Ethereum started this week with a minor aid bounce after final week's Flash fell beneath $1,500. Costs are presently supported, however momentum is weak and on-chain sentiment continues to be bearish, suggesting that any benefit may very well be restricted until consumers regain essential ranges of resistance.

Technical Evaluation

By Edris Dalakshi

Day by day Charts

The day by day construction of ETH stays grossly terrible. The asset continues to fall beneath the 200-day shifting common across the $2,800 mark, and has printed a number of low highs and lows over the previous two months. After falling beneath the $1,800-$2,000 vary final week, ETH has struggled to carry its $1,550 help zone.

Moreover, RSI stays restrained, hovering simply above oversold ranges, and momentum indicators don’t present robust bullish divergence. A break beneath $1,550 opens the doorways round $1,300-$1,400 heading in the direction of the subsequent main demand zone, however should acquire $1,900 to decelerate the present bearish development.

4-hour chart

Within the four-hour time-frame, ETH just lately bounced again from $1,550 help, however now faces a serious descending trendline that has served as a dynamic resistance for over a month. At the moment, costs are testing the resistance vary from $1,650 to $1,700.

A profitable breakout and flip of this zone over the development line may set off a short-term rally to $1,800. Nonetheless, sellers proceed to function on all bounces and the market construction nonetheless favors a low excessive until ETH can maintain above $1,700.

Emotional evaluation

By Edris Dalakshi

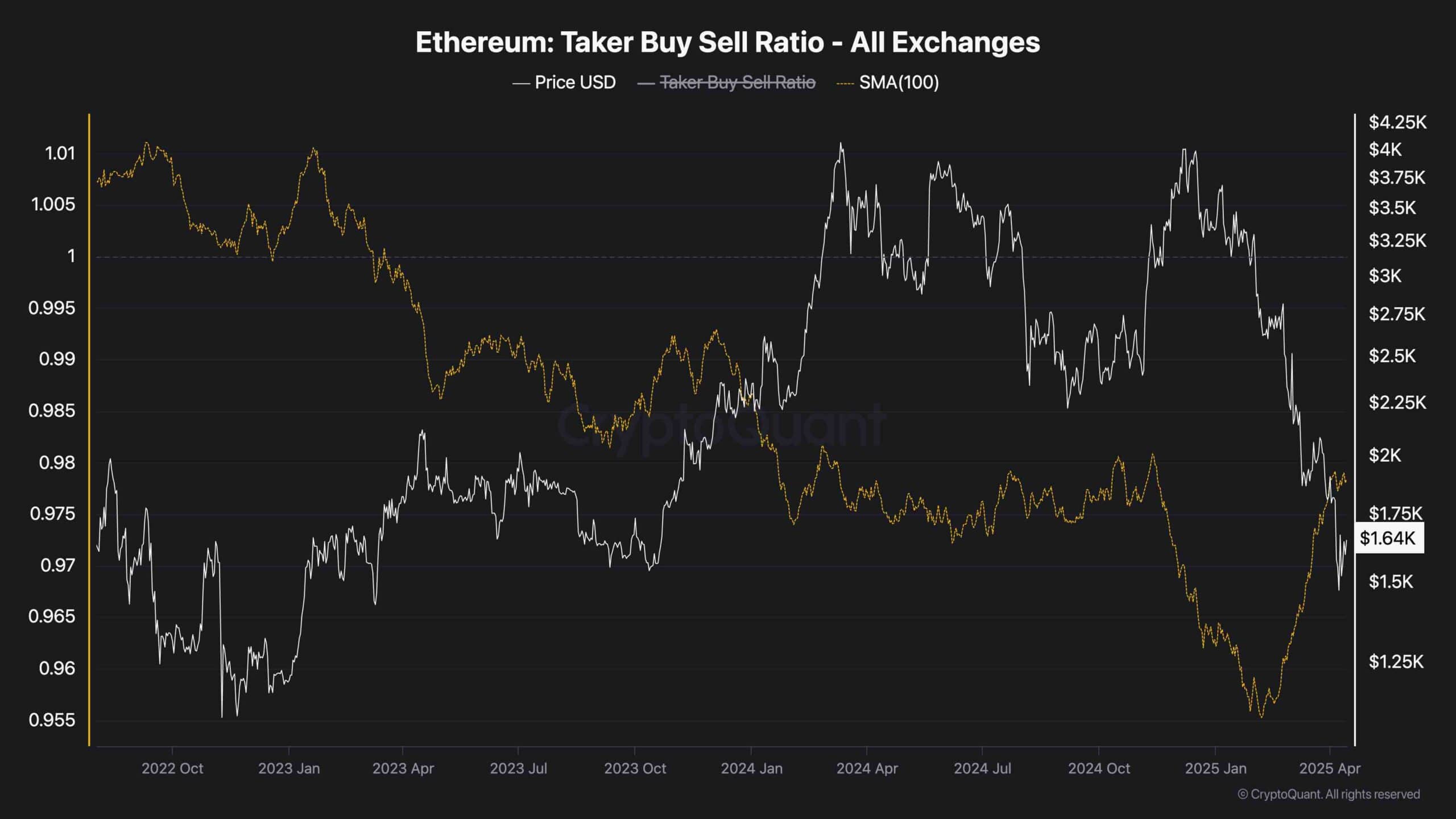

Taker buy and gross sales ratio

Taker reveals that market orders are primarily sales-driven with buy and gross sales ratios for ETH traits beneath 1. Though there was a rise just lately, the general development stays bearish, suggesting that bounce will not be supported by robust demand. This coincides with an absence of bullish perception within the chart.

Purchaser assaults might stay weak till the ratio is critically maintained above 1. Briefly, feelings present lingering concern, and the broader traits are dealing with additional downsides, until consumers are in a position to pressure adjustments in construction and amount.