Upexi, a registered NASDAQ firm, has introduced the acquisition of an extra 56,000 Solana (SOL), price round $7.8 million at its charges at present. The corporate at the moment owns SOL 735,692 price of roughly $1344 million. Upexi is the biggest Sol Treasure Firm. The corporate goals to maintain as many sols as attainable.

Regardless of her curiosity, Solana continues to shine purple

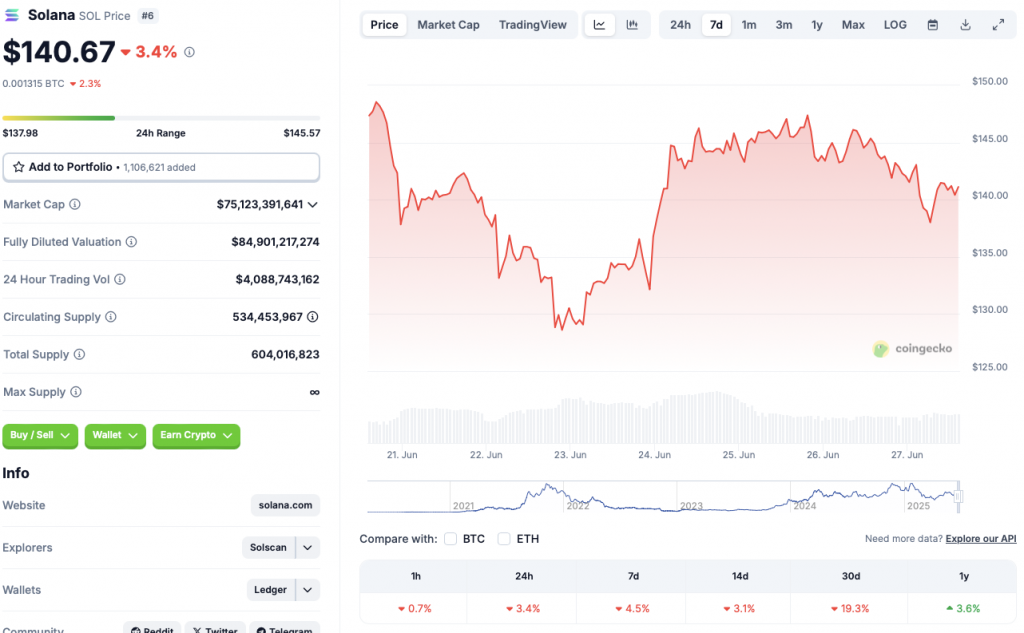

Sol spent roughly the previous few months this yr. Property rose to a peak of $293.31 on January nineteenth this yr, however have since declined greater than 52%. SOL at the moment has a decline of three.4% on each day charts, 4.5% on weekly charts, 3.1% on 14-day charts and 19.3% on earlier month. Regardless of the inactive efficiency in 2025, Sol has maintained some earnings on the annual charts, attracting 3.6% since June 2024.

The present predicament for Solana (Sol) could possibly be attributable to elevated volatility within the crypto market. The market has skilled a rebound after escalation within the Center East battle, however we appear to have hit a barrier once more. Bitcoin (BTC) seems to be built-in on the $107,000 stage.

BTC conferences could possibly be attributable to a constant institutional inflow. The dearth of retail cash could also be one purpose why the crypto market is struggling. Retail traders are nonetheless not assured. The Federal Reserve choice to maintain rates of interest unchanged might have banned retail traders from stealing harmful strikes.

Solana (Sol) might see the upwards within the coming weeks. The belongings have a number of spot ETF functions within the SEC. ETF approvals can result in a surge in facility cash. Given the scarcity of retail traders, a rise in facility inflows might drive the following Sol-Rally.

Additionally, as soon as retail traders regained confidence, Sol was in a position to see the rally. Price discount was the simplest option to give retail gamers extra confidence. This chance seems to be out of the image in the interim.

(tagstotranslate) solana