Tom Lee, head of analysis at Fundstrat, argues that Ether's current downturn must be considered as “enticing” as a result of its fundamentals stay sturdy, and that it was solely pushed down by a scarcity of leverage and a flight to treasured metals.

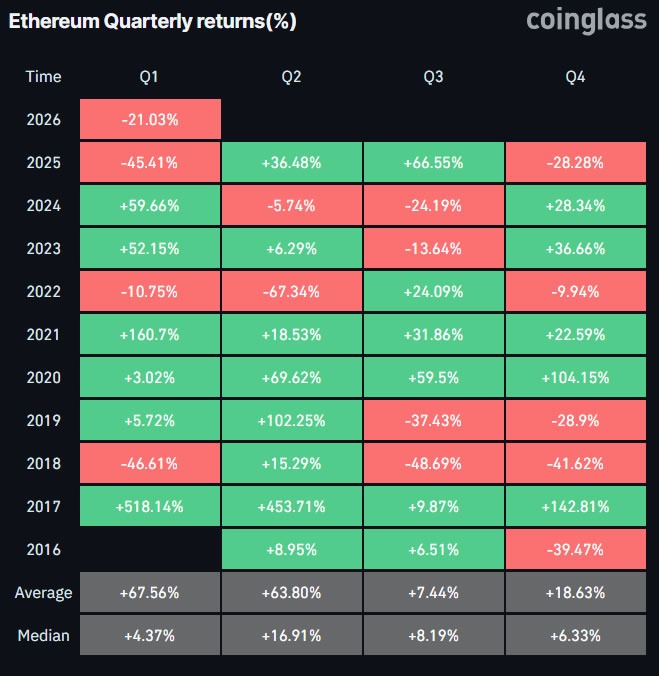

The primary quarter of 2026 is changing into the period of ether ($ETHProperty have fallen 21% thus far this 12 months, in line with CoinGlass, the third-worst first quarter on document.

Nonetheless, Lee stated the value decline occurred at a time when the community's on-chain exercise and fundamentals proceed to develop.

He stated the variety of Ethereum transactions per day hit a document excessive of two.8 million on January 15, and energetic addresses have soared to a peak of 1 million per day in 2026.

Through the crypto winters of 2018 and 2022, Ethereum buying and selling exercise and energetic wallets declined, which is “the other of what we've seen over the previous 12 months,” Lee stated.

“So non-fundamental components are in all probability extra of a proof for the financial system's weak spot.” $ETH value. ”

Lee stated there are two components contributing to the suppression of Ether costs. Whereas crypto leverage has not returned for the reason that October 10 crash, hovering treasured steel costs are “performing as a 'vortex' sucking danger urge for food away from cryptocurrencies.”

BitMine buys the increase $ETH 25% down in 1 week

Lee's Ethereum treasury agency seems to be betting on a restoration. Final week, BitMine gained a further 41,788 $ETH.

“We predict this pullback is enticing given the strengthening fundamentals, and Bitmine is steadily shopping for Ethereum,” he stated.

“In our view, $ETH doesn’t replicate the excessive utility of $ETH and its position as the way forward for finance. ”

BitMine at present holds 4.28 million items $ETH The token represents 3.55% of the whole provide, reaching 70% in the direction of the 5% objective. Roughly 2.87 million $ETH The guess is on.

Nonetheless, as a result of collapse of Ether costs, unrealized losses on the digital asset vault approached $7 billion.

Many of the value declines have occurred previously week alone; $ETH It fell greater than 25% from about $3,000 on Monday to a bear market low of $2,200, earlier than recovering barely.

$ETH is having its third-worst first quarter in historical past. sauce: coin glass