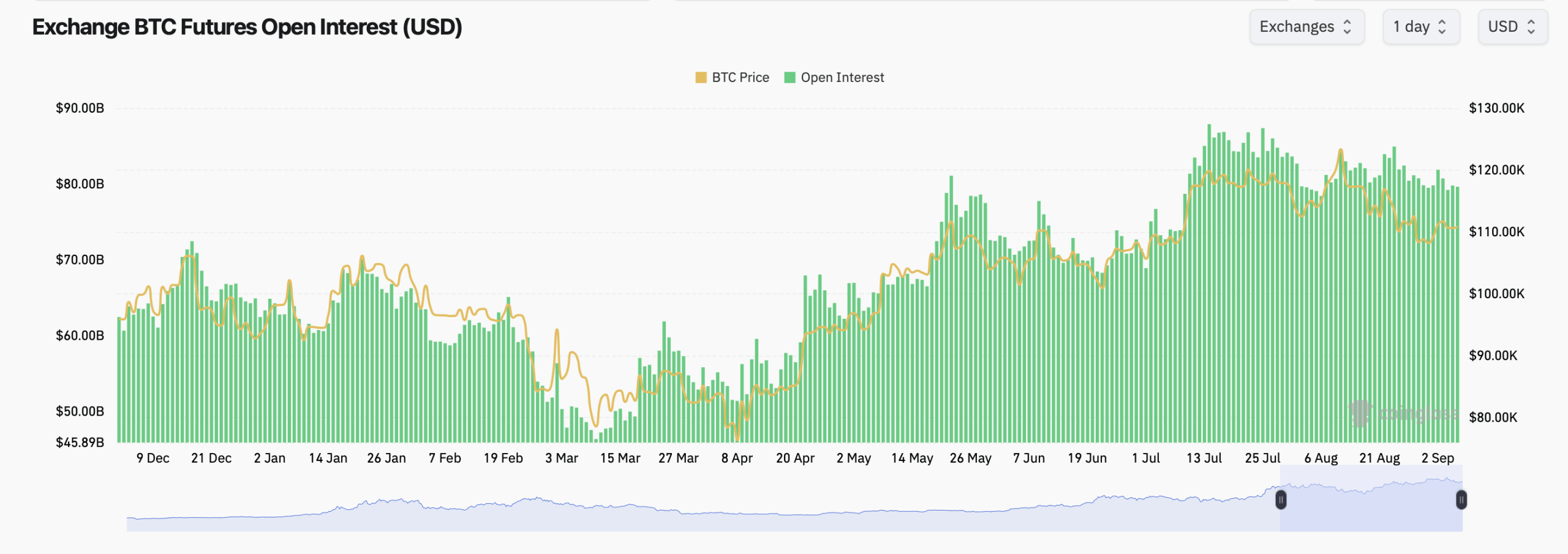

OKX, Gate and Kucoin chase after them, exhibiting Gate the strongest 24-hour improve. BINGX noticed the largest decline, down 15.84% over the previous 4 hours and seven.03% over the day. The symptoms present that open curiosity within the complete future has been lowering modestly since late August, however stays rising in comparison with the start of the 12 months. The worth of open curiosity constantly tracks the worth of Bitcoin, which peaked at over $90 billion in the course of the mid-July rally.

As of early September, futures curiosity was near $80 billion, reflecting a slight pullback after the summer season's greatest. Within the choices market, complete public curiosity reached practically $60 billion, with actions primarily specializing in Delibit. Cole accounted for 59.27% of open curiosity at 240,927 BTC versus 40.73% of PUT at 165,572 BTC. Over the previous 24 hours, Cole led the quantity at 52.19% (15,716 BTC), barely forward of Put at simply 47.81% (14,397 BTC).

The lean in the direction of the decision signifies stronger demand for upward publicity, however the put stays pretty energetic. The most important open curiosity positions embrace December 26, 2025, $140,000 (10,386 BTC), September 26, 2025, $140,000 cellphone (9,989 BTC), and September 26, 2025, $95,000 (9,918 BTC). Different notable strikes clustered at round $115,000 to $150,000, with a robust demand for each bullish and bearish contracts.

On the quantity facet, short-term expiration dates are managed, together with a $110,000 placed on September twelfth and a $116,000 name on September twenty sixth. Max's ache, the extent at which choice holders face the largest complete loss, was near $110,000 in September satisfaction. This positioning means that short-term pricing pressures may very well be centered round that stage as market producers intention to reduce funds.

With Bitcoin buying and selling simply above Saturday's greatest ache, the derivatives market seems to be balanced between bullish name demand and defensive hedges. Nonetheless, it's on the sting of the razor.