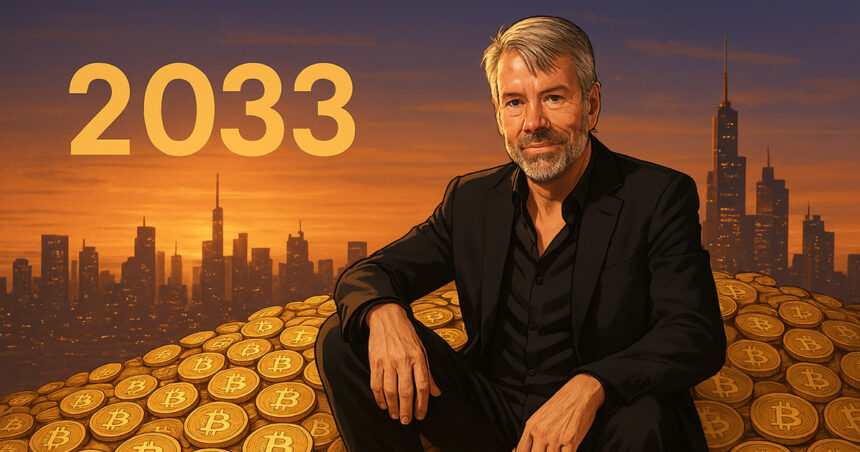

Bernstein believes that the technique, beforehand often called MicroStrategy, might acquire greater than 1 million Bitcoin (BTC) within the bull market cycle by 2033, Benzinga reported on March 26, citing a analysis word.

The forecast issued by Bernstein analysts outlines two considerably completely different paths for the corporate, relying on the macroeconomic situations and the long-term worth trajectory of Bitcoin.

Bull vs Bear Situation

In an optimistic situation, the technique will increase its holdings from the present 506,137 BTC to 1,013,000 BTC (roughly 5.8% of Bitcoin's present distribution provide), rising to $200,000 by the second half of 2025 and $500,000 by 2029, reaching $1 million by 2033.

To fund that stage of accumulation, the technique probably depends on continued entry to capital markets, rising its whole debt to $1 billion and elevating $84 billion in inventory.

Analysts highlighted that this trajectory relies on low rates of interest and powerful investor demand.

In distinction, the bear case suggests a extra constrained future. As Bitcoin enters a long-term stoop since reaching its native peak in 2025, the technique's BTC holdings may very well be leveled close to 514,800 BTC.

This forces the corporate to halt additional acquisitions and settle a portion of the Treasury to handle its debt and dividends. Beneath this base case mannequin, debt rises to $51 billion.

Maintained outperform scores

Regardless of the dangers, Bernstein reaffirmed its “outperform” score on its technique and set a worth goal of $600.

The corporate's valuation mannequin applies a double EV/promoting a number of within the software program phase and a 55% premium within the Bitcoin reserve. It is a determine that follows the typical market premium since pivoting to BTC.

Newest Buy of Technique – 6,911 BTC $584.1 million between March seventeenth and March twenty third additional entrenched the dedication to Bitcoin, lifting its whole holdings above the five hundred,000 BTC mark.

The corporate at present owns extra BTC than another stock-traded entity, attracting curiosity from retail and institutional buyers.

Bernstein's analytical alerts continued institutional curiosity within the leveraged publicity of the technique to Bitcoin. The corporate's strategy stays a transparent instance of how an organization's steadiness sheet is being restructured, with a deal with Bitcoin.

It’s talked about on this article

(tagstotranslate)Bitcoin