Based on the info, the US Etherum Spot ETF has simply seen the largest influx day, which is principally led by the demand for black rock and faithfulness.

Ethereum spot ETFs have elevated fast demand.

Based on the info from FarSide Buyers, July 16 was an enormous day for Ether Leeum department ETF, and the full influx exceeded $ 770 million, the brand new highest ATH. Spot Trade-Traded Funds (ETF) refers to funding signifies that buyers can expose to property with out proudly owning property instantly. For Cryptocurrencies, which means ETF house owners don’t must handle digital asset wallets or discover the trade. For conventional buyers, this may be made in a handy means for the ETF to discover the market.

Ethereum Spot ETFS was permitted in the US virtually a yr in the past. Since then, demand has been various, however property have just lately been positively influx, and the newest quantity is to point out momentum.

Beneath is a desk that exhibits how the netflows associated to varied Etherum Spot ETFs appear like a netflow over the previous couple of weeks.

Appears like BackRock's ETF has persistently led when it comes to inflows | Supply: Farside Buyers

As you may see, over the past week, the US Ether Leeum department ETF has already had greater than $ 200 million in notable influx, indicating that the demand for institutional organizations was robust however the newest recorded day has begun to be a better tools.

Blackrock's Etha noticed that the influx of July 16 was virtually $ 500 million. Constancy's FETH was a distant two seconds and acquired about $ 133 million as a cryptocurrency on behalf of the person. Capital was poured into ETFS when Ethereum noticed greater than $ 3,000 greater than $ 3,000.

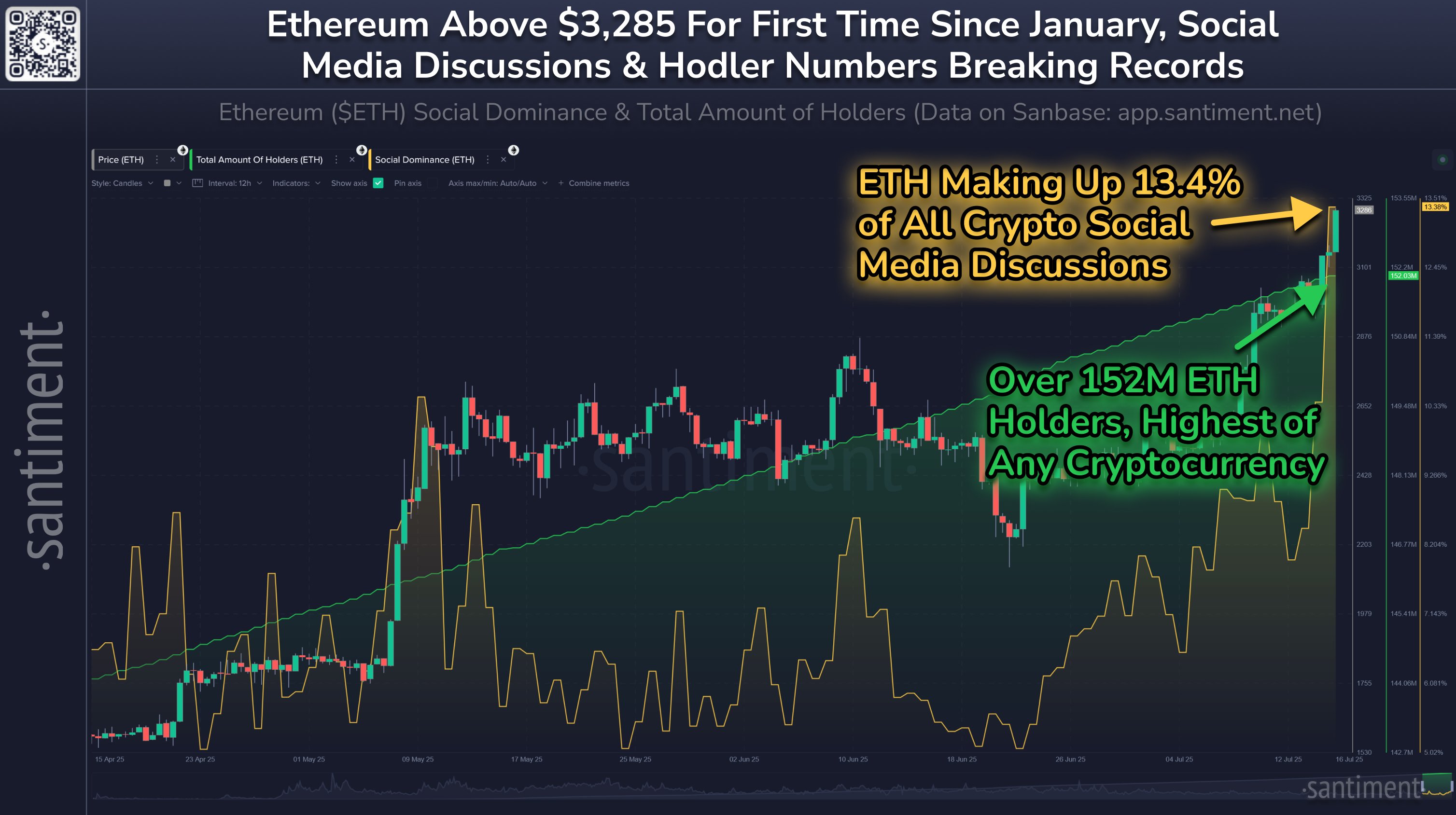

Following this rally, the analytical firm's knowledge of Santiment exhibits a surge in retail pursuits, so institutional buyers will not be the one particular person to concentrate to ETH.

The development within the Social Dominance and Whole Quantity Of Holders for ETH over the previous couple of months | Supply: Santiment on X

On the chart, Santiment hooked up knowledge from social domination. That is an indicator of the dialogue share of Ether Lee's share of the key social media platforms in comparison with different cryptocurrencies.

Since retail buyers are a lot bigger than the bigger holders when it comes to numbers, this metrics replicate the habits of small palms. Within the graph, ETH social dominance has surged with the surge in costs, and there are 13.4percentof all digital asset discussions on social media associated to coin.

Clearly, retailers are at the moment being attentive to their property, however traditionally, over -advertising between the gang tends to finish with cryptocurrency, so this development may be famous.

ETH worth

On the time of writing, Ether Lee is buying and selling $ 3,400, up greater than 23% from final week.

The worth of the coin seems to have sharply been going up | Supply: ETHUSDT on TradingView

DALL-E, Santiment.web's major picture, TradingView.com chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing customary and every web page is diligent within the prime know-how consultants and the seasoned editor's workforce. This course of ensures the integrity, relevance and worth of the reader's content material.