Bittensor (TAO) has emerged as one of many market's standout performers, shortly recouping all its losses from the latest crypto Black Friday crash. This can be a feat that even Bitcoin (BTC) and Ethereum (ETH) have but to attain.

The outlook for TAO is wanting more and more constructive, supported by elevated buying and selling volumes, growing institutional publicity and tight provide forward of the primary halving.

What’s driving Bittensor (TAO) to outperform the market?

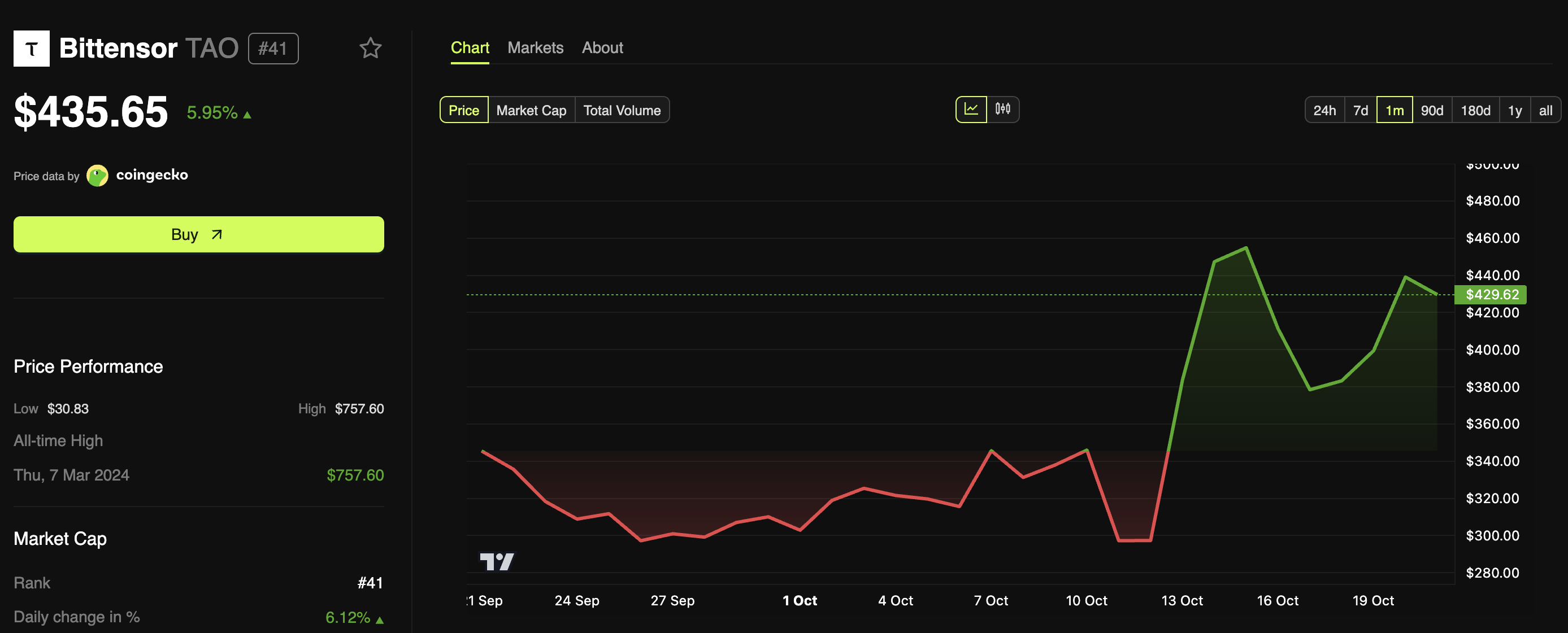

A lot of the main cryptocurrencies have fallen over the previous two weeks, in response to knowledge from BeInCrypto Markets. In distinction, Bittensor (TAO) bucked this pattern and rose 35.7% over the identical interval.

The cryptocurrency not solely managed to get better from the October market crash, but in addition rose to multi-month highs. Up to now day alone, the altcoin has elevated in worth by 5.95%, buying and selling at $435.65.

Bittensor (TAO) worth efficiency. Supply: BeInCrypto Markets

There are a number of elements contributing to TAO's robust efficiency. CoinGecko knowledge confirmed that the token has maintained every day buying and selling quantity of over $400 million for the previous week, besides yesterday. On October 15, quantity reached $943 million, indicating excessive dealer curiosity and exercise.

TAO's development is additional supported by its robust stake participation. Taostats knowledge reveals that greater than 70% of TAO in circulation is staked. This limits the obtainable buying and selling provide and helps the value.

Institutional curiosity fuels momentum

Institutional adoption additional expanded Bittenshal's affect. Grayscale’s decentralized AI fund has allotted greater than a 3rd of its holdings to TAO, demonstrating rising confidence within the coin as a central participant in decentralized AI.

Grayscale's AI Fund 33.53% on $TAO 👀 pic.twitter.com/KbG5TQn60L

— Quinten | 048.eth (@QuintenFrancois) October 19, 2025

Moreover, the corporate lately filed a Kind 10 for Grayscale Bittensor Belief with the SEC. This might pave the best way for future exchange-traded merchandise, much like developments seen with different main cryptocurrencies comparable to BTC and ETH.

The launch of the ETF might present additional liquidity, institutional investor participation, and general market visibility for TAO.

Bitensol will attain its first half-life in December 2025

Whereas present catalysts are driving short-term positive aspects, further elements might drive TAO's long-term development. December 2025 brings a milestone: the primary halving occasion for Bittensor holders.

As acknowledged within the official documentation, Bittensor halving doesn’t comply with a block timeline like Bitcoin. As a substitute, TAO's supply-based triggers cut back every day emissions when set thresholds are reached. A deliberate discount within the provide of latest tokens can result in worth will increase, particularly if robust staking additional limits liquidity.

Token recycling could change the halving timeline barely, however the principle impact is elevated shortage, which can trigger elevated demand.

Click on right here to buy $TAO!

That is even larger than the $ZEC $TAO halving scheduled for December 2025.

Don't miss it pic.twitter.com/S4F6mz272q— Crypto Eagles (@CryptoProject6) October 19, 2025

Moreover, the asset has acquired vital assist from main market consultants. In reality, analyst Quinten Francois lately claimed that TAO might turn out to be a $1 trillion asset by 2030-2031.

“Probably the most interesting factor about TAO is that its path ought to comply with Reed's Legislation, quite than Metcalf's Legislation like BTC. Bitcoin reached a $1 trillion market cap in 2021, simply 12 years after the Genesis block. In idea, TAO ought to do it inside 12 years,” he predicted.

Francois cited the mission's aggressive subnet mannequin and Bitcoin-like tokenomics as key strengths. He additionally referred to as TAO's mannequin “brilliantly thought out.”

As such, TAO is well-positioned as December approaches because of excessive buying and selling volumes, staking, and institutional curiosity. The approaching months will check Bitensor's resilience because it strikes right into a part of diminished provide and continued investor consideration.

The publish The Cryptocurrency That Overcame the Market Crash – What's Driving TAO's Quiet Rise?The publish appeared first on BeInCrypto.