Matthew Sigel, head of digital property analysis at Vaneck, proposed a brand new monetary product referred to as “Bitbonds” to handle the US authorities's looming $14 trillion refinance obligation necessities.

The last decade-long monetary merchandise mix conventional US Treasury with Bitcoin (BTC) publicity. This supplies a possible resolution to the nation's monetary issues.

Will Bitcoin-backed bonds assist resolve the US debt disaster?

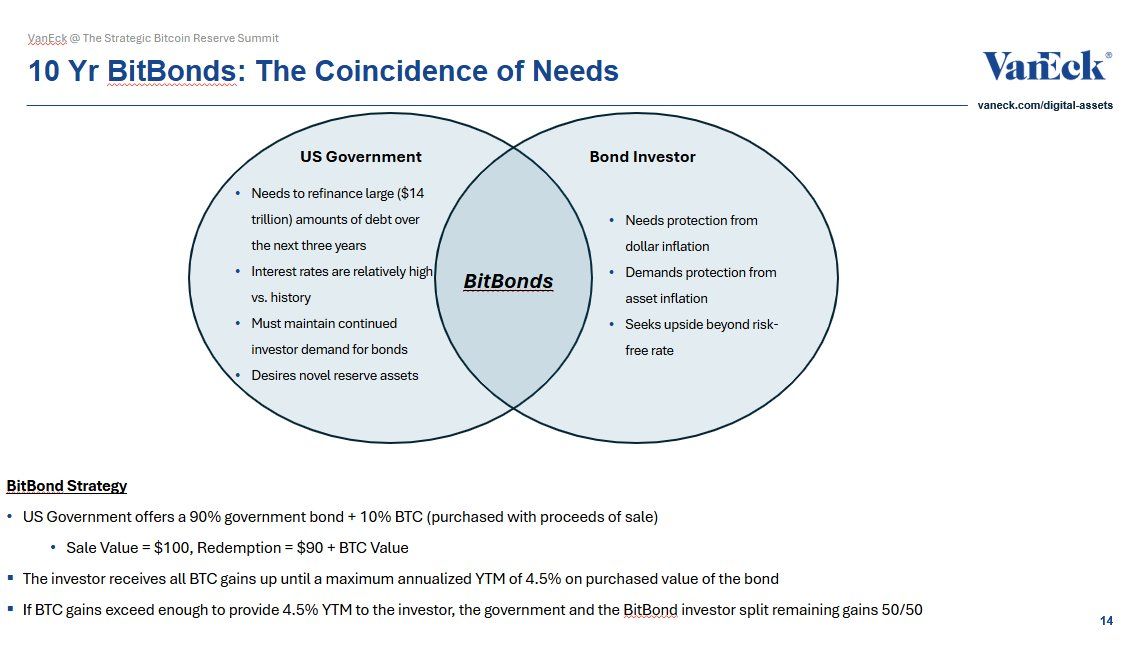

In response to Sigel's proposal, Bitbonds' funding construction allocates 90% of its funds to decrease and decrease danger Bitcoin, combining stability with increased return potential. Moreover, the federal government will buy Bitcoin with income from bond gross sales.

Vanek's proposed construction for Bitbonds. Supply: X/Matthew Sigel

Buyers obtain all Bitcoin earnings as much as 4.5% of their annual yield. Moreover, traders and the federal government will divide further earnings equally.

“An identical resolution for incentives for discrepancies,” Sigel mentioned.

From an investor's perspective, Siegel emphasised that bonds will provide break-even Bitcoin annual progress price (CAGR) between 8% and 17%, relying on the coupon price. Moreover, if Bitcoin grows at a CAGR of 30%-50%, traders' returns may skyrocket.

“A convex wager – in case you imagine in Bitcoin,” he added.

Nevertheless, the construction shouldn’t be with out danger. Buyers have suffered the drawbacks of Bitcoin and are partially concerned on high of it. If Bitcoin is under efficiency, low-coupled debt may lose enchantment.

In the meantime, the Ministry of Finance's shortcomings are restricted. Even a whole collapse of Bitcoin's worth will result in price financial savings in comparison with conventional bond issuance. Nevertheless, that is topic to coupons remaining under the break-even threshold.

“BTC the other way up simply sweetens the deal. Worst case: low cost financing. Finest case: lengthy publicity to the toughest property on the planet,” Siegel mentioned.

Sigel argued that this hybrid strategy would alter the earnings of governments and traders over a decade. The federal government faces excessive rates of interest and vital debt refinancing wants. In the meantime, traders are searching for safety from inflation and asset collapse.

The proposal comes amid rising concern over the US debt disaster, which has been exacerbated by the latest enhance in debt ceilings to $36.2 trillion, as reported by Beincrypto. Particularly, the Bitcoin Coverage Institute (BPI) has additionally endorsed this idea.

“Based mostly on President Donald J. Trump's March 6, 2025 government order establishing strategic Bitcoin reserves, this paper proposes that the US undertake revolutionary monetary instruments to deal with a number of key objectives utilizing Bitcoin-enhanced US Treasury debt (“₿ bonds” or “bitbonds”) as an revolutionary monetary instrument.”

Within the paper, co-authors Andrew Hohns and Matthew Pines proposed that by issuing $2 trillion Bitbonds at a 1% rate of interest, it may cowl 20% of the Treasury's 2025 refinancing wants.

“Over the last decade, this represents a nominal financial savings of $700 billion and a gift worth of $544.4 billion,” the writer writes.

BPI estimates that if Bitcoin achieves a CAGR of 36.6%, it may doubtlessly invalidate federal debt of as much as $50.8 trillion by 2045.

These suggestions are a part of a broader dialog in regards to the potential impression of Bitcoin on nationwide finance. Beforehand, Sen. Cynthia Ramis argued that the US strategic Bitcoin reserve may lower nationwide debt by halving. The truth is, Vaneck's evaluation reveals that such reserves will assist cut back their $21 trillion in debt by 2049.