In early Might 2025, the Ethereum (ETH) market witnessed contrasting habits from massive buyers, generally often called whales.

These conflicting actions from whales current each threat and alternative to buyers.

Contrasting whale habits

On the one hand, a number of Ethereum whales accumulate massive quantities of ETH. ETH Whale bought 3,029.6 ETH, value $5.74 million. Nevertheless, the whale is at the moment going through a short lived lack of $142,000 as its worth has dropped to $1,842 per ETH.

On Might 1, 2025, Lookonchain reported that a number of whale addresses had gathered 1000’s of ETH inside two hours. These actions point out that some key buyers are assured within the long-term potential of ETH regardless of short-term worth volatility.

In the meantime, gross sales stress from Ethereum whales is necessary. On Might 2, 2025, Onchainlens reported that the whales deposited 2,680 ETH on Kraken, with an estimated lack of roughly $255,000.

In the meantime, analysts revealed that one other whale had moved 3,000 ETH to Kraken inside 10 minutes on the identical day, strongly supposed to promote.

Specifically, whales that acquired 76,000 ETH throughout their 2015 ICO offered 6,000 ETH, probably securing a revenue of $109,900.

Moreover, on Might 1, 2025, chain information was proven to incorporate a whale that will increase its quick place by borrowing an extra 4,000 ETH. The whale brings a complete quick place to 10,000 ETH, value round $18.4 million.

These strikes spotlight clear variations in Ethereum Whale Methods, and accumulation and gross sales put an excessive amount of stress on ETH costs.

Market context and buyers' emotions

The volatility of whale habits coincides with crypto markets affected by quite a lot of components. In accordance with Beincrypto, ETH costs rose 10% in per week, however have dropped barely prior to now 24 hours. It's hovering for round $1,842. This can be a marked decline from the March 2025 peak of $2,500.

Ethereum worth chart for the previous month. Supply: TradingView

However, market sentiment exhibits some optimistic indicators. Ethereum Funding Merchandise additionally noticed an influx of US$183 million final week after persevering with its eight weeks of outflow. The Ethereum Spot ETF had a complete web influx of USD 6.4932 million yesterday. This displays sustained long-term curiosity from the company, even amid short-term gross sales pressures from whales.

Moreover, the massive 10,000 ETH quick place in whales suggests expectations of a short-term worth drop, which may amplify downward stress if market sentiment goes adverse.

In the meantime, retail buyers look like affected by this uncertainty, with ETH buying and selling quantity dropping by 10% over the previous 24 hours.

Dangers and Alternatives

The whale's conflicting habits locations buyers on the intersection of threat and alternative. On the danger aspect, particularly given the extreme market state of affairs, gross sales stress from whales, notably the necessary quick positions, may decrease ETH costs within the quick time period.

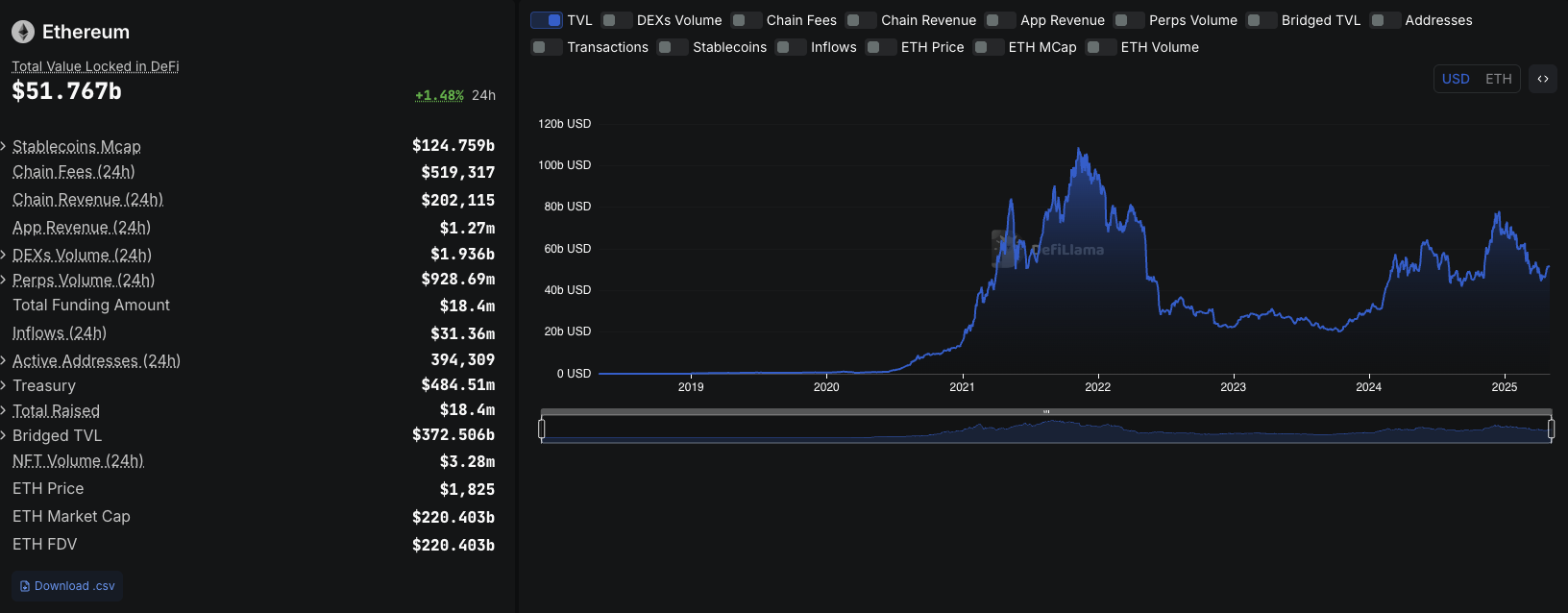

Ethereum tvl. Supply: Defilama

However there are many alternatives too. In accordance with Defilama, the buildup of 1000’s of whales displays long-term confidence within the potential of Ethereum, notably because the community continues to guide in Defi, with a complete of $52 billion (TVL) locked in Might 2025.

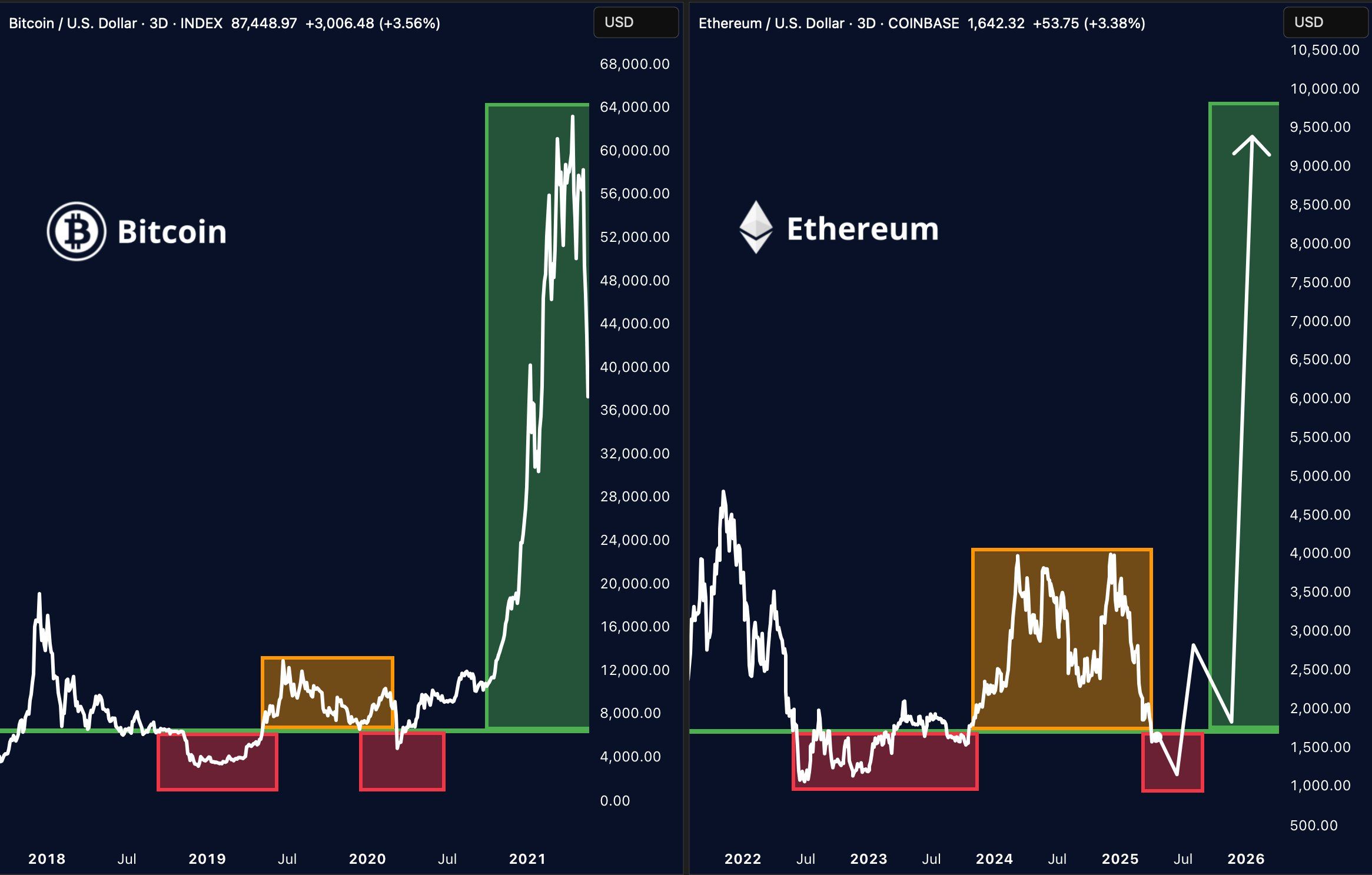

Analyst Merlijn exhibits that Ethereum's present worth construction is much like Bitcoin's 2020 worth construction. Due to this fact, he believes that if historical past is repeated, Ethereum will witness a powerful growth.

Ethereum exhibits the identical construction. Supply: Merlin

Ethereum dangers dropping builders to Solana. That is gaining momentum due to improved startup help and a streamlined consumer expertise.

Nevertheless, technological upgrades like Ethereum 2.0 and development of layer 2 options comparable to Arbitrum and Optimism additionally helps the long-term improvement of ETH.

Buyers could view present low worth ranges as a chance to build up, however whales' exercise and technical indicators should be intently monitored to mitigate correction threat.