ETH Technique, a Defi protocol that mimics Comporate Treasury Operations On-Chain, is at the moment deploying ETH in a yield place by means of a partnership with EtherFi, a non-biological liquid staking protocol.

In response to a weblog announcement on August 18th, assignments to companions like Etherfi “geared toward producing sectarian returns for sustainable ETH as a part of the ETH strategic finance programme.” The person will get a sequence receipt token for every place. This serves as a dwell verifiable “help proof,” the ETH technique defined.

The ETH technique, which has over 11,000 ETHs within the Treasury, states that the mixing is “designed to sit down alongside different defi venues when deploying extra companions, and is designed to diversify the supply of yield whereas sustaining liquidity and administration.”

In apply, this implies you can purchase returns by means of lending, staking or different yield mechanisms and assign ETH to a number of protocols with out locking down person liquidity.

Staking yield

In an X submit on August 18th, Ether.fi mentioned the ETH technique “will deploy a good portion of its ETH holdings to Weeth.”

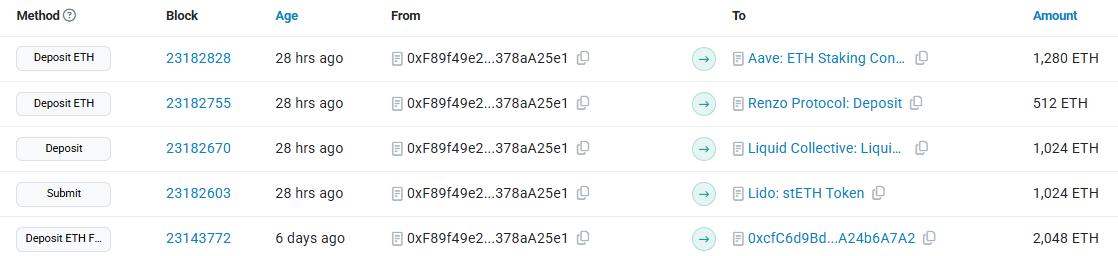

Though the precise quantity has not been revealed, on-chain knowledge exhibits that the ETH technique has been allotted Weeth to 2,048 ETH up to now, with small deposits to Lido, Liquid Collective, Renzo and Aave.

ETH deposits

ETH Technique isn’t an organization with conventional off-chain stability sheets. This can be a set of good contracts run on Ethereum, which autonomously manages the Treasury's location. ETH Technique states in its official documentation that “two audits have been accomplished” however provides that it will likely be “revealed later” with out naming the auditor or offering a timeline.

The ETH technique didn’t reply to Defiant's request for remark.

The protocol's native token struts are designed to offer leveraged publicity to ETH with out the everyday liquidation danger of borrowing. Customers will glue ETH or STABLECOINS to obtain a convertible be aware consisting of Furnibble On Chain Debt Token (CDT) and NFT Name Choices on STRAT.

The holder can promote CDTs for Stablecoins, holding the NFTs transformed to struts later.

The protocol will get its choice premium and Strat is barely minted when somebody workout routines an NFT choice.

Strut Chart

Nevertheless, its construction doesn’t rule out market danger. Paperwork for the mission particularly warn {that a} long-term ETH recession may “have insufficient worth for the Treasury to repay money owed on expiration date.”

As of press time, Strat has dropped by about 13.5% since its launch on August thirteenth, in comparison with about 9% of ETH per Coingecko knowledge.