Enterprise capital allocation choices are a invaluable sign at a time when investor sentiment is at a stage of maximum worry attributable to a pointy outflow of capital from the crypto market in early 2026. These strikes will help retail traders establish sectors which will nonetheless have potential throughout a bear market.

Latest stories point out that the cryptocurrency market surroundings has modified. The sectors attracting VC funding have modified accordingly.

Enterprise capital invests greater than $2 billion in cryptocurrencies in early 2026

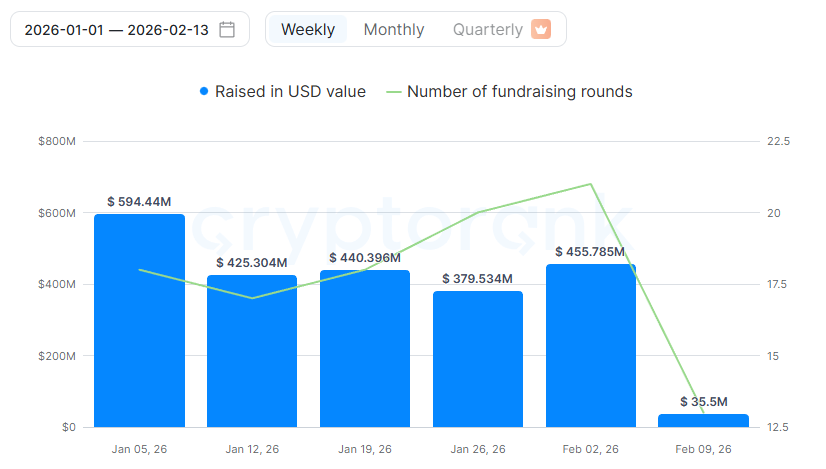

In keeping with knowledge from CryptoRank, enterprise capital corporations have invested over $2 billion in crypto initiatives for the reason that starting of the 12 months. On common, weekly inflows exceed $400 million.

Cryptocurrency funding in early 2026. Supply: CryptoRank

Just a few massive offers stand out. Rain has raised $250 million to construct an enterprise-grade stablecoin funds infrastructure. BitGo secured $212.8 million by means of its IPO, strengthening its position as a custodian of digital property and a safety supplier for institutional clients.

BlackOpal additionally raised $200 million for its GemStone product, an investment-grade product backed by tokenized Brazilian bank card receivables.

High funding rounds for crypto VCs in early 2026. Supply: Alex Dulub

Moreover these offers, Ripple invested $150 million in buying and selling platform LMAX. This transfer helps the mixing of RLUSD as a core collateral asset inside institutional buying and selling infrastructure. Tether additionally made a $150 million strategic funding in Gold.com to increase world entry to each tokenized and bodily gold.

Analyst Milk Lord factors out that cash is not flowing into layer 1 blockchains, meme cash, and AI integration. As an alternative, stablecoin infrastructure, custody options, and real-world asset (RWA) tokenization are rising as key funding themes.

Market knowledge helps this variation. For the reason that starting of this 12 months, the market capitalization of cryptocurrencies has fallen by about $1 trillion. In distinction, the market capitalization of stablecoins remains to be over $300 billion. The full quantity of tokenized RWA reached an all-time excessive of over $24 billion.

What does a change in VC's urge for food point out?

Ryan Kim, a founding associate at Hashed, argues that enterprise capital expectations have basically modified. This alteration displays new funding norms throughout the business.

In 2021, traders centered on tokenomics, group progress, and story-driven initiatives. By 2026, VCs will prioritize actual returns, regulatory advantages, and institutional shoppers.

“Take a look at what's lacking. No L1, no DEX. Nothing 'community-driven'. Each greenback spent on infrastructure and compliance,” Ryan Kim stated.

The most important transactions talked about above contain infrastructure builders somewhat than token-driven initiatives geared toward producing worth hypothesis. In consequence, the market is lacking the weather that beforehand drove hype cycles and FOMO.

“It's not hypothesis, it's not a hype cycle. They're wanting on the pipes, the rails, the compliance layer,” analyst Milkroad stated.

Nevertheless, analyst Lucas (Miya) takes a extra pessimistic view. He argues that crypto enterprise capital is in a state of collapse, citing a pointy and continued decline in restricted associate commitments.

He identified some warning indicators. Excessive-profile firms akin to Mechanism and Tangent are transferring away from cryptocurrencies. Many firms are quietly eliminating positions.

Contemplating that over $2 billion has flowed into the sector for the reason that starting of the 12 months, it might be too early to declare the demise of crypto VC. On the very least, these adjustments counsel that cryptocurrencies have gotten extra deeply built-in with conventional monetary programs, a possible signal of long-term maturation.

The put up The place will crypto enterprise capital funds put money into early 2026? appeared first on BeInCrypto.