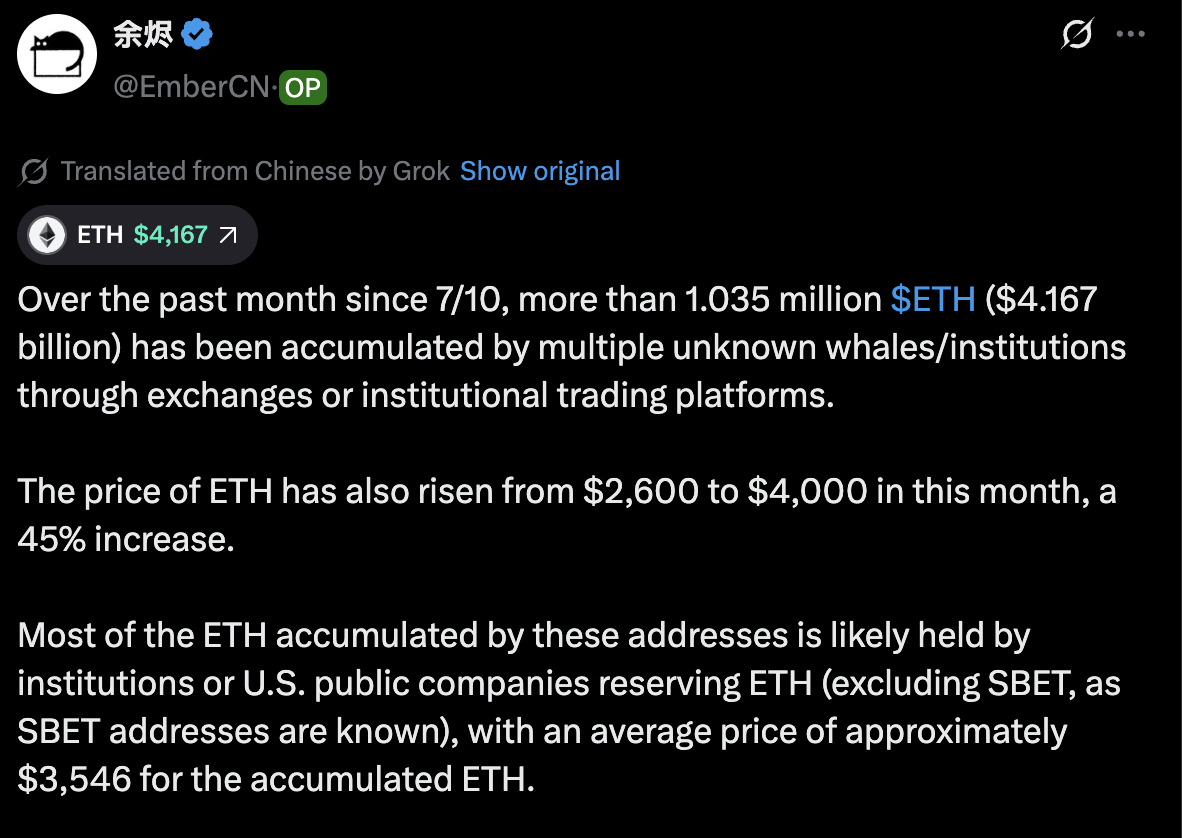

Over the previous month, greater than $1167 million in Ethereum, value $4.167 billion, has been gathered by unknown whales and companies.

abstract

- Whale, the company has gathered 1.035 million Ethereum value $4.17 billion in a month.

- The common ETH buys $3,546 as costs soar from $2,600 to $4,170.

- Analysts warn of over-expansion and advise ETH ecosystem play as an alternative.

In line with analyst Ember CN, the huge purchases coincided with a surge in ETH costs and $4,000 above $4,000.

Institutional accumulation occurred by way of trade and institutional buying and selling platforms, in addition to by way of the common value (ETH) of round $3,546 per Ethereum.

Ember CN prompt that the majority addresses belong to the establishments that construct Ethereum reserves or public US corporations, excluding identified addresses similar to SBET.

xPosted by analyst Embercn

When the worth breaks $4,000, Binance strikes ETH

Arkham Intelligence Information reveals that inside hours of costs surged, hundreds of ETH have been transferred to market maker WinterMute.

Transactions started with a circulation of 250-500 ETH per switch earlier than escalating to a bigger motion involving a single transaction of greater than 1,800 ETH.

WinterMute's switch means that institutional demand must be higher carried out to keep away from market impression. Market makers course of massive orders by breaking them down into smaller transactions or offering liquidity in the course of the unstable interval.

Ethereum's 24-hour 6.6% revenue pushed the worth to $4,170, bringing its all-time excessive of almost $4,800. A 30-day efficiency of almost 50% signifies sustained institutional buying stress throughout a number of time frames.

Technical analysts warn of over-expansion

Analyst Michael Van de Poppe warned in opposition to buying ETH on the present stage. He additionally described the transfer as “wild,” saying the worth “sweeped out the highs.”

Poppe prompt that the setup might result in a “large breakout to Ass,” however as an alternative really helpful allocation of funds throughout the Ethereum ecosystem.

$eth's wild motion.

It's dominated the highs and is a bit too dangerous to purchase $eth at these highs.

It's arrange for a giant breakout to ATHS, but it surely ought to result in increased returns, so I believe it might be wiser to allocate funds throughout the $ETH ecosystem. pic.twitter.com/slydtcukqt

– Mycal Van de Poppe (@cryptomichnl) August 9, 2025

“It's a bit harmful to purchase $eth at these highs,” posted Van de Poppe. “I believe it might be clever to allocate funds throughout the $ETH ecosystem.

Analyst suggestions illustrate a normal technique for buying ecosystem tokens that will outweigh ETH throughout conferences whereas being uncovered to Ethereum progress.

The $4.17 billion accumulation interval coincides with a rise in institutional cryptocurrency adoption.

Public US corporations are more and more adopting cryptocurrency monetary methods, and Ethereum has grow to be a secondary choice after corporate-holding Bitcoin.

learn extra: Because the Sib Burn Charge jumps 1,800%, the worth rebound for Seabain