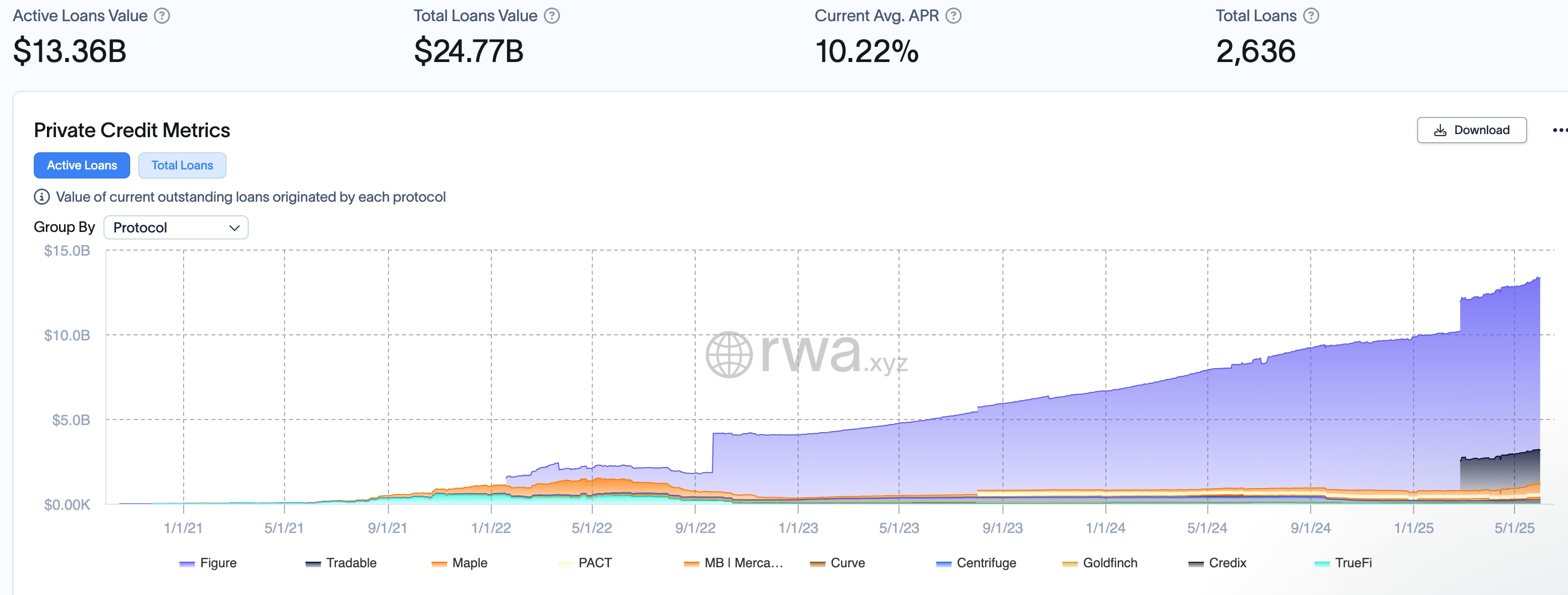

The tokenized personal credit score market has quietly emerged as one of many quickest rising sectors in real-world belongings (RWA), with over $13.3 billion in belongings underneath administration.

As soon as within the realm of the establishment, personal credit score is now pushed by figures and tradeable platforms, attracting help from heavyweights resembling Apollo, BlackRock and Franklin Templeton.

When asset managers compete to carry the historically non-current debt market to the blockchain rail, tokenization is reshaping the best way credit score is accessing, managing and buying and selling, forming a brand new gateway to non-public $3 trillion credit score area for each retail and institutional buyers.

You would possibly prefer it too: Mogul Membership brings Tokenized Actual Property, accomplice at AVA Labs, to Web3 buyers

Might be traded with figures

The businesses invested by Morgan Creek Capital, Apollo and Ribbit Capital have belongings of over $12 billion. We additionally function the Residence Fairness of Credit score (HELOC) market, which helps purchasers hire out their houses.

Tradable is the second largest participant within the personal credit score business to be tokenized. It boasts over $1.8 billion in chain belongings. Backed by Parafi, Matter Labs, and Victory Park Capital, Tradable helps asset managers tokenize belongings.

Tradable additionally helps people be a part of the personal credit score business, which has lengthy been reserved by the establishment. The opposite high participant within the personal credit score business that has been tokenized is Maple (syrup),, Settlement, Mercado Bitcoin, and Centrifuge (CFG).

Tokenizaed Non-public Credit score Belongings | Supply: RWA

Giant firms within the personal fairness business have an interest within the tokenized personal credit score sector. With greater than $641 billion in personal credit score belongings, Apollo World already launched the Apollo Diversified Credit score Securitize Fund or Acred in January.

Equally, firms like Vaneck, Franklin Templeton and BlackRock all launched tokenized belongings. BlackRock's Buidl exceeded greater than $3 billion in belongings, whereas Franklin Templeton's FOBXX fund has greater than $706 million in belongings.

You would possibly prefer it too: High 4 Causes Why XRP Costs Might Surge 50% in June

The personal credit score business is rising

The personal credit score business is without doubt one of the quickest rising sectors of finance. The Different Funding Administration Affiliation report estimated that the market has exceeded $3 trillion in belongings. This continues to develop.

The sector is rising primarily within the US, with many firms counting on personal credit score specialists to lift funds. These firms need to diversify their borrowing from banks.

A few of the largest banks have since launched personal credit score funds. Goldman Sachs has created Capital Options Group, a enterprise that provides direct lending options. Extra not too long ago, State Avenue has partnered with Apolo to launch a brand new personal credit score resolution.

Tokenized personal credit score is without doubt one of the quickest rising areas within the RWA business, collectively holding $231.1 billion in belongings. Over 113,350 buyers maintain RWA belongings.

Different high areas within the RWA business are stubcoin, US Treasury Division, commodities and institutional funding. Tokenized shares could possibly be the subsequent large factor after Kraken tokenized greater than 50 shares in Could.

learn extra: Plume secures funding from Apollo of RWA infrastructure