Wall Avenue is more and more betting on US rate of interest cuts by the tip of 2025. On the identical time, political stress from Donald Trump is rising.

With inflation cooling and markets adjusting expectations, crypto might have the ability to get probably the most out of free financial coverage.

Trump hopes to decrease rates of interest to 1%

Right now, Trump up to date his assault on Federal Reserve Chairman Jerome Powell. He referred to as for a 3% level fee minimize, claiming it might save $1 trillion a 12 months to the US economic system.

The US president additionally accused Powell of preserving the worth excessive for “political causes.”

The Fed has been steady at 4.25%-4.50% since June, however estimates have risen. Goldman Sachs is hoping that the primary minimize will arrive in September.

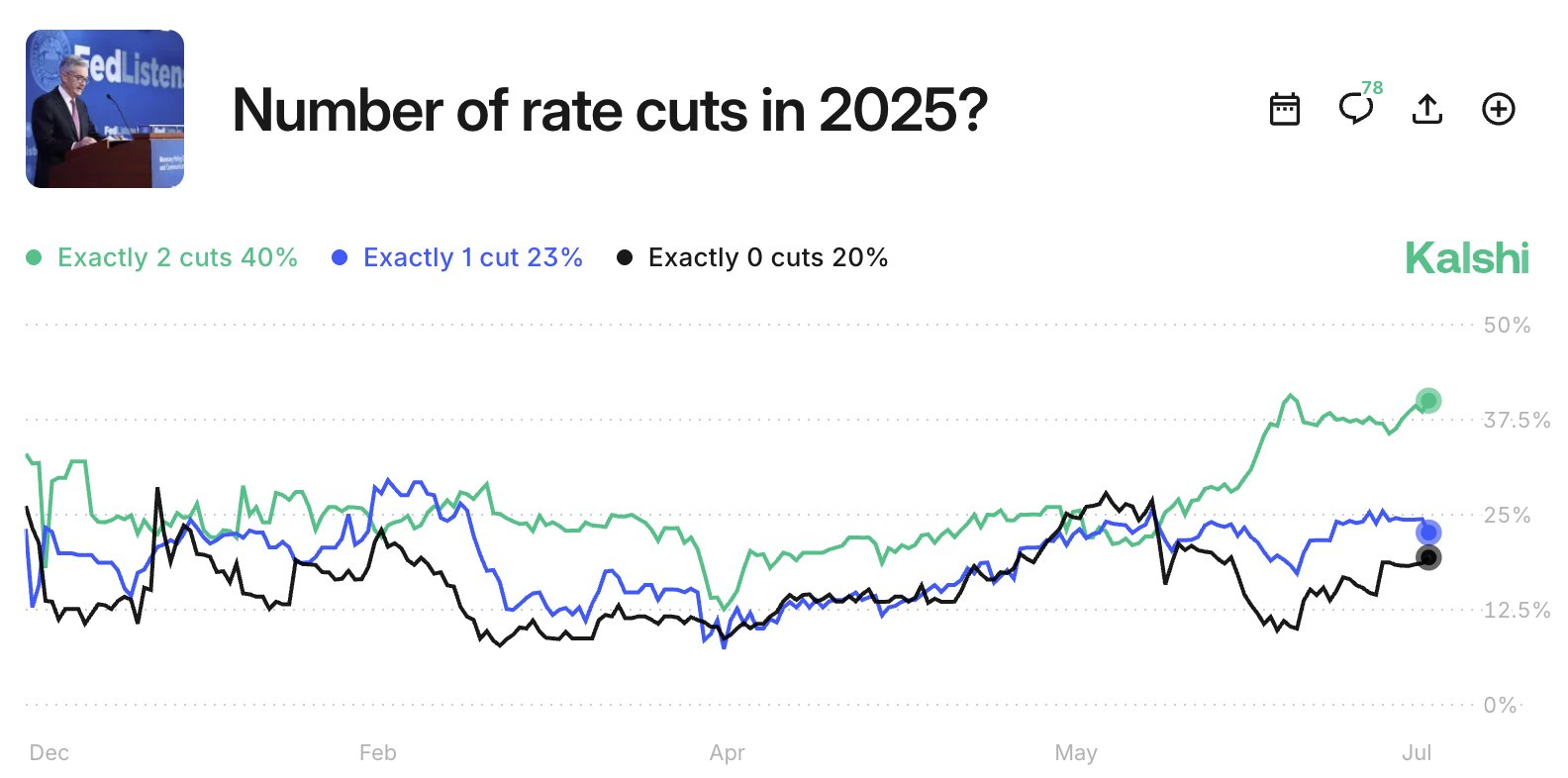

In the meantime, forecast market dealer Kalshi seems at a 40% probability of two cuts earlier than the tip of the 12 months.

Calciods of the 2025 Federal Reserve Discount

This transformation follows a pointy decline in US inflation expectations. Client expectations for the 12 months fell to 4.4% in July, the bottom since February. This exhibits a 2.2 factors drop in simply two months. This is among the greatest two-month declines in historical past.

Lengthy-term inflation expectations have additionally been eased. The five-year outlook fell 0.8 proportion factors within the final quarter and at the moment sits at 3.6%.

Total, these developments counsel that there’s room for the Fed to facilitate extra time with out inflicting worry of a worth spiral.

The crypto market is taking nice care.

Bitcoin is over $118,000, whereas Ethereum holds practically $3,700. Each belongings have traditionally rallyed after Fed fee cuts, benefiting from elevated liquidity and investor danger urge for food.

Can a significant cryptocurrency run start?

Traditionally, rate of interest cuts have launched a robust code bull market.

After the Fed was minimize in March 2020 in the course of the Covid-19 disaster, Bitcoin has surpassed $60,000 to lower than $10,000 inside a 12 months. Ethereum continued, supported by the expansion of defi and NFTs.

A brand new fee discount cycle begins in September might lead to related circumstances. A decline in yield pushes traders in direction of risk-on belongings, together with crypto.

Capital can be rotated from bonds and money to Bitcoin, Ethereum and altcoins with excessive convictions.

Moreover, decreasing inflation expectations and bettering readability in regulation can strengthen traders' belief, reminiscent of genius and readability behaviour.

This convergence of macros and coverage indicators might lengthen the present cycle past earlier historical past highs.

Nevertheless, timing is necessary. As ciphers are already near report ranges, momentum can rely on the velocity and depth of the minimize. Delays or shallow responses from the Fed could be restricted to the wrong way up.

Essential dates to see

The following Federal Reserve Coverage Convention will happen July Twenty ninth-Thirtieth. The market shouldn’t be anticipating any change, however the Fed's commentary can be intently analyzed in opposition to the sign from round September.

The following necessary date is September Sixteenth-Seventeenthwhen FOMC reunites. That is broadly seen as the primary practical window of fee discount, particularly when inflation continues to say no.

Different necessary metrics to watch:

- July CPI Print: In early August, this kinds expectations for the September choice.

- Jackson Gap Symposium (August 22-24): Powell's speech right here can change feelings considerably.

- US Job Report (August and September): Work softness could strengthen the case of discount.

For crypto merchants, these dates present clues to potential market inflection factors. Verified Fed pivots could cause renewed buying stress, notably for Bitcoin, Ethereum and hyperfluid altcoins.