President Trump is as soon as once more urging low rates of interest after bullish US employment information. Some analysts hope that the brand new fee cuts will create constructive momentum for Bitcoin.

However there isn’t any indication that Powell will change his thoughts. If something, that's even much less. Tariffs may cause unprecedented disruptions, and the financial system doesn't want velocity reductions to outlive now.

Can Trump power US rates of interest?

Immediately, the U.S. Bureau of Labor Statistics launched its newest employment report. This appears very bullish within the face of the concern of a recession.

Complete non-farm payroll employment elevated by 177,000, far exceeding expectations, however the unemployment fee stays steady and wages have risen. This has led President Trump to hunt one other spherical of cuts in rates of interest.

President Trump has repeatedly requested Federal Reserve Chairman Jerome Powell to chop rates of interest. The crypto trade can be steadily advocating for such strikes, encouraging funding in risk-on property.

However each Powell and the opposite Fed's tops are very clear that tariffs are too unpredictable to permit additional rate of interest cuts.

Powell's place may be very constant. Tariffs can critically harm the financial system, and the Federal Reserve should preserve the powder drying to cease future collapse. In the event that they reduce charges after bullish information, the Fed has one potential instrument within the occasion of an actual disaster.

Trump even threatened to fireside Powell over the problem of rate of interest cuts, however relented after the market paniced. He can not legally fireplace Powell. Ejecting such a distinguished regulator would undoubtedly trigger chaos.

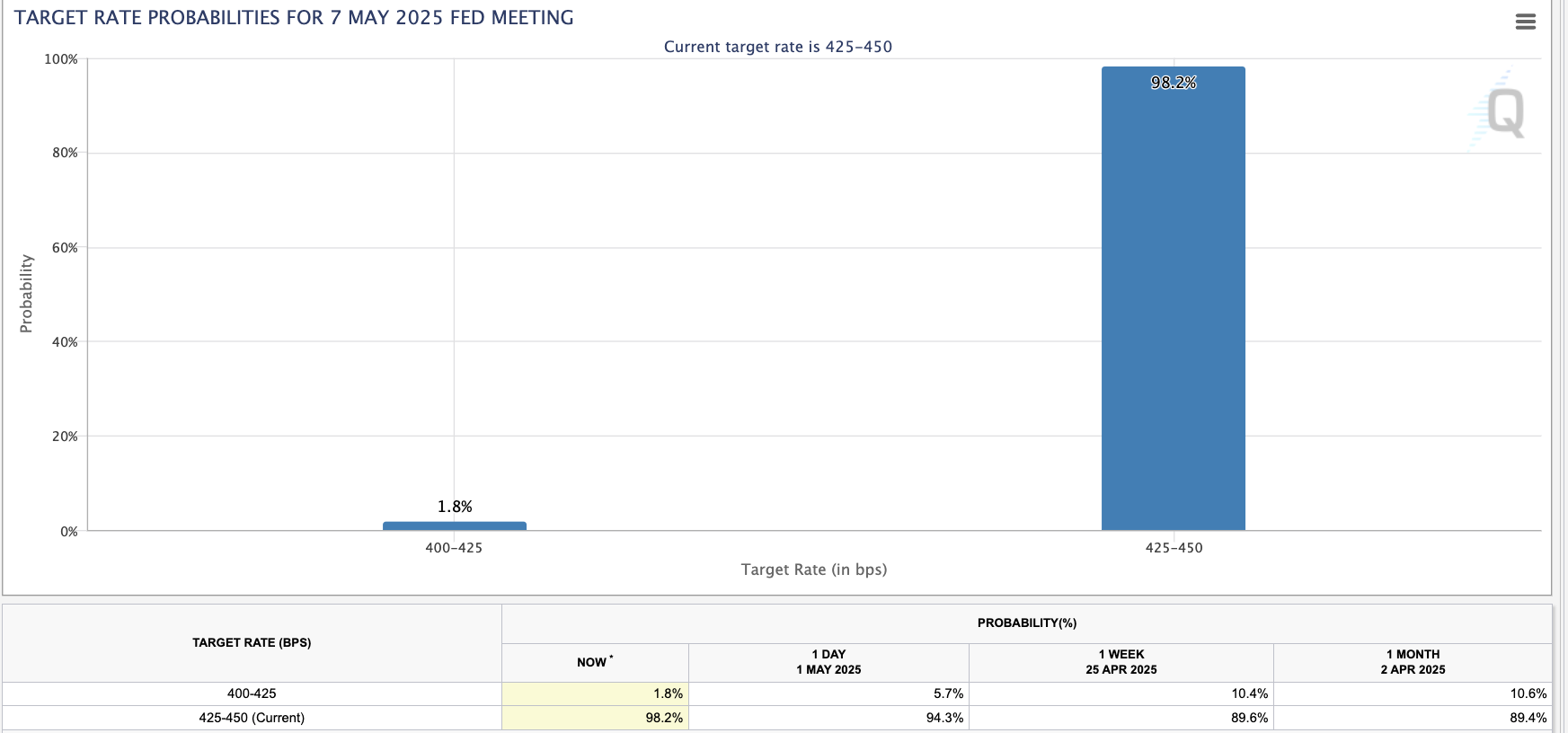

After the employment report was launched, the market predicted a decline in rate of interest cuts, and CME reported that changes for Might had been just about not possible.

CME rate of interest forecast. Supply: CME Group

Frankly, it's not possible that Trump will quickly get the rate of interest cuts he hoped for. College of Michigan economist Justin Wolfers defined why bullish reviews really scale back the chance of fee reductions.

“It's virtually sure that the Fed will likely be on maintain on the subsequent assembly. The true financial system (thus far) is robust sufficient to ensure fee reductions. And all the massive questions are over the horizon. Powell was clear.

President Trump desires to chop these charges, however he can not power the problem with out inflicting any larger points. Tariffs are so complicated and unpredictable that misrules have moved via the crypto market on a number of latest events.

Merchants have to be cautious about speculations that appear too good.