Etro Getting ready for Turning Factors: Yoni Assia, CEO of the platform that has been listed on Nasdaq since Might in Might, confirmed the opening to its personal in an interview with Fortune Blockchain It helps hundreds of thousands of month-to-month transactions and accelerates the supply of recent digital property reminiscent of tokenized shares at Ethereum.

What’s Etro's personal blockchain? Why is it needed?

Assia mentioned that Present blockchain infrastructure is just not enough To help the huge quantity of transactions managed by Etro every month. “We will't course of hundreds of thousands of month-to-month transactions on our present community,” the CEO explains. For that reason, Etoro is contemplating a “mild chain” linked to the primary blockchain. It handles quicker and cheaper operations whereas sustaining the safety of your important system.

The corporate is in Superior negotiations with 4 or 5 platforms Choose a know-how associate, but it surely has not been named but. It’s not anticipated to be launched anytime quickly, however the course is obvious. With its personal blockchain, Etro goals to strengthen your complete ecosystem, from transactions to digital property to interoperability between wallets.

What modifications will occur for customers with stock tokenization?

Assia introduced it Most Widespread Shares and ETF Tokenization Within the US, straight at Ethereum. The tokenization course of means that you can convert conventional shares into digital ERC20 property (Ethereum token normal) and robotically handle 24/5 buying and selling, switch and robotically handle inventory market deadlines.

Obtainable on the time of launch 100 tokenized shares and ETFsConsists of main US names. European customers will initially be accessible by way of a devoted wait listing, with subsequent enlargement promised.

Tokenized shares develop into Might be transferred between Etro Digital Walletseven regulated securities pave the way in which for decentralized finance. Contemplating that different opponents (reminiscent of Robinhood) have taken related steps, there’s a robust benefit amid many regulatory considerations.

How does Etro match for Wall Road tokenization?

After the announcement, Bloomberg Etoro's initiative has confirmed it follows the Robinhood initiative. In contrast to Robinhood, nonetheless, Etoro selected normal know-how (Ethereum, ERC20) and step-by-step entry strategies (initially solely in Europe) to keep away from the chance of controversy and laws.

Robinhood is in hassle after it seems that the “Openai Tokens” air route is a by-product contract reasonably than an precise truthful. The information sparked criticism from US regulators. Etro As a substitute, it focuses on transparency, compliance and a step-by-step strategy. Every tokenized asset corresponds to an actual underlying inventory or ETF.

Transferability Pockets-to-wallets present conventional funds which are nearer to the ideas of Defi (decentralized finance) the place management stays within the arms of the consumer, regardless of being regulated infrastructure.

What’s the market response: Is ETOR shedding floor?

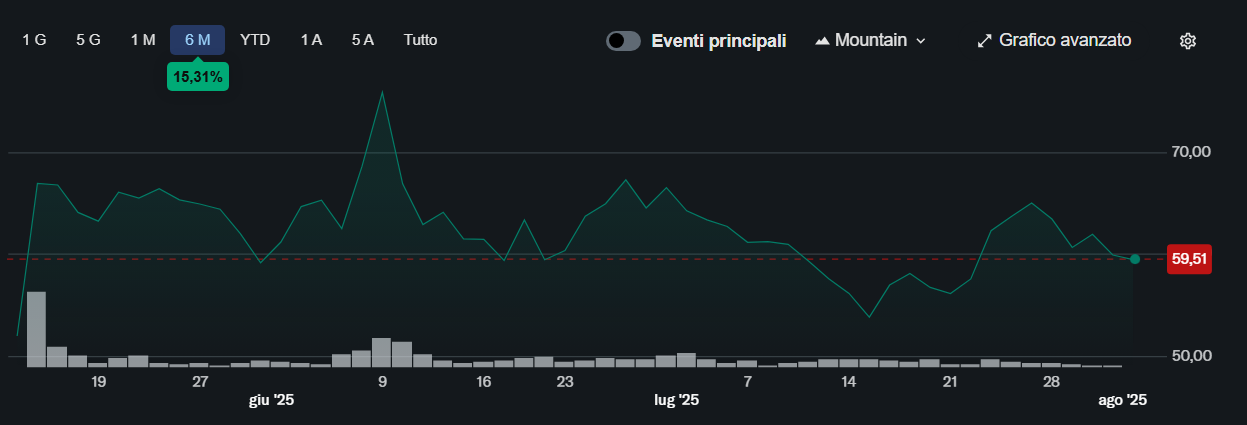

Regardless of the information, the value of Cultivated land (Etoro inventory listed in Nasdaq) decline has occurred. -4percentJune 18thshut $60 In comparison with data of $79 Reached June tenth as a consequence of total loss twenty 4%. The market seems to be ready for concrete proof on the effectiveness of the blockchain mannequin and the true potential of large-scale tokenization.

A chart of worth developments for ETOR shares that aren’t listed on the inventory change. sauce: Yahoo Finance

TradingView confirmed a downward development final week, with buyers wanting intently on the precise adoption of tokenized shares and future partnerships within the blockchain sector.

” `html

Etor Quotes by TradingView

1M”), “fontsize”: “10”, “headerfontsize”: “medium”, “autosize”: false, “width”: 800, “peak”: 500, “notimescale”: false, false, false, false, false, false

” `

What are the dangers and advantages of an Etoro shopper?

Those that be a part of the ready listing Tokenized Motion You may profit from quicker buying and selling, prolonged hours and better flexibility in managing your digital property. Nonetheless, dangers stay associated to laws, token volatility, and safety of the blockchain infrastructure used.

ASSIA guarantees the best warning and regulatory cooperation to keep away from “The case of Robin Hood”. The gradual strategy, initially restricted to Europe and inside etro wallets, reveals warning, but additionally has a transparent willingness to open a brand new season of traditional buying and selling. Tokenized property Lastly, it’s open 24 hours a day, one year a 12 months.

What's occurring now: Transactions and Blockchain impacts and future outlook

An announcement by Assia reveals a change in tempo. Hybridization between custom and defi Presently within the operational stage, however the precise recreation depends upon:

- Future Etroblockchain capabilities to actually help “hundreds of thousands of transactions”

- Person suggestions on tokenized stock and 24/7 usability

- Responding to regulators and competitors within the US and Europe

With competitors diving into this sector and markets more and more responding to high-tech innovation, The way forward for tokenized buying and selling may change faces within the coming weeks. Observe the Etoro neighborhood and upcoming official bulletins to make sure you don't miss out on the most recent info on blockchain and monetary tokenization.