President Donald Trump introduced he would impose 100% tariffs on Chinese language items beginning November 1, in robust retaliation for China's determination to limit exports of uncommon earth supplies important to high-tech manufacturing.

The market reacted sharply to this announcement, with the S&P 500 index dropping 2.7% from the day before today. The information sparked widespread volatility throughout international equities, with crypto shares posting sharp declines as buyers' threat urge for food weakened.

Crypto shares lead double-digit market decline

The flare-up of commerce tensions between the US and China brought on a broad market selloff, hitting crypto shares laborious. As of Friday's shut in New York, main digital asset corporations had been all down sharply.

World cryptocurrency trade Coinbase (COIN) closed at $357.01, down 7.75% from its earlier closing worth of $387. The inventory worth opened at $387.66 and fell to $351.63 in the course of the session, reflecting buyers' elevated threat aversion.

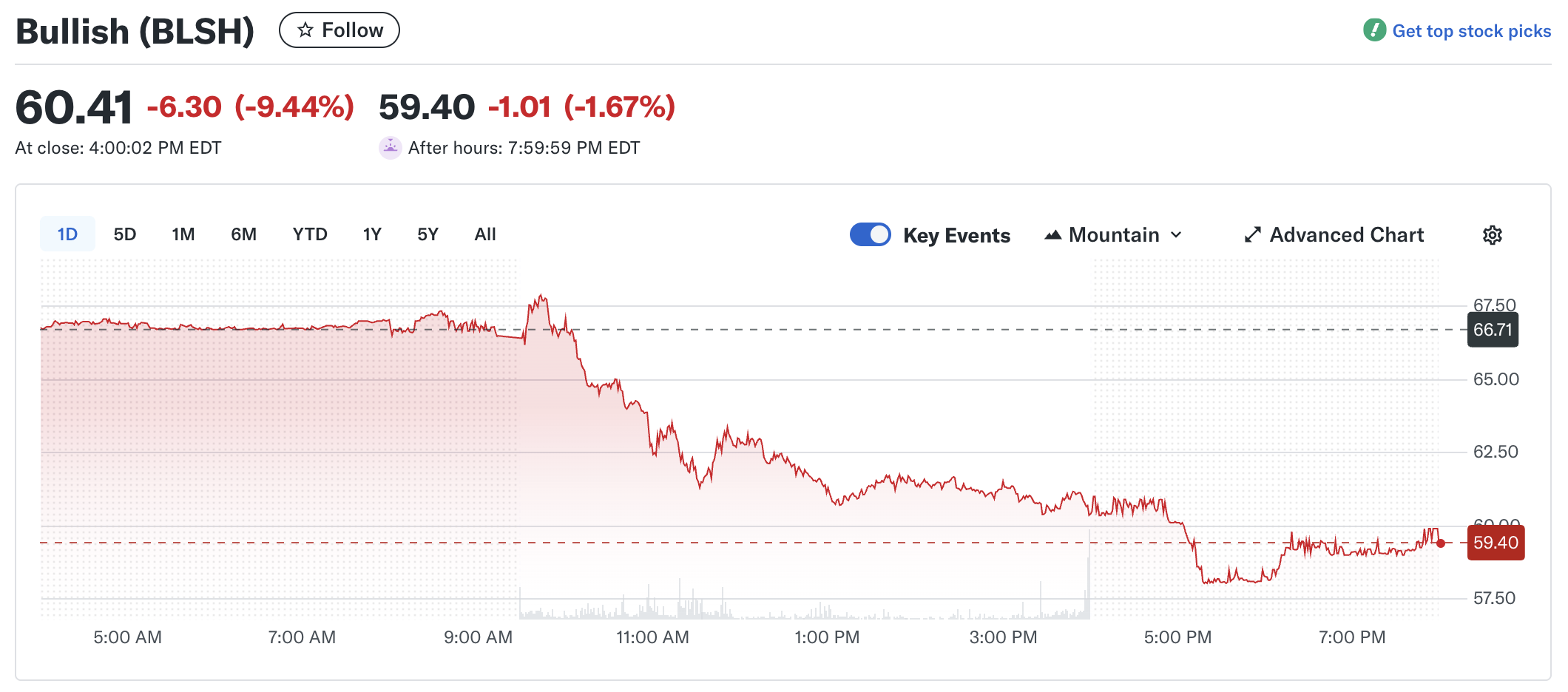

BLSH inventory worth efficiency up to now day / Supply: Yahoo Finance

Cryptocurrency monetary companies firm Blish (BLSH) additionally posted vital losses, dropping 9.42% to $60.37 from the earlier closing worth of $66.65. Shares briefly reached $68 earlier within the day, however fell to $60.25 because the broader market slumped.

Japan-based Bitcoin treasury firm Metaplanet (MTPLF) closed 2.25% decrease at $3.48 in comparison with its earlier closing worth of $3.56. It rose to $3.65 in the course of the day, however the positive aspects had been short-lived because the inventory fell in late buying and selling.

Bitcoin mining firm MARA Holdings, Inc. (MARA) suffered the steepest decline, dropping 7.67% to $18.65. After an early try at a rebound, the inventory worth plunged round 11 a.m. and continued to fall in after-hours buying and selling, dropping one other 1.72% to $18.33, indicating that investor considerations persist.

BREAKING: 🇺🇸 $1.2 trillion disappeared from the inventory market in the present day.

Pray for cryptocurrencies. pic.twitter.com/TiGFJBzSfb

— Ash Crypto (@Ashcryptoreal) October 10, 2025

Technique’s mNAV highlights the danger of Bitcoin authorities bonds

Bitcoin monetary large Technique (MSTR) was additionally hit laborious by the sharp decline. On the identical day, the inventory worth fell 4.84% to $304.79 in comparison with the day before today's worth of $320.29. The inventory fluctuated between a excessive of $323.43 and a low of $303.57 in the course of the session, displaying excessive volatility.

Extra importantly, the main target has shifted past the short-term inventory worth decline to deepening considerations in regards to the firm's elementary valuation metrics. Analysts reported that the corporate's a number of to internet asset worth (mNAV) fell beneath 1.180, its lowest degree in almost two years (19 months).

Technique mNAV move / Supply:saylortracker.com

Jeffrey Kendrick, head of digital asset analysis at Customary Chartered, warned that it’s important for digital asset treasury (DAT) corporations to keep up mNAV above 1.0 with a view to develop their holdings. He mentioned something beneath that threshold signifies weakening steadiness sheets and growing consolidation strain throughout the business.

Technique corporations and comparable corporations are additionally going through elevated strain from PIPE (Non-public Funding in Public Fairness) financing buildings used to fund Bitcoin acquisitions. In keeping with a CryptoQuant report final month, Bitcoin authorities bonds are inclined to cluster towards discounted PIPE subject costs. This sample brought on some early buyers to face losses of as much as 55%.

Listed Bitcoin Treasury Firm / Supply: bitcointreasuries.internet

Technique at the moment holds roughly $78 billion price of BTC, however its market cap is $94 billion, implying a $16 billion premium. However given the corporate's complete income of lower than $350 million over the previous 12 months, most analysts consider the premium displays investor optimism associated to founder Michael Saylor's efforts to advertise Bitcoin-backed bonds and funding merchandise.

The article U.S. and China Tariff Considerations Hit Bitcoin Treasuries appeared first on BeInCrypto.