Bitcoin Costs In the present day: BTC Evaluation of Charts

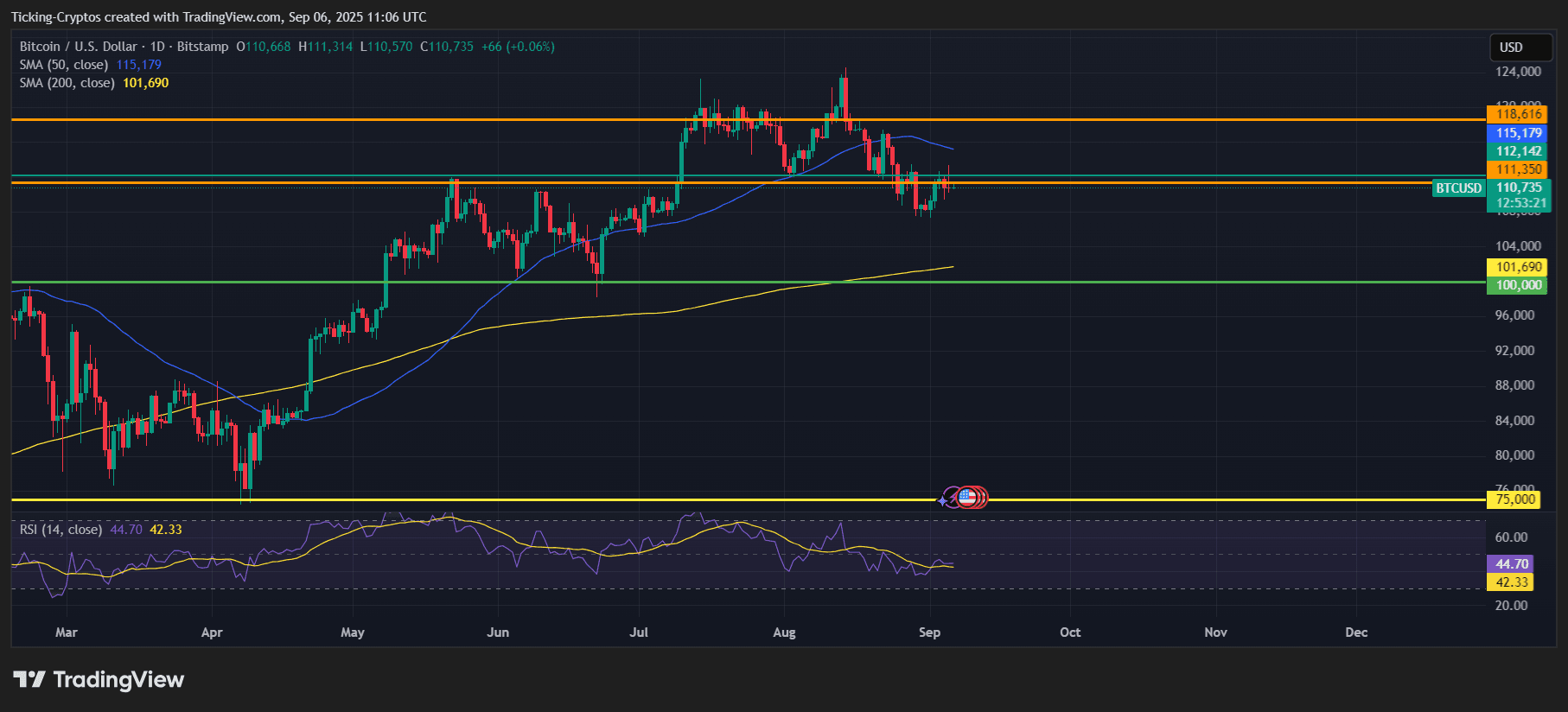

Bitcoin ($BTC) is at present buying and selling $110,700Sitting proper above the vital assist $111,350. 50-day SMA for $115,179 It acts as a resistance 200-day SMA for $101,690 It capabilities as a long-term security internet.

- Instant assist: $111,350

- Key assist: $101,690 (200-day SMA) / $100,000 psychological degree

- resistance: $112,142 – $115,179

- Breakout goal: $118,616

BTC/USD by way of 1 day chart TradingView

RSI and 44 BTC has been built-in after the modification however signifies that it has not been offered but. A breakout above $115K might open up a technique to retest $118,000 earlier than resuming the uptrend. If BTC exceeds $100,000 in September, the stage will probably be This fall Parabola motion.

1. US 10-year bond yield crash

The US 10-year bond yield has been declining sharply, which has had a significant affect on risk-on belongings like $bitcoin. Decrease yields common:

- Low value of borrowing.

- Easy accessibility to institutional fluidity.

- A brand new urge for food for development and various belongings.

Traditionally, decrease yields have brought on a spin-off into shares and crypto. For BTC, this units the perfect storm for the fourth quarter influx.

2. China's liquidity injection

Breaking information from Beijing: the This week, the Folks's Financial institution of China injected 2 trillion yen in liquidity.. This huge money flood into the monetary system is designed to stabilize development, however international markets really feel its affect.

- Extra liquidity = stronger demand for danger belongings.

- Asian traders are already enjoying a dominant position within the crypto market.

- Traditionally, China's liquidity flows into international BTC demand.

This injection displays the earlier cycle through which Asian liquidity has directed Bitcoin climbing to new highs.

3. Fed charge reductions are coming

Federal Reserve Chairman Jerome Powell is cornered. Analysts are hoping for it now on account of slowing development and signaling stress within the bond market Price discount of 25-50bps Within the subsequent few months.

Price discount means:

- Low value of capital.

- Investor belief is rising.

- A tide of liquidity tying shares and codes.

“Survive September” has change into a mantra. As soon as the lower begins, bitcoin can result in dangerous belongings Fourth quarter's all-time excessive.

Bitcoin Worth Prediction: The Highway to $150,000

Bitcoin is now within the technique of breaking down bond yields, China provides trillions to liquidity and prepares for the Fed to chop charges. Parabolic gathering 2026.

- brief time period: September ranges between $111,000 and $115,000.

- This fall 2025: A breakout above $118K might ignite a rally to $130,000.

- Earlier than 2026: Macrofluidity tail can drive BTC $150,000.

For portfolio managers, sustaining core BTC publicity whereas hedging draw back dangers of lower than $100,000 is the perfect play.