In line with an in depth Coingecko report, Ethereum gross sales by the Ethereum Basis (EF) don’t considerably have an effect on token costs as generally believed.

“Does the sale of Ethereum Basis (EF) trigger important market actions?” Coingecko requested in a tweet. There, we uncovered the most recent analysis that proves that the sale of Ethereum Basis of ETH under 9k just isn’t considerably positively correlated with value modifications.

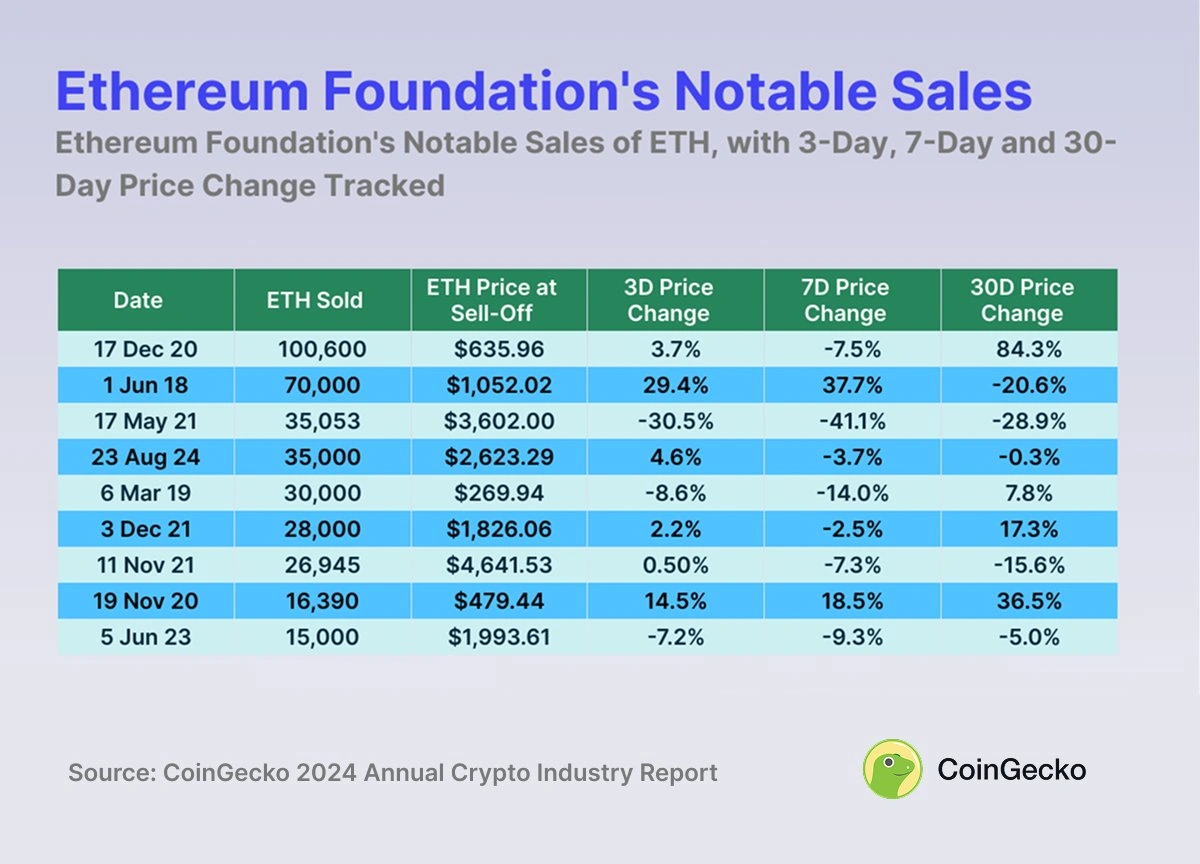

The identical can’t be mentioned for gross sales exceeding 15K ETH. For instance, one instance of the fundamental promoting 70K ETH was 20.6% DIP, with 16.3K ETH gross sales adopted a 36.5% rise.

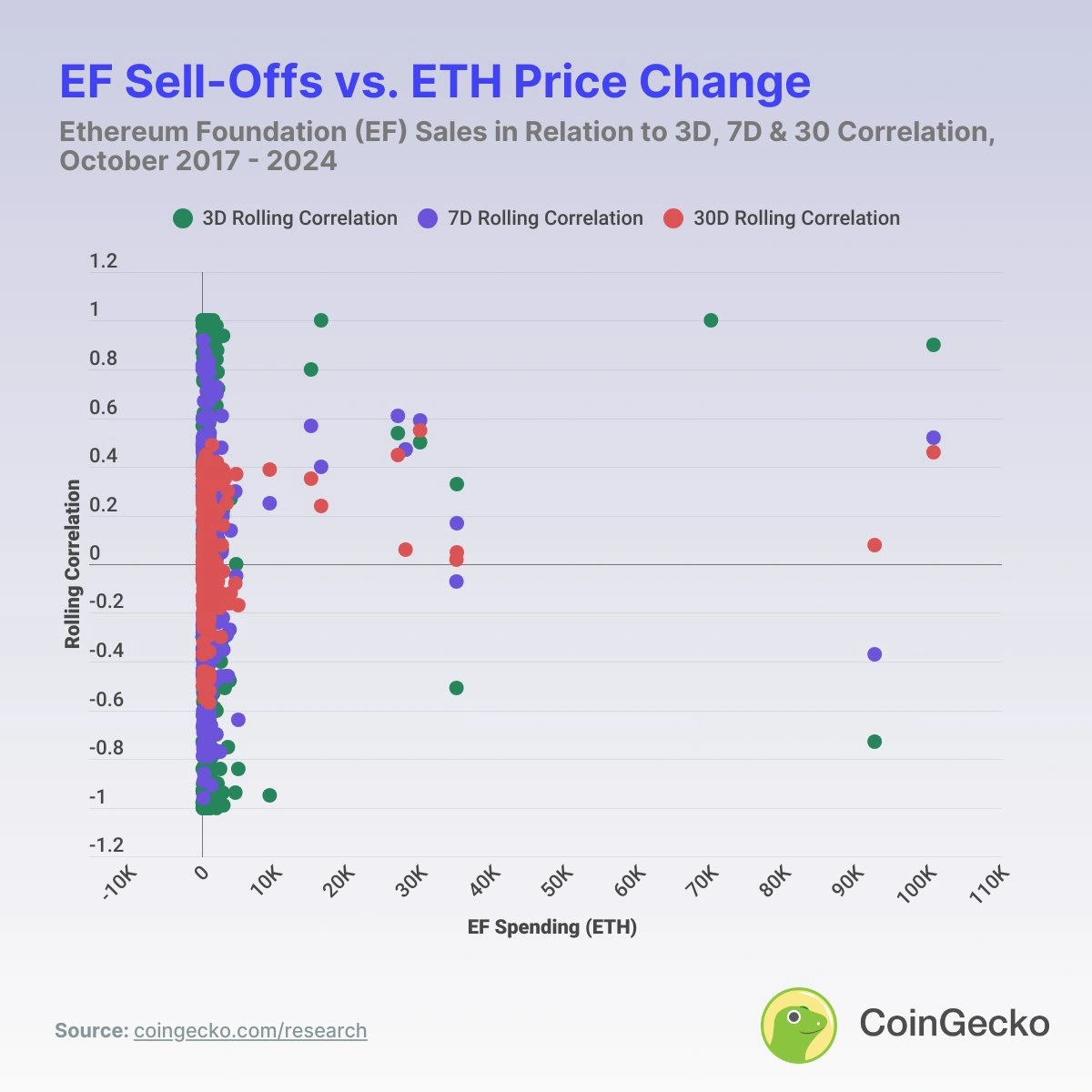

For the needs of the investigation, Coingecko analyzed the sale of EFs from October 16, 2017 to January 15, 2025 utilizing publicly obtainable on-chain knowledge from Dune, Etherscan and Coingecko. Be aware that solely ETH transactions above 100 ETH are thought-about, and the evaluation doesn’t have in mind market developments or macroeconomic occasions.

Ethereum Basis ETH gross sales have had completely different impacts on costs over the three, 7 and 30-day time frames. Supply: Coingecko

Coingecko's findings affirm the connection between EF gross sales and ETH value motion

In line with the report, the typical value change for ETH over the seven days after the sale of ET is +1.3%. The report doesn’t disprove the declare {that a} huge sale of the Ethereum Basis (EF) will set off a direct market response. Nonetheless, they argue that these actions should not uniformly damaging.

The share of instances the place ETH costs have fallen inside seven days of the sale of EF is -47.6%, suggesting that lower than half of EF gross sales will lead to fast value drops. In actual fact, Coingecko argued that most often EF gross sales actions don’t trigger deep diving in Ethereum costs.

Because the sale was made, the most important weekly decline on file after EF gross sales was -41.1%.

Some gross sales result in outstanding short-term responses. For instance, a sale that occurred on Might 17, 2021 triggered costs to plummet inside per week at -41.1%.

Coingecko argues that such ranges of decline should not common as different massive transactions can as an alternative coincide with value will increase. Additionally, regardless of the large sale, ETH costs noticed pumps in 164 instances, however fell to 149 instances.

The blended outcomes are proof that EF spending just isn’t a dependable ticket to a bloody ETH chart.

Over the 30-day vary, the muse's sale after a mean ETH value change is +8.9%.

Ethereum Basis spending varies with ETH costs throughout completely different time frames

To additional discover the connection between EF expenditures and ETH value motion, Coingecko analyzed the rolling correlation over three time frames: 3 days, 7 days, and 30 days.

Gross sales from the well-known Ethereum Basis. Supply: Coingecko

Information revealed that the rolling correlation over the 3-day ranged from -0.999 to +0.999. This means excessive volatility, suggesting that short-term value actions might be strongly influenced by broader market situations somewhat than EF expenditures.

One case confirming this occurred was on November 19, 2020, when the rolling correlation reached 0.9998 after EF offered 16,390 ETH and the value of the ETH rose from $479 to $560 over 4 days.

After all, EF was offered and ETH may undergo a value drop over the subsequent three days.

Nonetheless, in each instances, the short-term correlation proves that it’s extremely delicate to market sentiment and fluidity, somewhat than what the Ethereum Basis does with ETH reserves.

In contrast to the 3-day correlation, the 7-day rolling correlation has much less volatility and customarily varies between -0.7 and +0.7. This exhibits a extra steady however inconsistent relationship between EF expenditures and ETH costs over the weekly timeframe.

The 30-day rolling correlation gives perception into broader market developments. For instance, between 2018 and 2020, the correlations are primarily constructive, usually above 0.3.

Because of this EF funding actions could also be associated to market belief and development, notably throughout the early levels of ecosystem growth, within the naked market.

Nonetheless, since 2021, the correlation has step by step flowed to impartial or damaging values, a change that displays the influence of Ethereum's market maturity and larger macroeconomic energy.

So far as gross sales distribution is worried, there isn’t a important constructive correlation between modifications in ETH costs and gross sales of ETH under 9K. Nonetheless, it’s reported that when extra ETHs are offered, stronger constructive correlations will seem most often.

Coingecko evaluation revealed that the 30-day rolling correlation between EF expenditure and ETH costs was concentrated primarily between -0.3 and 0.5, indicating a weak to reasonable relationship.

The 7-day rolling correlation follows an analogous distribution however exhibits extra variation, whereas the 3-day rolling correlation is extra excessive, at increased concentrations, highlighting a pointy however inconsistent short-term response to EF gross sales.

All of those findings affirm that long-term correlations are weak and inconsistent when Ethereum Basis gross sales usually have an effect on value actions within the short-term timeframe.