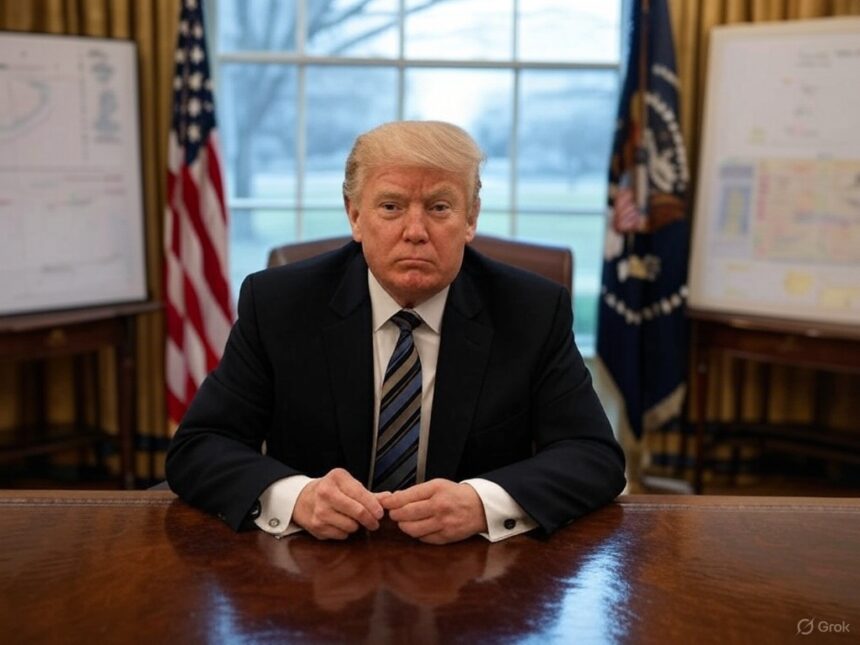

All the things reveals {that a} new business storm is coming, lighting up US President Donald Trump and worldwide warnings.

With an awesome message revealed on social networks' true social networks, Trump warns about mass tariff levies if he acknowledges that the European Union and Canada will act collectively To harm your nation's financial pursuits.

Three months after he deliberate his mission, The President reaffirms his protectionist place, This line marked business coverage from the start.

market They’re inhale, but it surely seems to be tempered, however resurfaces strongly.

A transparent and direct message

Trump wrote: «If the European Union works with Canada to break the US economically, they are going to each be topic to a lot larger tariffs than is at present deliberate to guard the perfect mates every of those nations have had! ».

With these phrases, the president factors it out. He doesn’t tolerate what he interprets An alliance to US pursuits.

The risk is meant to beat measures already deliberate. 25% customs duties on imported automobiles, It should come into impact on April 2, 2025.

Moreover, the White Home is making ready ads for brand spanking new pricing for the timber, semiconductor and drug sectors scheduled for subsequent week, Bloomberg says.

The April 2nd customs spherical is medium than anticipated. Nevertheless, this message modifications the panorama. The business disputes that had been believed close to the answer will probably be in flip and strengthened.

Set off: Conferences in Europe

Trump's response arrives after the primary official journey of recent Canadian Prime Minister Mark Kearney, who visited the UK and France final week.

In Paris, Carney met President Emmanuel Macron Advocated for strengthening the strategic associations of Canada and France They confronted international coverage challenges that come up after Trump returned to the White Home.

“It's extra essential now that Canada is strengthening its relationships with reliable allies,” Carney mentioned. He added: “I need to guarantee that France and Europe are all working with enthusiasm with Canada, essentially the most European within the non-European nation.”

These statements and conferences seem to have inspired Trump's suspicions of decoding diplomatic manipulation as an try and counter his financial agenda. In response, the US President raises a guess along with his tariff warning.

Impression in the marketplace and Bitcoin

Business warfare is just not an unknown land for the market. Over the previous few months, Trump has introduced a rise in import duties from Mexico, Canada and China. It brought on a decline that raised the value of Bitcoin to $76,000lowest degree for 2025.

Now, new tensions can replicate its results. Tariffs intervene with financial stability by procuring imports and supplying inflation. Press central banks such because the Federal Reserve to regulate financial coverage. This creates uncertainty and normally prevents funding.

Bitcoin is taken into account a shelter asset, however its costs usually are not affected by these dynamics. In a excessive volatility context, traders have a tendency to maneuver in direction of safer choices And there will probably be much less efficiency, corresponding to treasure bonds.

Moreover, business disputes strengthen the greenback. This places bearish strain on “danger” belongings corresponding to shares, Bitcoin and different cryptocurrencies.

to this point, Nevertheless, the digital foreign money is secure, at round $87,00020% beneath the historic most of $109,300 in January, matching Trump's property.

Deep rooted coverage

Trump's imaginative and prescient is nothing new. Since his first time period, he has argued that the business deficit displays an obstacle to the US and accuss different nations of “fraud.”

In January, the US business deficit reached a file of $13.1 billion, with the EU and Canada changing into one of many main business companions.

For Trump, tariffs are a device that “ranges the enjoying subject.” Nevertheless, these measurements even have inner prices. Imports are costlier, have an effect on provide chains and create financial tensions In the US.

The market is analysing every phrase from Trump, however the worldwide panorama is tense. The approaching weeks will probably be key to figuring out whether or not the president's warning will probably be translated into concrete actions or whether or not negotiations are deactivating this business bomb. For now, Bitcoin and main inventory market indexes resist, however a shadow of tariffs is deliberate on them.

(tagstotranslate)bitcoin(btc)