The Winklevoss Twins-Run Trade is subsequent consistent with its public debut on inventory indexes.

Coinbase and bulls have already made a leap, elevating some eyebrows. What's subsequent for Gemini?

Ongoing minutes

Shared through a press launch by means of the trade's mum or dad firm, Gemini House Station Inc., it introduced earlier this week that it had begun an preliminary public providing (IPO) course of with affords of over 16.6 million shares of Class A standard inventory.

This follows the registration assertion on the S-1 kind filed with the US Securities and Trade Fee. Along with the supply, shareholders promoting Gemini and inventory plans will supply the underwriters (the monetary establishment/specialists who assess potential mortgage threat and envision potential mortgage threat) the choice to buy further shares for a month.

These quantities are 2,396,348 and 103,652 shares of Class A standard inventory, respectively, that are used to cowl over-allotment (an choice that enables the underwriter to promote as much as 15% extra shares than initially deliberate). The IPO worth for the inventory is presently within the vary of $17 to $19, relying on the financial state of affairs and different circumstances.

Moreover, the announcement has introduced that there isn’t any assure as to when the providing will likely be accomplished or its precise measurement. Gemini utilized for an inventory of Nasdaq indexes with the ticker “Gemi”. The most important bookrunners (underwriters) are monetary giants Goldman Sachs, Citigroup and Morgan Stanley.

Do you see one other nice efficiency?

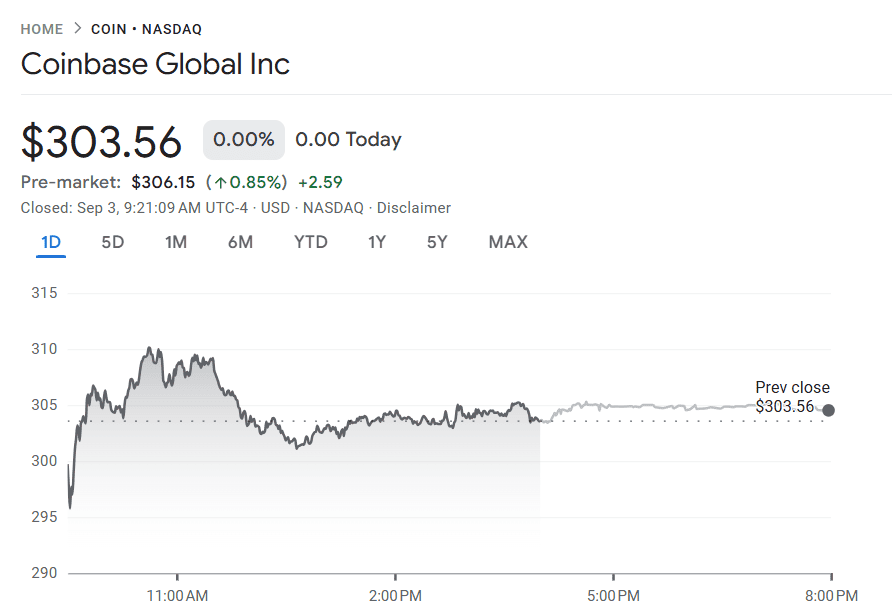

Keep in mind Coinbase in 2021. This has now been straightened to Nasdaq's direct checklist, somewhat than the same old IPO. Earlier than the checklist, the reference worth per share was $250. On the finish of the primary buying and selling day it ended with a 31% leap of $328.28. Earlier this week, the coin traded for Arond $303. This represents a slight decline over the previous few years.

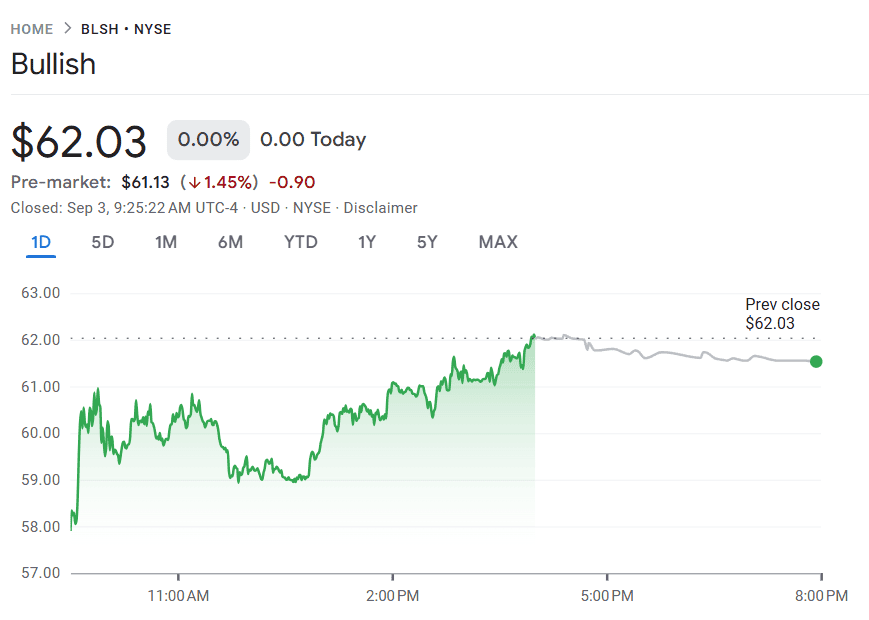

Just lately, Bullish Trade, which was launched final month on the New York Inventory Trade (NYSE), additionally noticed a powerful debut after the IPO.

That first buying and selling day went nicely, with shares opening at $90 and Peaks reaching $118, representing a rise of 143% and 218% earlier than ending the day at $68 respectively. When printed, the inventory worth is steady at round $62.

Specifically, this IPO was distinctive in its personal proper. As a result of it was the primary to be utterly settled in Stablecoins.

“Getting IPO income with Stablecoins is a baller's transfer. A giant second for all crypto. Quickly it will grow to be a brand new regular.” – Brian Armstrong, CEO