DIEM, an ERC-20 token issued on the Base blockchain, has risen practically 120% over the previous month, outpacing a lot of the broader cryptocurrency market amid rising curiosity in tokenized AI computing.

Tokenized AI Computing Noticed as DIEM Rise Practically 120% in 30 Days

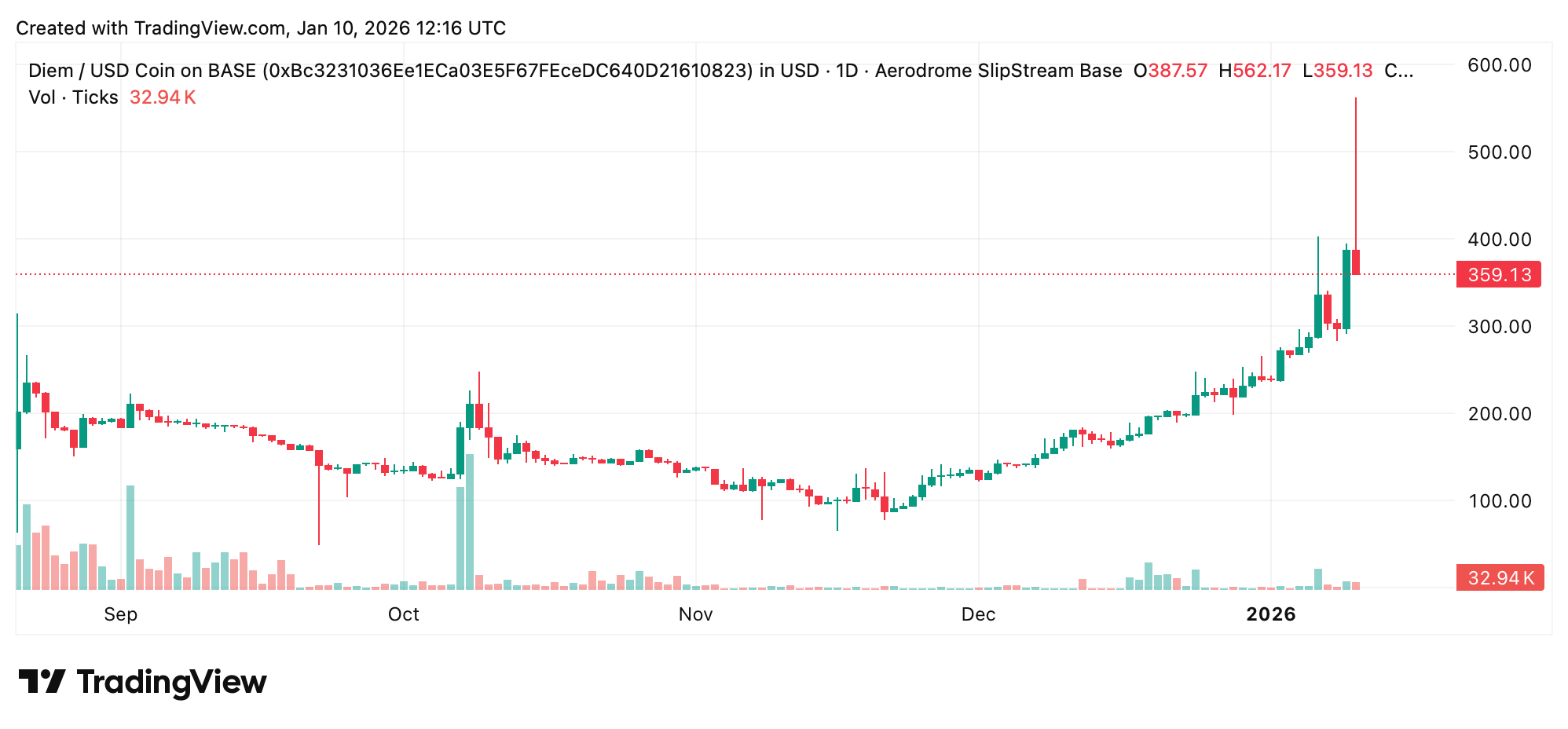

Final week, DIEM traded in a variety between $263 and $426, with the interval starting round $263 and ending nicely above that degree by the top of the week. DIEM is buying and selling at $360 per coin as of seven:45 AM ET on Saturday, January 10, 2026. In keeping with market information, the weekly enhance has reached roughly 34%, and the token's market capitalization now stands at greater than $13 million.

This worth motion comes at a time when many digital belongings are shifting sideways, putting DIEM amongst a small group of tokens with robust relative efficiency. With a circulating provide of simply over 36,000 tokens, even modest adjustments in demand lead to noticeable worth fluctuations.

DIEM was launched in August 2025 by Venice AI as a tradable type of tokenized AI computing. The token is designed to offer holders with steady entry to AI inference, relatively than a fixed-term subscription, and is distinct from typical software program licensing fashions. The launch was initially controversial, however Venice's person progress (greater than 400,000 registered customers) and integration with prime AI fashions have helped counter this controversy.

Basically, every DIEM staked unlocks $1 price of AI credit per day on the Venice platform, which resets day-after-day at midnight UTC. These credit can be utilized for textual content, pictures, and different AI duties by the Venice net software or API with out accumulating if unused. Holders can stake, unstake, commerce, or burn DIEM at any time, however there’s a one-day delay in unstaking.

Venice aggregates entry to a number of AI fashions right into a single interface, positioning DIEM as a utility token tied on to compute utilization relatively than governance or speculative incentives. Tokens usually are not inflationary. Its provide is managed by a capped mint curve that approaches a long-term aim of roughly 38,000 tokens.

The mission was based by Erik Voorhees, identified for creating Satoshi Cube and Shapeshift. Voorhees publicly framed DIEM as a approach to simplify entry to main AI programs with out recurring funds. As of late, Voorhees has regularly talked about DIEM relating to X, highlighting key milestones whereas explaining why the token has resonated with customers.

“Persons are beginning to notice that with DIEM, they will entry all their AI fashions at no cost, each within the Venice.ai app or API,” Voorhees wrote this week. “Claude Opus 4.5, GPT 5.1, Gemini 3, Nano Banana Professional, GLM 4.7 and plenty of extra.”

Additionally learn: UK creates regulatory framework for crypto corporations

DIEM is minted by Venice's native rock Vacationer info middle The token creates a closed-loop mechanism the place computing demand locks capital elsewhere within the ecosystem. Writing DIEM returns the unique Vacationer info middle It was used to mint and strengthened the connection between provide and demand in public works.

Latest positive factors seem to replicate rising consciousness of this construction, as merchants and customers admire DIEM's function as a perpetual entry token relatively than a conventional AI subscription or governance asset.

How lengthy that demand lasts will in the end be decided over time. Venice additionally faces important competitors from established decentralized AI protocols, together with Hugging Face and different companies within the computing market, which might constrain widespread adoption. Nonetheless, some observers argue that Venice's privacy-preserving design might differentiate it from competing platforms.

Often requested questions 🤖

- What’s DIEM used for?DIEM offers day by day up to date AI computing credit while you guess on the Venice platform.

- Why has the worth of DIEM elevated not too long ago?Market members are more and more involved in tokenized AI computing and utility-based designs for DIEM.

- How does DIEM generate AI entry?Every staked token unlocks $1 in AI credit per day that can be utilized through Venice's app or API.

- Is DIEM inflationary?No, DIEM provide is proscribed by a managed casting curve related to the lock. Vacationer info middle token.