Bitcoin (BTC) has been constantly hit the brand new all-time excessive (ATH) lately. According to this surge, the problem of Bitcoin mining has reached document highs, reflecting the event of the community.

Total, the mixture of BTC ATH, rising problem in mining, and long-term holders (LTH) habits stays dangerous, however it attracts an optimistic image.

AS Pricing, Issue of Asmining

In keeping with information from BlockChain.com, the problem of Bitcoin mining elevated by 7.96%, reaching 126.27 T, with a median community hashrate over the seven days of 908.82 EH/s. This diagram exhibits miners' computing energy is rising, notably as Bitcoin costs have lately reached $122,000.

If this pattern continues, it might scale back the effectivity of miners, particularly provided that the outcomes of the June mining haven’t deteriorated.

The issue of the Bitcoin community. Supply: Blockchain

Nevertheless, a notable adjustment for the longer term is the subsequent change within the problem of Bitcoin mining, which is projected to lower by 6.69% on July 27, 2025. This can be a constructive sign for miners and will optimize operational effectivity.

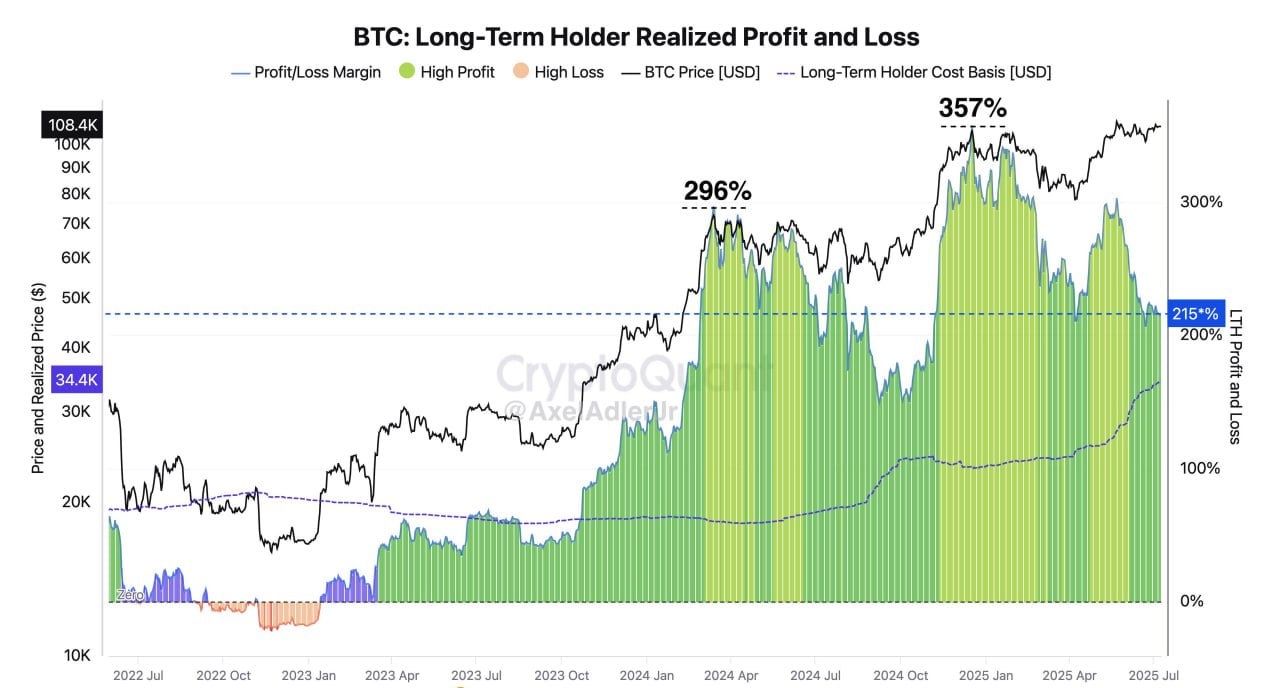

Moreover, the GlassNode chart shared by X's Nekoz supplies deep perception into the habits of long-term holders (LTH). Their realised income had a revenue margin of 357% in July 2025, and their common price base remained considerably decrease than present costs, with revenue margins surged to $108,400.

Lengthy-term holder habits (LTH). Supply: Nekoz

This means that even when BTC reaches Ass, most LTH are usually not going to promote out. From 2022 to the current, the chart exhibits that the for-profit stage (similar to 296% in mid-2024) usually entails sustainable value will increase. This reinforces the view that the present market remains to be not saturated.

However the thought-provoking issue is Google's low curiosity in trying to find Bitcoin. This stays restrained and has little enchancment in comparison with the earlier bull market. This might probably shift from misplaced (FOMO) horrors to a long-term technique relatively than short-term hypothesis, reflecting investor maturity.

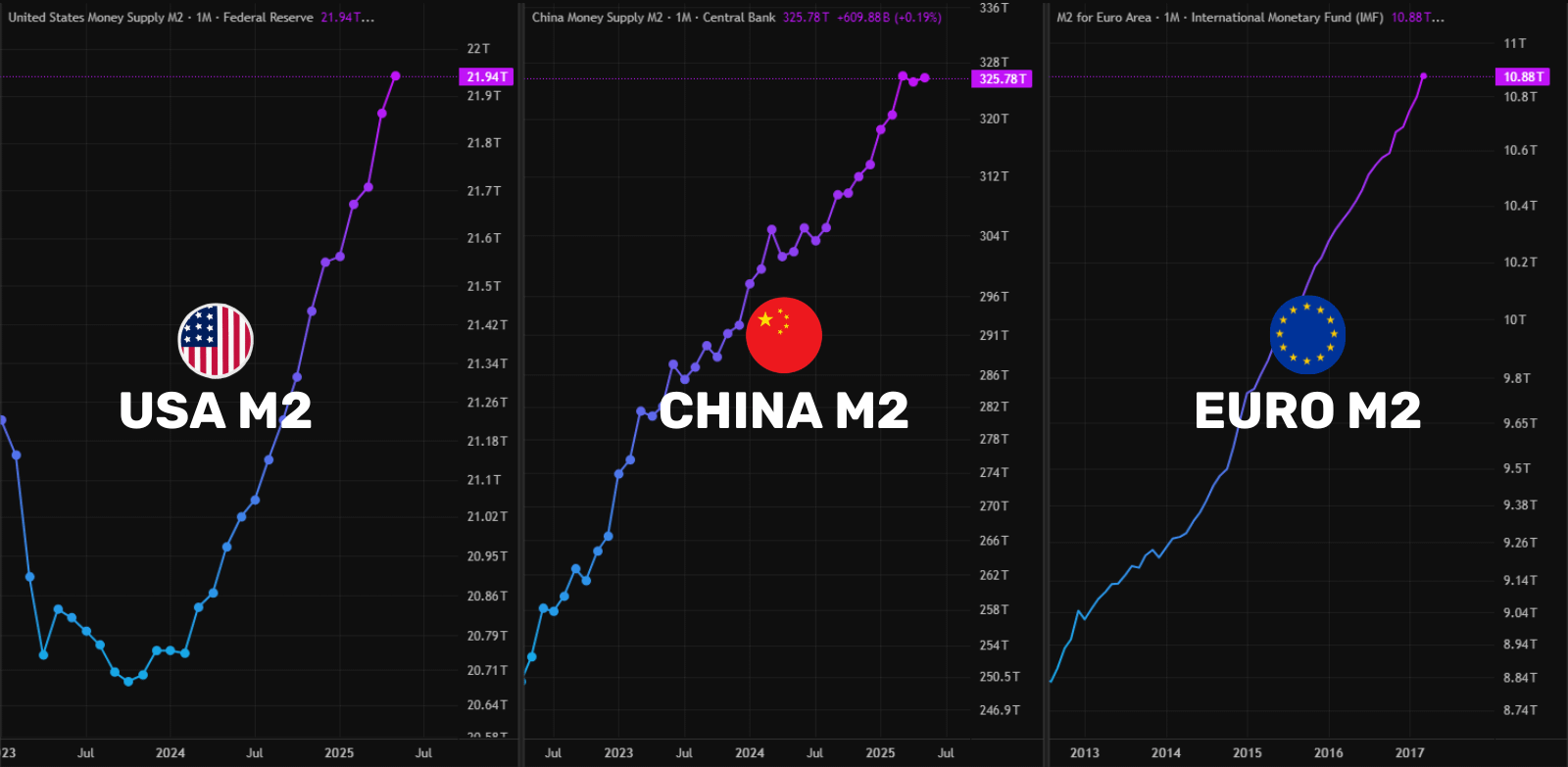

Total, the ATH synergy of BTC's ATH, the excessive diploma of bitcoin mining problem, and the LTH Holding Conduct create encouraging however harmful outlook. With international liquidity rising (US, China and Europe M2s additionally hit ATH), Bitcoin holds an enormous short-term potential.

World liquidity. Supply: Rekt Fencer

Nevertheless, traders ought to intently monitor key metrics similar to hashrate, adjusting the problem of Bitcoin mining, and market sentiment to mitigate dangers from potential value changes.