Fistbump (fist), the token of the BNB chain ecosystem, is dealing with a possible liquidity disaster. The token had a big gathering, with whale indicators cashing out the hype.

Fistbump (fist) is a token that has been heated over the previous few days, inflicting concern of potential rug pull. A number of chain analysts recommend that fists could also be dealing with a sudden liquidity disaster as whales use short-term hype to money out.

The fist now depends solely on the Pancakeswap pair for many of its fluidity. This additionally signifies that if the biggest liquidity supplier strikes forward or the whale cashes out, the token can return to a comparatively inactive state. Regardless of years of historical past, Fist by no means gained an inventory of central exchanges.

Fist carried out a rally after three years of inactivity

The Fist undertaking shouldn’t be a stranger to the fast crash following its first launch on the finish of July 2022. The Fist was quickly spiked to a peak of $3.36, erasing most of its worth and drifting beneath the penny for years. Fist is among the uncommon tokens that transfer after the long-term bear market, even surpassing the report excessive of $3.52.

Fist staged a vertical rally at sub-penny costs just a few years later. Now, the undertaking obtained new warnings about potential liquidity crunches and one other deep correction. |Supply: Coingecko

After being virtually forgotten, the Fist Challenge instantly confirmed exercise, miraculously recouping a worth vary above $3.20 inside just a few days. Fist obtained hype from former holders, but additionally obtained disastrous warnings a few potential crash much like the 2022 crash.

A number of sources have began caveat The fist confirmed indicators of whales cashing following long-term transactions at low vary. Present buying and selling pairs obtainable might dry out if the liquidity pool is drained.

The fist was launched in 2022 throughout the growth interval, inflicting a stir and extensively adopted. The fist reached a complete of 226,842 wallets, most of which suffered severe losses. Some fist house owners seem like going down by way of the 2022-2023 Bear Market.

The fist exhibits a warning signal on the insider management chain

The Fist Token is principally focused on one pancake swap pair, with over 95% quantity. The property reached $30 million at a day by day quantity, an uncommon exercise stage.

As of August 28, the key buying and selling pair nonetheless had greater than $7 million in liquidity. Nevertheless, its liquidity depends totally on a single whale supplier. Prime liquidity supplier carried over 77% of pair liquidity based mostly on DexScreener information.

On the newest rally, a number of whales every cashed round $600,000, with no single entity exhibiting huge income. Nevertheless, older holders might try to money out if retailers and new patrons take part.

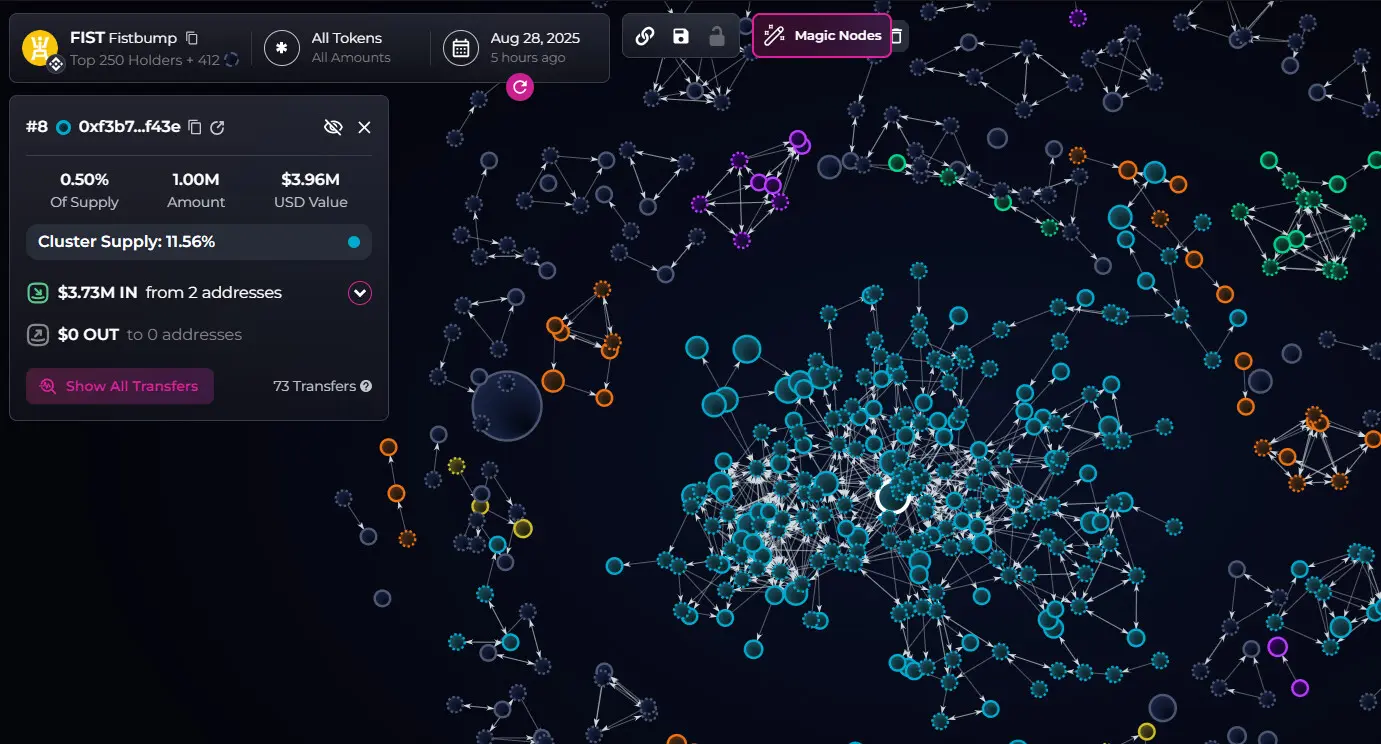

Moreover, the fist exhibits indicators of insider holdings. There are a number of essential whales with giant wallets, however the high 20 holders are related to the pockets cluster based mostly on information from Bubbles information.

The fist shouldn’t be a whale-sized pockets, however the high deal with is related by a big pockets cluster that holds greater than 11% of the availability. |Supply: Bubblemaps

The Fistbump undertaking can also be busy promoting FST Swap distributed exchanges. Regardless of the hype, there are nonetheless FST swap exchanges commercial Fist token beneath “Parody Account.”

Fistbump has launched aggressive advertising on social media within the bull market in 2025. Tokens purpose to place themselves as Defi Hub within the BNB chain ecosystem, buying and selling in danger much like new meme tokens. Regardless of the purpose of “make your fist nice once more,” the token raises a number of purple flags after an virtually vertical rally that occurred throughout the general market reversal of BTC and different main cash.