Bitcoin (BTC) mining issue reached an all-time excessive of 127.6 trillion this week, however is predicted to drop through the subsequent issue adjustment on August ninth.

In keeping with Coinwarz, mining issue is predicted to fall by round 3% to 123.7 trillion through the subsequent adjustment interval, with the present common blocking time being round 10 minutes and 20 seconds.

Information from Cryptoquant exhibits that mining issue declined in June, with difficulties falling to 116.9 trillion ultimately of the month and the primary two weeks of July. Nevertheless, the issue resumed the long-term uptrend within the second half of July.

The problem of Bitcoin mining and the community hashrate – the full computing energy dedicated to defending the community – is central to sustaining the profitability of miners and the excessive stock-to-flow ratio of Bitcoin, defending the worth of BTC from overproduction.

The problem of Bitcoin mining has turn into the latest ever, and is regularly rising over time. sauce: Encryption

Associated: Solo Bitcoin Miner wins a block reward of $373,000

Bitcoin issue adjustment and inventory and circulation ratio

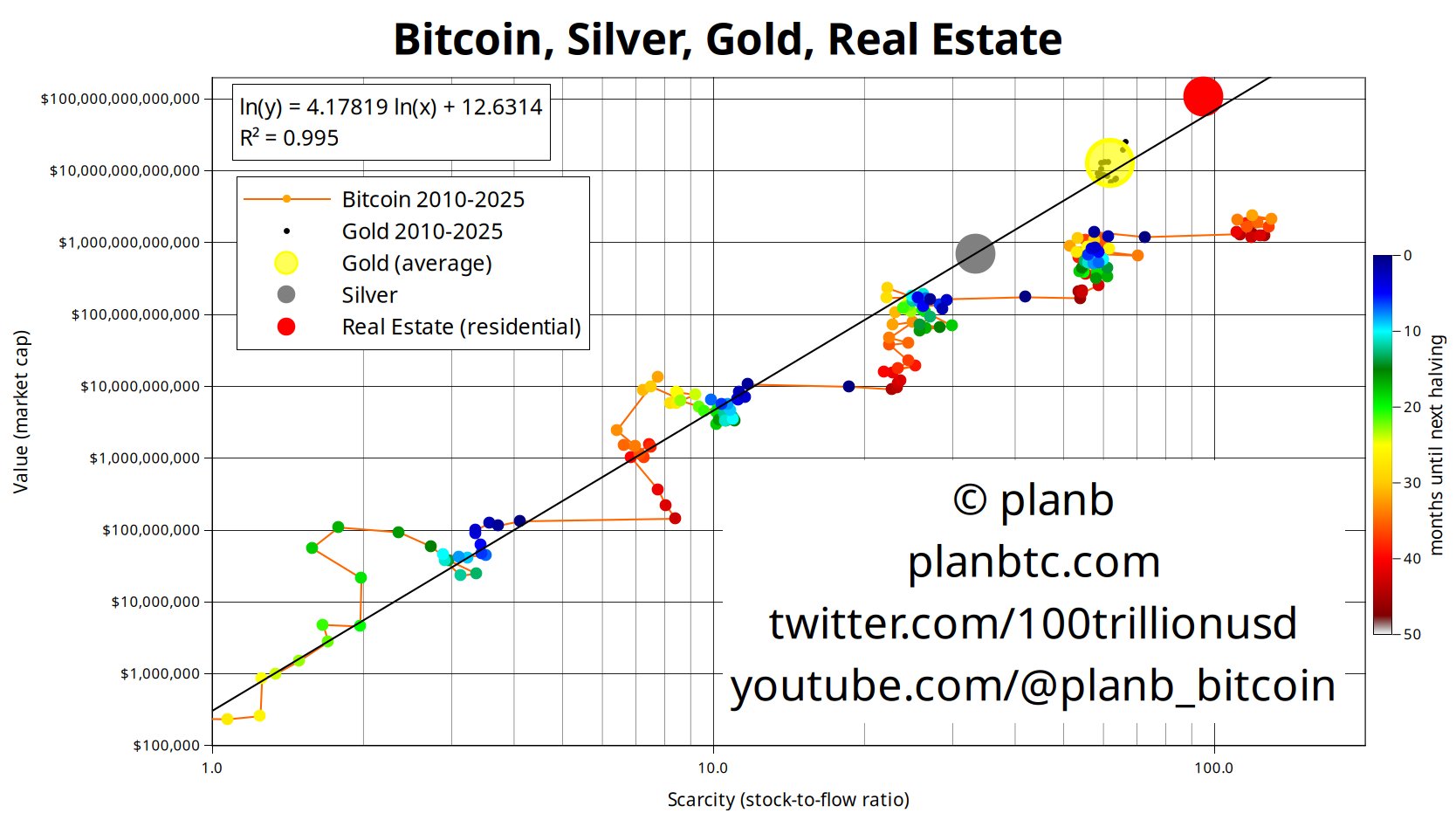

The share-to-flow ratio measures the full obtainable provide of monetary belongings or items to newly created provides added by miners or commodity producers.

The upper the ratio, the extra resilient the asset or commodity is because of worth adjustments brought on by overproduction. The decrease the ratio, the extra the belongings or items are affected by the brand new provide.

This ratio is a part of the explanation why silver was demoed with gold. Silver has a decrease stock-to-flow ratio than gold. The rising costs of silver will lead miners and producers to generate extra provide, killing new silver available in the market and pushing costs down.

Bitcoin has a better share worth to circulation than gold, with about 94% of BTC's 21 million provide already mined and distributed available in the market. Compared, gold doesn’t have a tough provide cap and inflation charges are round 2% per 12 months.

Examine the stock-to-flow ratio of Bitcoin with gold, silver and residential actual property. sauce: planb

“The shortage of gold, the stock-to-flow ratio, is about 60. The shortage of Bitcoin is about 120. Due to this fact, Bitcoin is twice as poor as gold,” in accordance with Planb, creator of the Bitcoin Inventory-to-Stream Value Evaluation Mannequin.

With issue changes, Bitcoin's worth turns into inelastic in manufacturing and is proportional to the full computing energy deployed by miners.

Adjusting the issue prevents overproduction and subsequent costs collapse as new provides are dumped in massive portions into the marketplace for a brief time frame.

The hashrate of a Bitcoin community represents the full quantity of computing energy deployed to guard the community. sauce: Encryption

As extra computing energy is deployed and Bitcoin networks are protected, it should turn into tough to match new computing sources, and block manufacturing will hold it as shut as attainable to the 10-minute goal of protocols.

Conversely, when computing energy decreases, the community issue is adjusted, guaranteeing that new blocks are mined at a secure tempo of about 10 minutes.

journal: Bitcoin vs. Quantum Laptop Threats: Timelines and Options (2025–2035)