It is a section of the Ahead Steering E-newsletter. Subscribe to learn the total version.

This week is likely one of the greatest issues we've executed shortly, for the discharge of financial knowledge.

Let's run some charts and takeout within the spirit of all this knowledge.

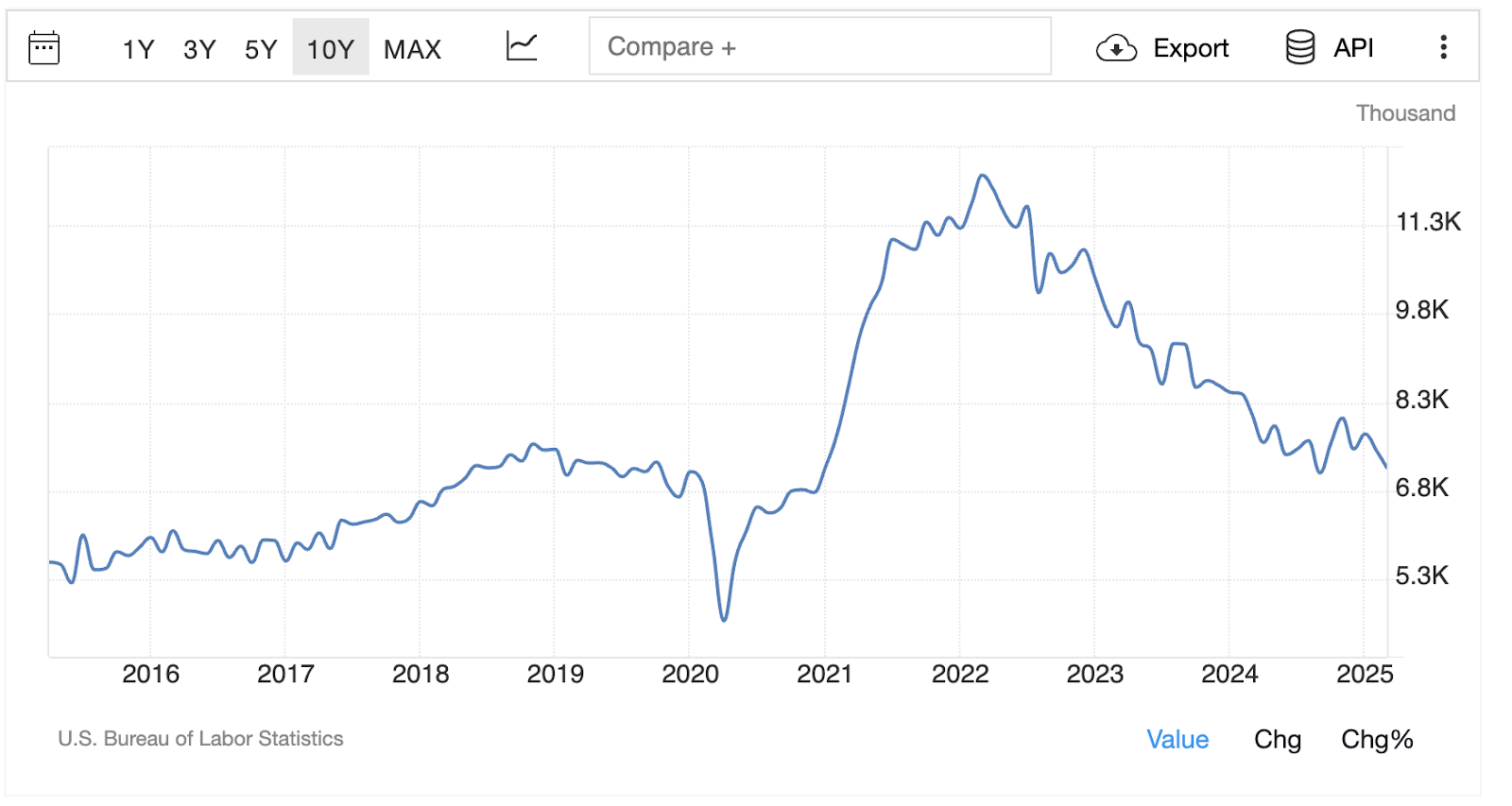

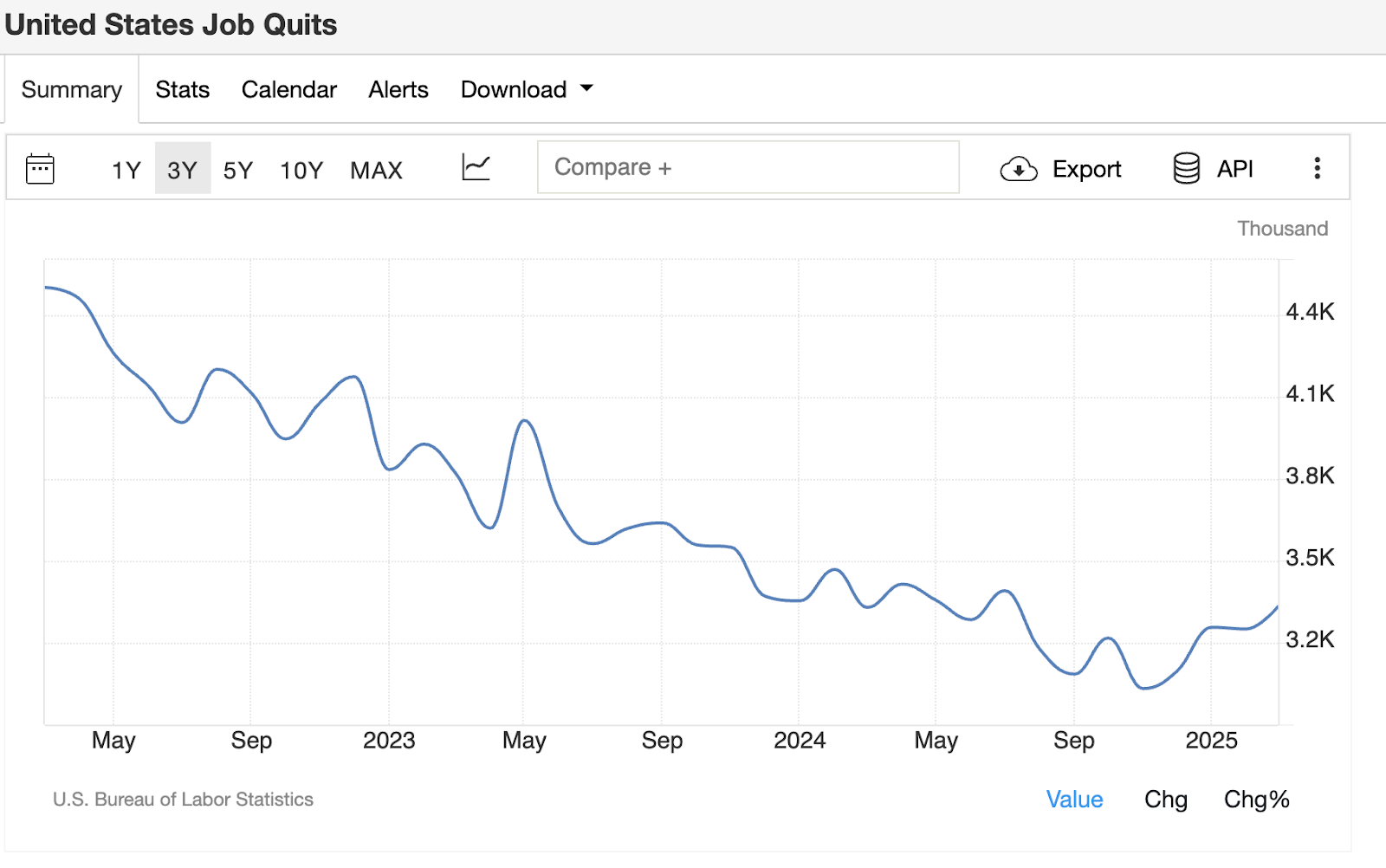

Jolts Report

On Tuesday we obtained our job openings and labor turnover investigation (JOLTS) report. It was a mix.

On one aspect, after a number of months of optimistic surprises, the opening of the work missed the failings and commenced to roll.

Conversely, we now have seen the Quits charge really rise, suggesting a rise in confidence within the job market by people prepared to stop their jobs and discover one thing higher elsewhere.

It is extremely uncommon to see these two prints department out. I feel we have to take a look at Friday's employment report back to get a cleaner learn on the labour market course, which is a key driver of the Fed's response perform.

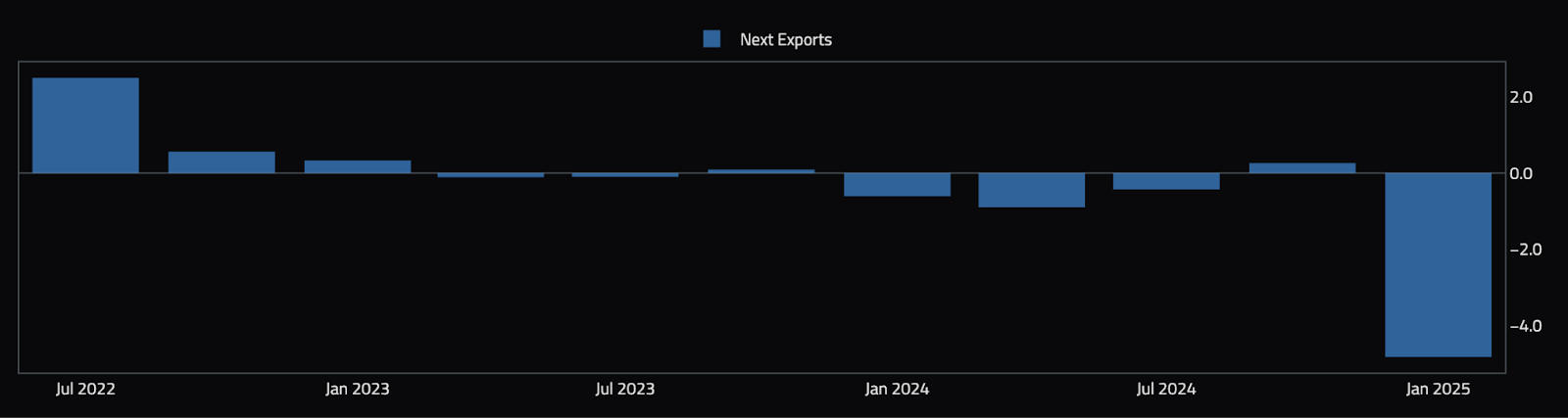

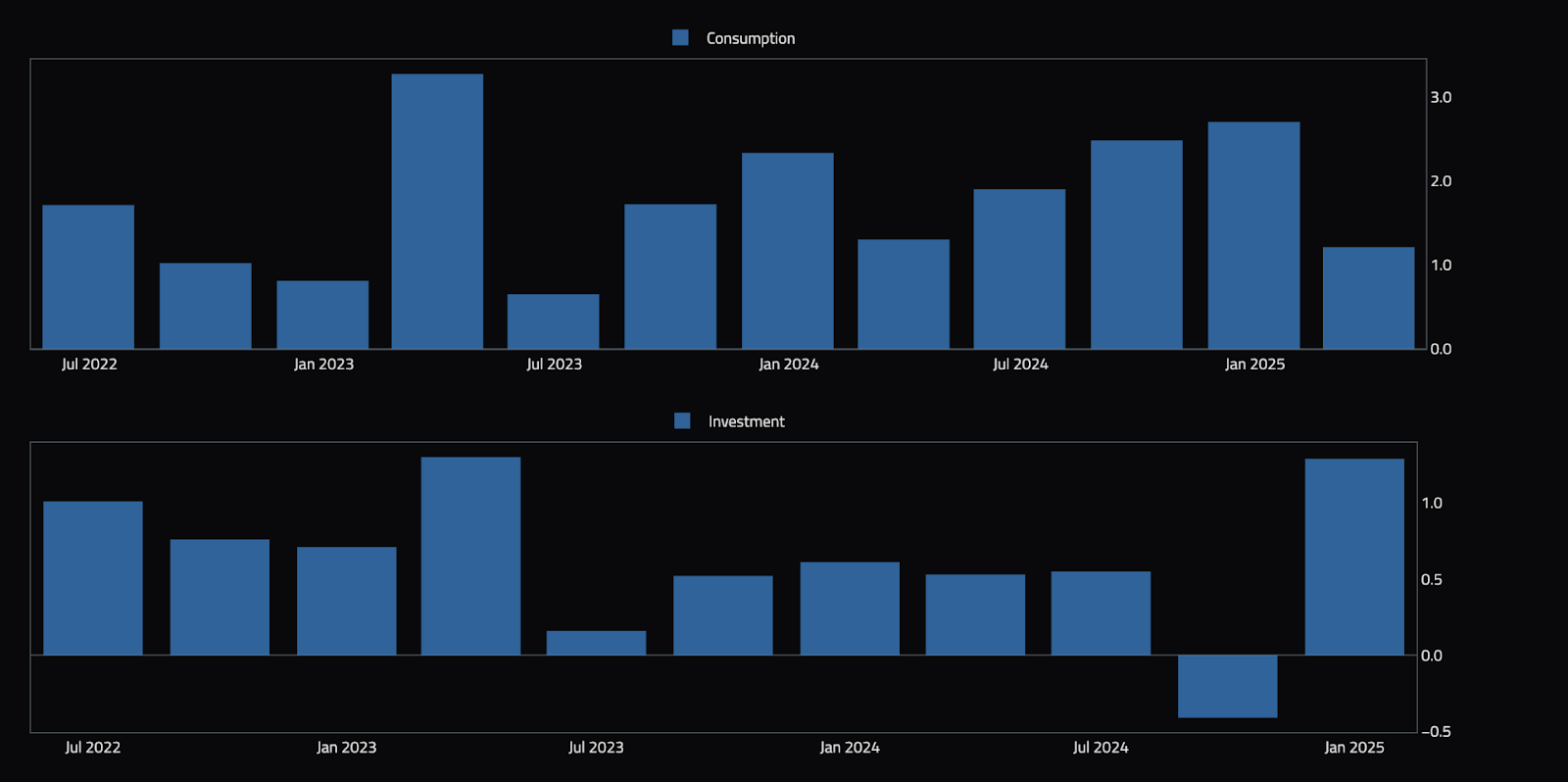

GDP Print

As talked about in yesterday's e-newsletter, I obtained the primary look of the Q1 GDP print. This was additionally very combined. The topline numbers for quarters past the quarter hidden some attention-grabbing insights:

The large driver was primarily because of a drop in web exports because of a big enhance in imports. It mechanically reduces GDP development.

Nonetheless, wanting on the extra necessary parts of GDP, consumption has been correctly postponed and funding has really skyrocketed!

This means one thing I've been fascinated by not too long ago. In different phrases, tariffs could also be creating mirages on laborious knowledge. This mirage creates the emergence of a powerful financial system for all of the tariffs that come up from each shoppers and companies seeking to purchase items earlier than the tariffs actually start.

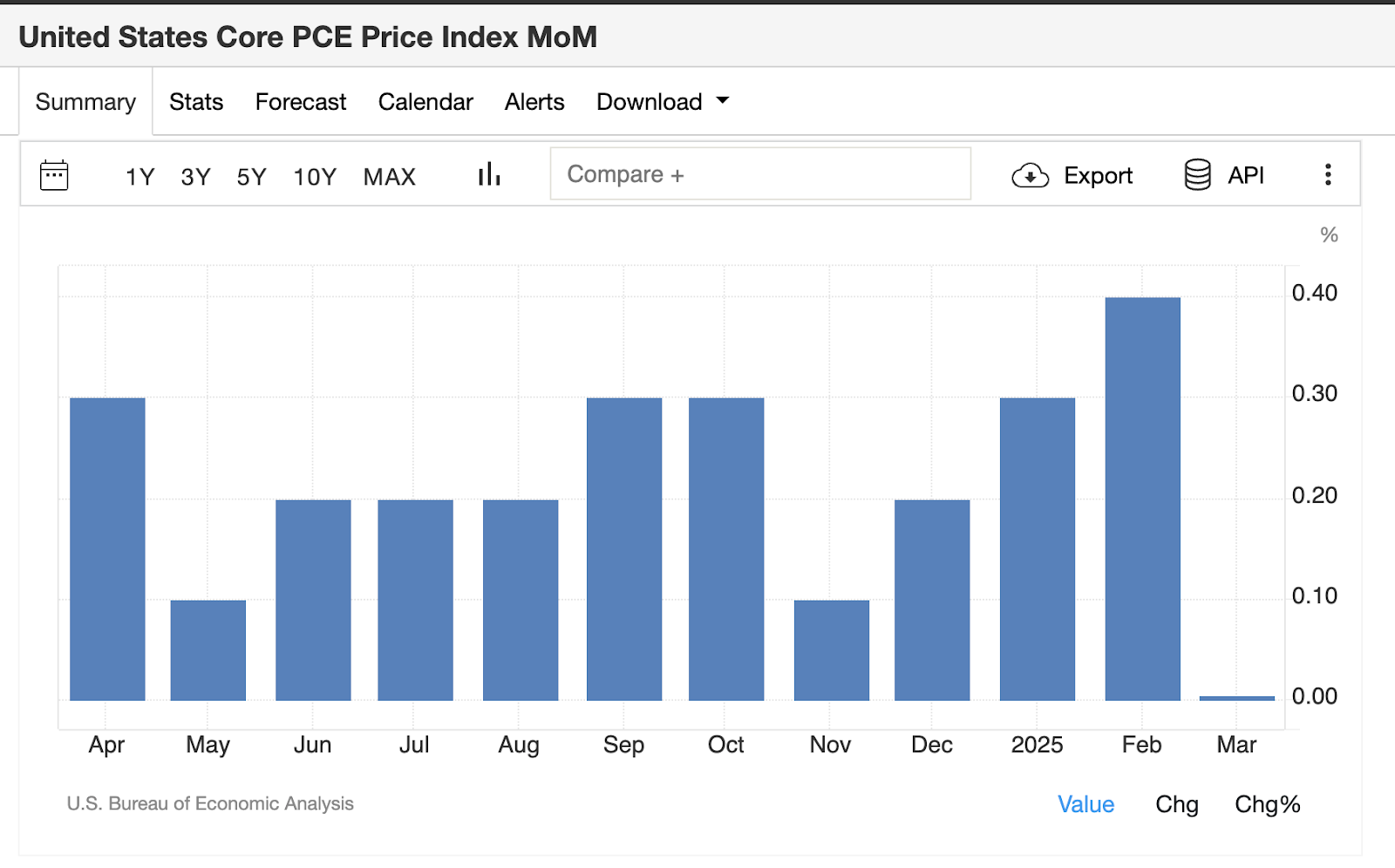

Core PCE Print

I additionally received a Core Private Consumption Expense (PCE) print. This has arrived at 0% for a month (consensus expectations of 0.1%)!

This type of knowledge is on a fast truck the place inflation returns to targets, in the event you're not afraid of tariff-related inflation, sheds gentle on how the Fed can lower loopy rates of interest.

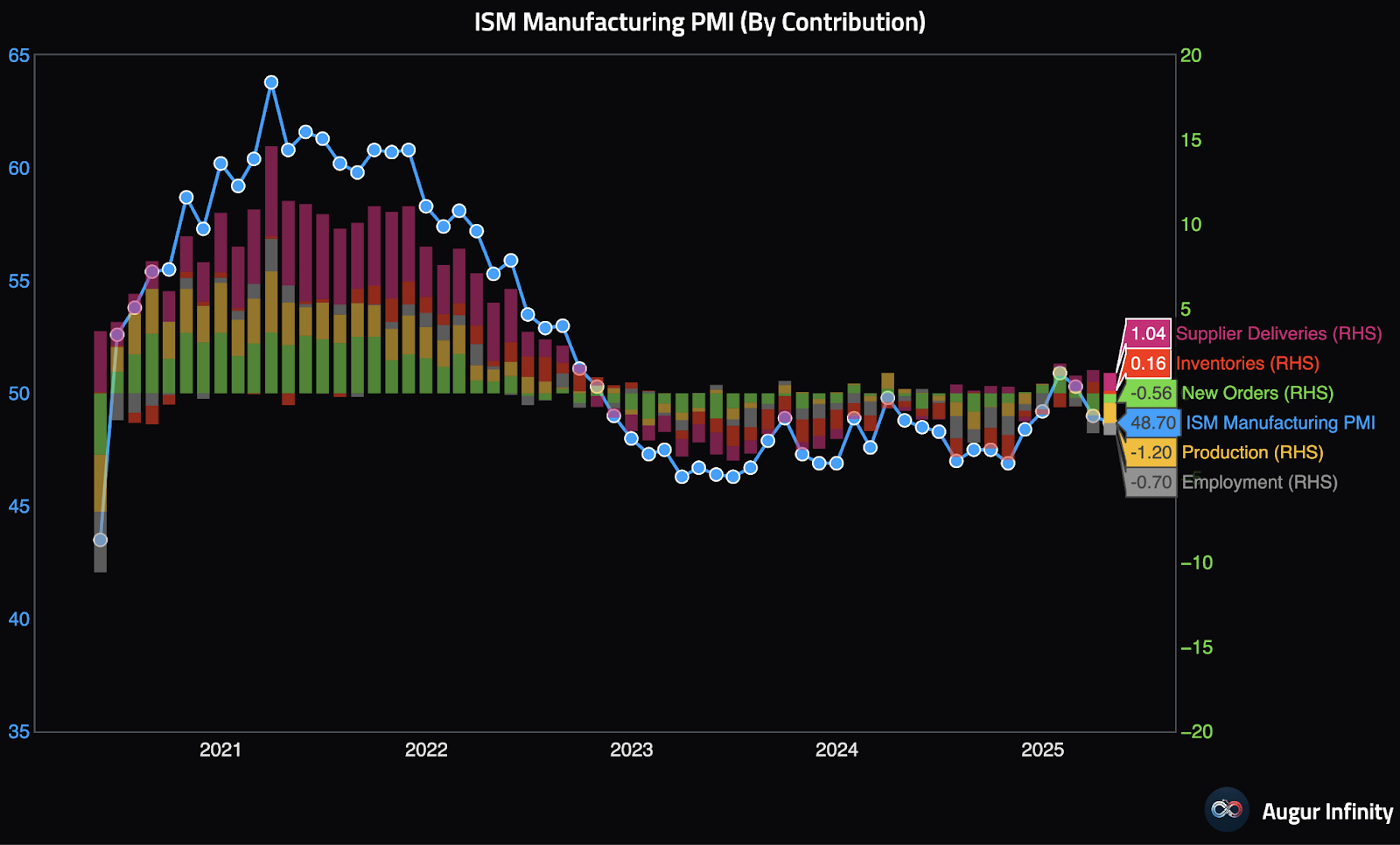

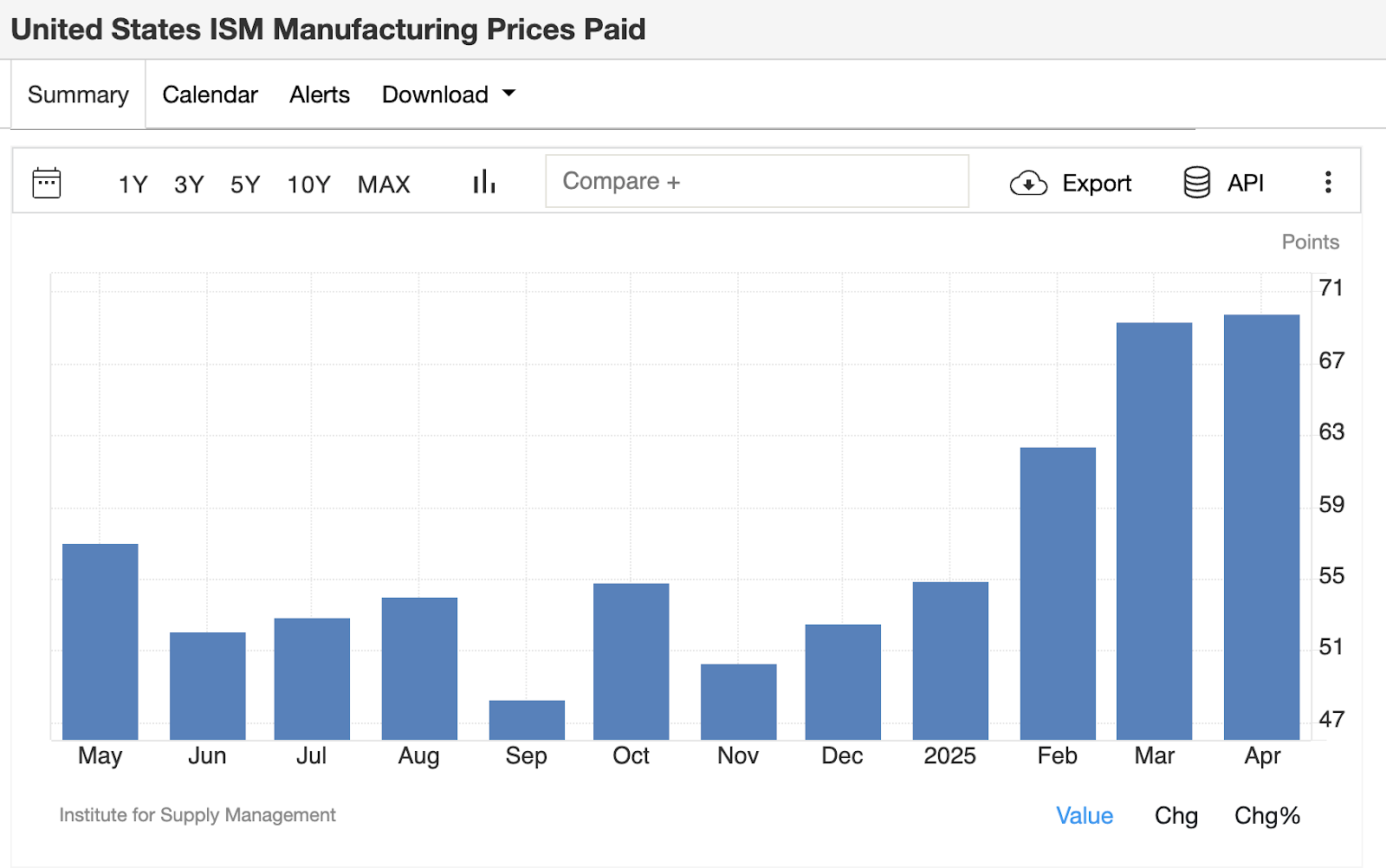

ISM Survey

Lastly, right now we noticed the outcomes of a PMI survey on ISM manufacturing. This gives a serious take a look at how the financial system is digesting tariff wars.