Ethereum continues to consolidate between institutional zones, with clear boundaries outlined by assist at $3.4,000 and resistance at $4.6,000. The present symmetrical triangle formation signifies a interval of compression, and a breakout is feasible in both course.

technical evaluation

Written by Shayan

every day chart

On the every day time-frame, ETH stays trapped in a midrange construction between the $3.4,000 institutional demand zone and the $4.6,000 provide zone. The rejection from $4.2,000 coincides with a retest of the damaged uptrend line and the 100-day shifting common, each of which at the moment are appearing as resistance ranges.

Momentum has slowed, and ETH is at the moment hovering close to the midline of its broad vary and under its 100-day shifting common. The 200-day shifting common close to $3.1,000 continues to behave because the final dynamic assist, whereas the demand zone at $3.4,000, the extent that absorbed liquidity throughout the Trump tariff crash, is attracting repeated shopping for curiosity.

For ETH to regain bullish momentum, the worth might want to decisively shut above $4.2,000, reclaim the midrange, and arrange a transfer in the direction of $4.6,000. Till that occurs, the broader construction stays impartial to barely bullish, supported by the secular uptrend and the institutional accumulation zone under.

4 hour chart

The 4-hour timeframe reveals ETH forming a symmetrical triangle, reflecting market indecision after the current selloff. The higher sure of the sample coincides with the resistance at $4,000, and the decrease sure is supported by the decrease finish of the short-term vary at $3.8,000.

This construction represents a liquidity compression part, the place volatility continues to contract earlier than a directional breakout. If the bulls are in a position to break above the development line, we will count on a rise in the direction of $4.4 million to $4.6 million, which might coincide with the higher finish of the vary and the institutional provide zone. Conversely, a breakdown under $3.7k may re-expose the $3.4k demand zone.

Till affirmation, costs are anticipated to fluctuate inside this slender vary, a typical setup for merchants ready for extra volatility to develop.

sentiment evaluation

Written by Shayan

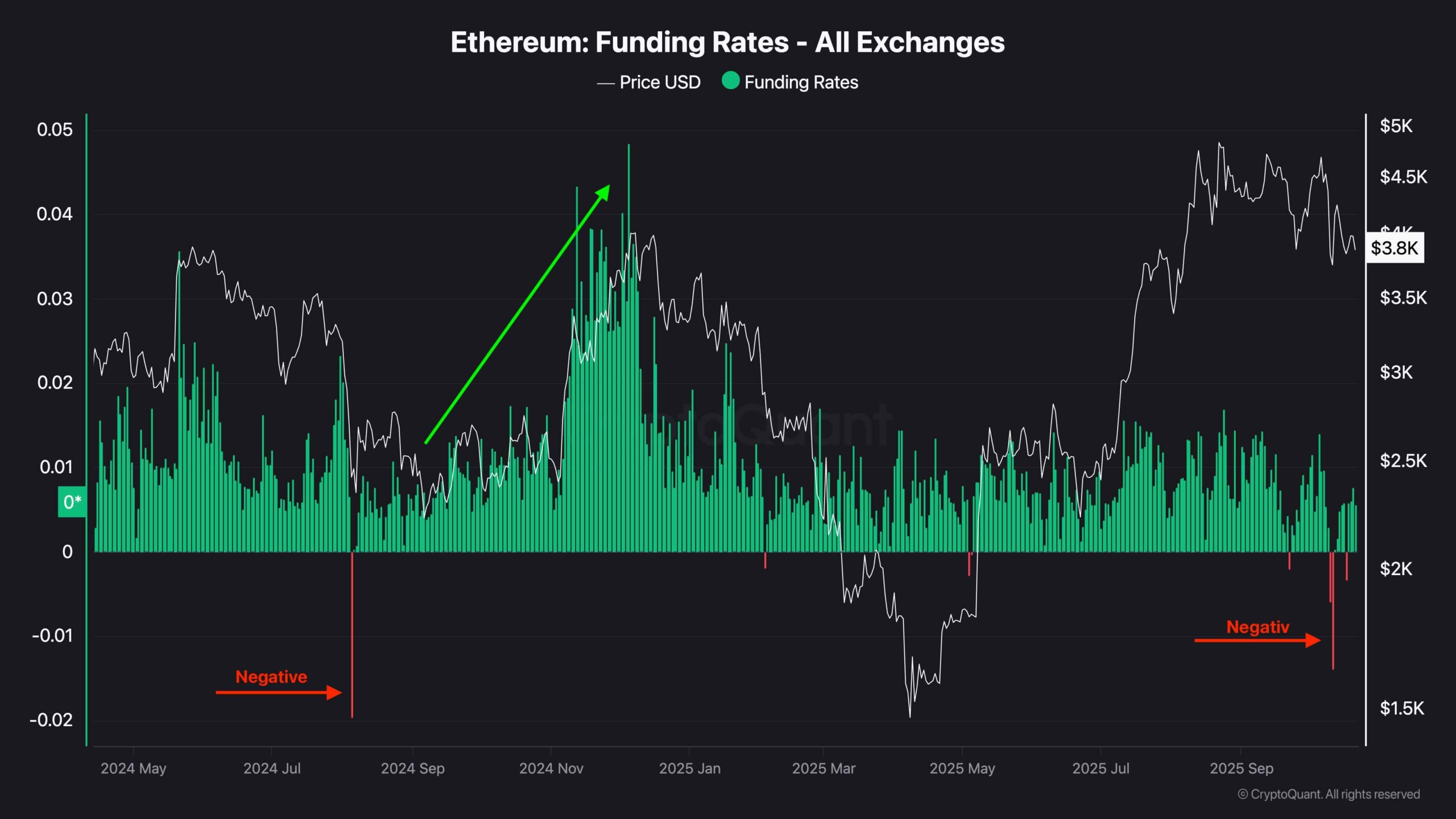

Ethereum funding charges throughout all exchanges have just lately turned adverse, reflecting the sentiment noticed throughout main market bottoms in previous cycles. Traditionally, a pointy bullish reversal has been preceded by a interval of adverse funding charges the place brief positions prevail and everlasting merchants pay a premium to carry the place, as seen in late 2024 earlier than the rally in the direction of $4.8K.

The present adverse numbers recommend there’s fear-driven brief promoting stress, which paradoxically typically acts as gasoline for a bull market as soon as the sell-off begins. If this case continues whereas ETH maintains the structural assist stage round $3,800 to $3,400, it may set the stage for one more brief squeeze to return to the higher vary.