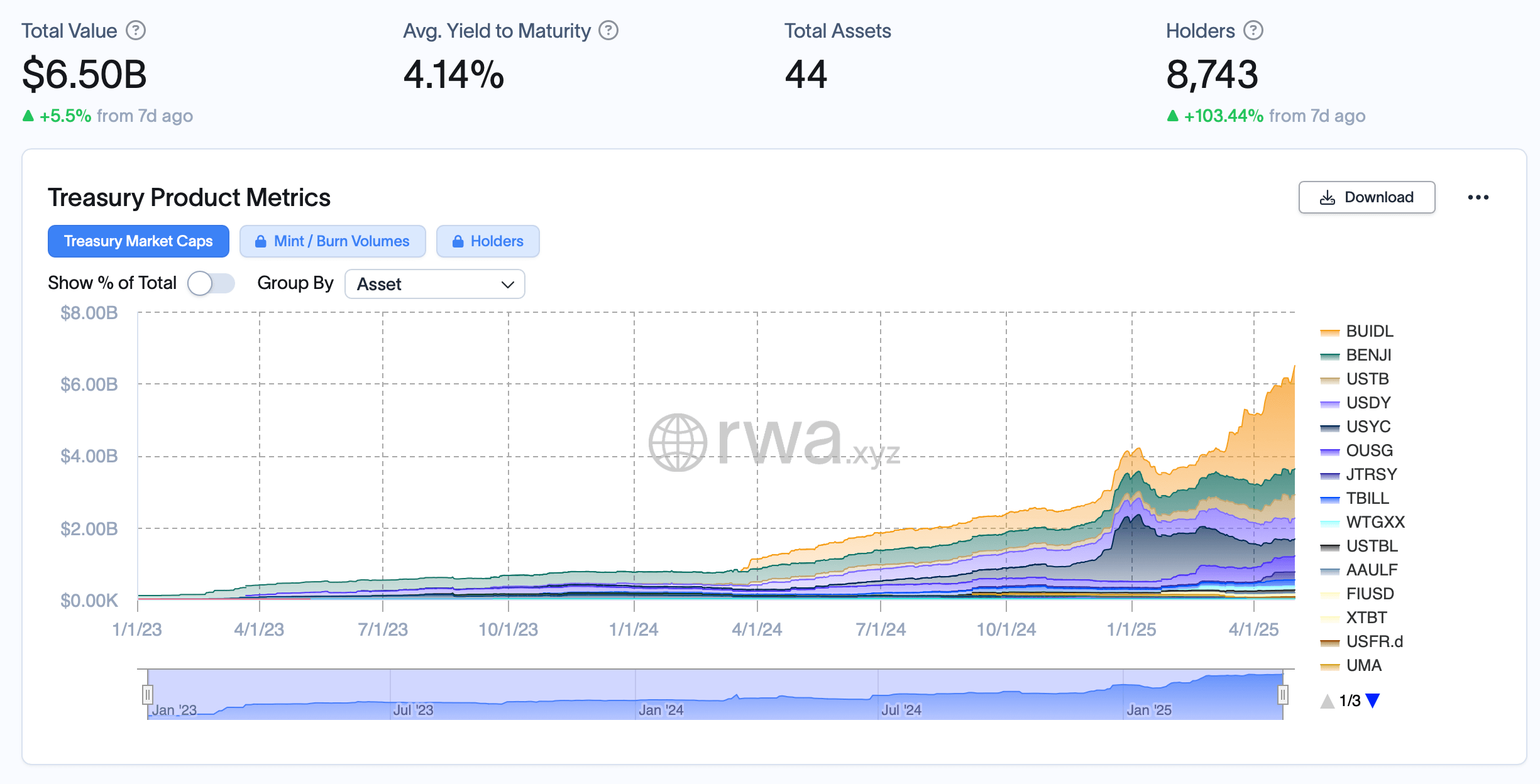

In simply 15 days, the tokenized Treasury Division has swelled to $560 million, bringing its whole worth to $6.5 billion as of Could 2, 2025.

Buidl and USTB drive 98% of the expansion of the tokenized Ministry of Finance market in simply two weeks

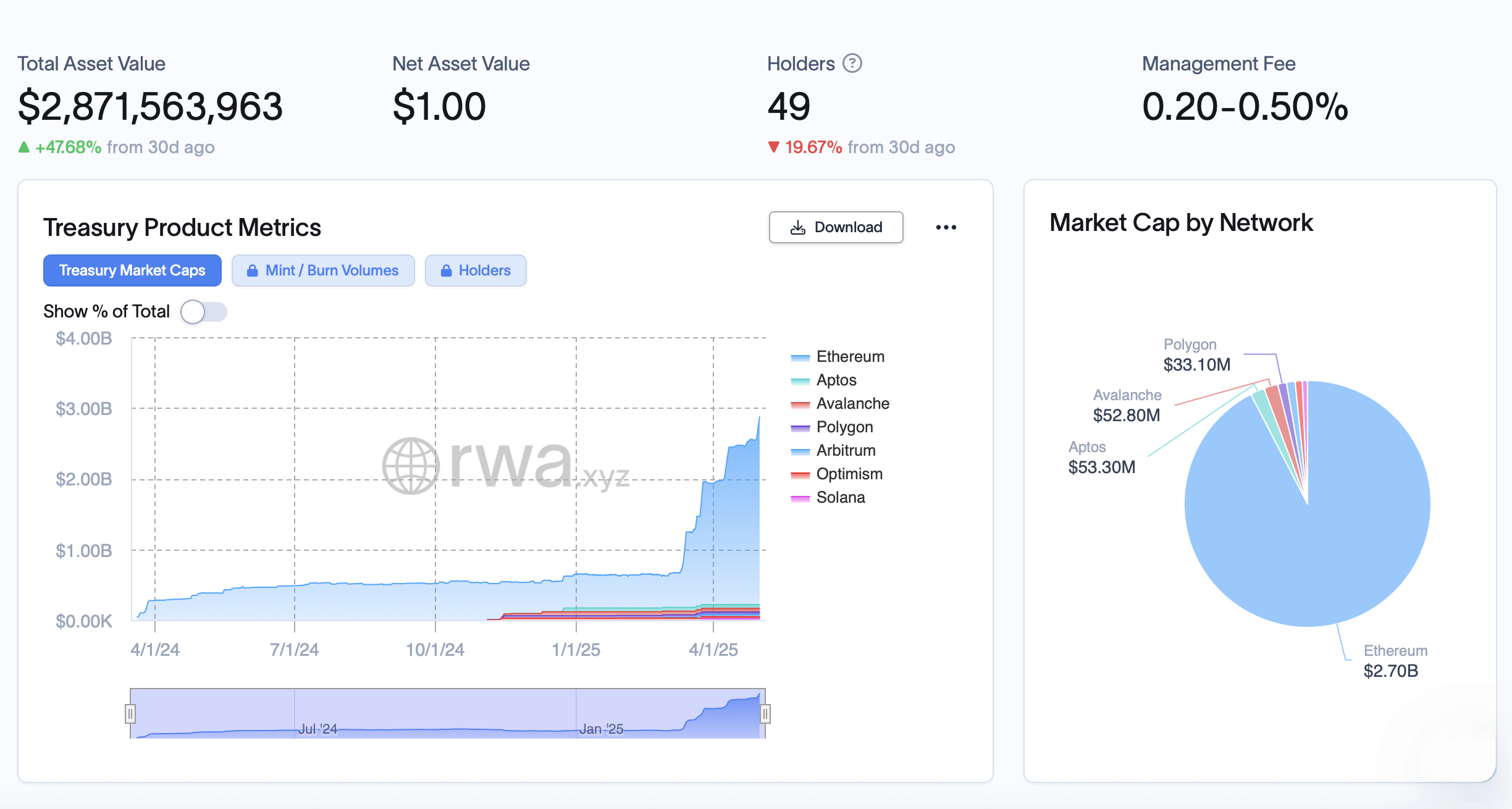

The BlackRock USD Institutional Digital Liquidity Fund (BUIDL) has acquired a big portion of the influx with securitization, bringing its market capitalization to an enormous $442 million. The RWA.xyz metric exhibits that in simply 15 days, Buidl has been rounded to a conductor from $2.469 billion to $2.877.1 billion.

Supply: RWA.xyz Metric

Franklin Templeton's on-chain US authorities cash fund (Benji) rose from $702 million to $71684 million. In the meantime, the third-placed race gave a twist: Ondo's USDY fund, beforehand held bronze, introduced its place to Superstate's short-term US Authorities Securities Fund (USTB).

Of the $2.871 billion Buidl, $2.7 billion has been issued in Ethereum. Supply: RWA.xyz Metric

SuperState's USTB made waves, leaping from $550 million to a formidable market capitalization of $651.51 million. Together with Buidl, these two Titans have accounted for $55121 million of the sector's $560 million progress since April seventeenth. In the meantime, Ondo's USDY came upon the rankings and after throwing $4.7 million, it got here in fourth at $581.20 million.

Circle's USYC didn't need the play to cross it, however Circle's USYC secured its place within the high 5 at $468.68 million, eased from its earlier place at $525.17 million. In line with statistics from RWA.xyz, out of 44 tokenized Treasury choices, the typical maturity yield was settled at 4.14%. Over the previous week, the variety of these tokenized Treasury cryptocurrency holders rose 103.44%, reaching a complete of 8,743 homeowners.