- Following the consolidation of the bear flag sample, Bitcoin worth is poised to drop 20% and retest $55,000.

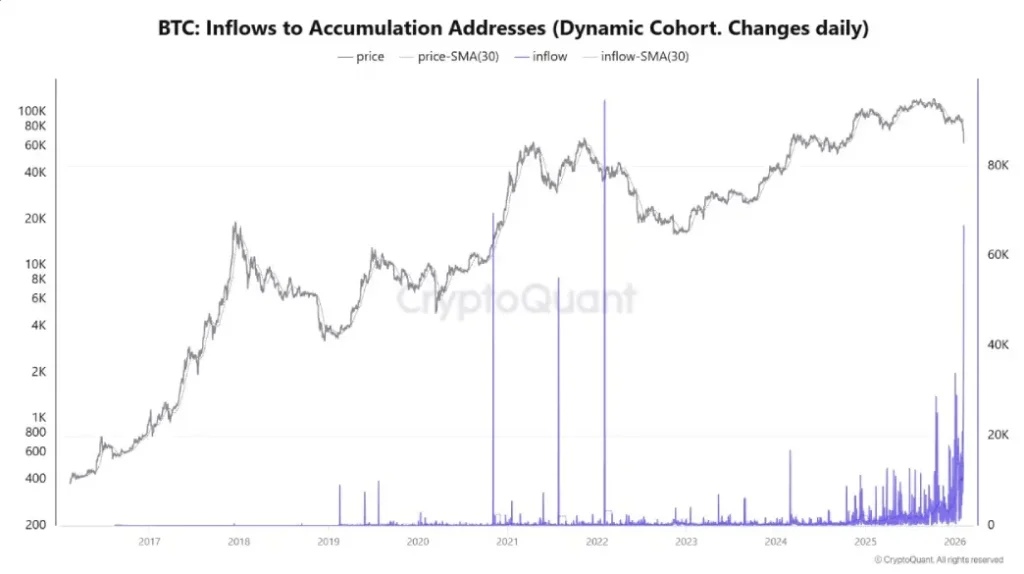

- On February sixth, the accumulator pockets absorbed 66,940 $BTC In simply sooner or later.

- $BTC's Worry and Greed Index of 9% signifies that market sentiment is in excessive worry.

Pioneering cryptocurrency Bitcoin recorded low-volatility buying and selling within the US on Monday as its worth tried to regain $70,000. Immediately's worth developments reveal the failure of efforts by both patrons or sellers to drive costs increased. $BTCmotion, however the every day candlesticks present uncertainty with lengthy wick rejections from both aspect. Whereas the worth stoop might trigger concern amongst retailers, on-chain knowledge exhibits robust confidence from whales and establishments persevering with to build up extra Bitcoin amid the present market decline.

Whale influx file vs. unstable worth motion at $70,000

Since final week's low of $59,930, Bitcoin worth has rebounded about 16% and is at present buying and selling across the $70,000 degree. The every day chart exhibits a collection of short-bodied, long-wicked rejection candles close to $70,000, suggesting there is no such thing as a sustainability on both aspect.

Market sentiment perceives the current rally as a brief restoration rally to regain depleted bearish momentum. Due to this fact, retail buyers stay cautious as Bitcoin costs may fall once more.

Regardless of potential losses, whales and businesses continued to load extra cargo $BTC. Roughly 66,940 folks on February sixth $BTC Flows into accumulator addresses had been the most important single-day flows we now have seen within the present market cycle. Such exercise signifies that giant gamers typically quietly add to low-level positions and take away cash from exchanges for safekeeping.

Moreover, Michael Saylor's MicroStrategy continued to develop steadily. Bought 1,142 gadgets from February 2nd to eighth. $BTC The common worth per coin is $78,815, making it price about $90 million. This elevated the entire stash to 714,644. $BTC In whole, roughly $54.35 billion was acquired at a mean value of $76,056 per deal. Bitcoin has just lately been buying and selling round $70,000, and the place represents a paper lack of round $5 billion or about 9%.

Binance’s Protected Belongings Fund for Customers (SAFU) additionally elevated its Bitcoin reserves. Added 4225 $BTCthe worth primarily based on stablecoin equivalents is roughly $300 million. The fund at present holds 10,455. $BTCwhich at present charges could be roughly $734 million. With this step, the Bitcoin allocation is one step nearer to reaching its aim of reaching $1 billion, with Bitcoin now over 73% full and with a mean entry worth of roughly $70,214 per coin, unrealized features are at present negligible.

These strikes stand out towards broader promoting strain from some retail merchants and short-term contributors within the volatility.

Bitcoin worth correction may result in a pointy drop forward of main help at $55,000

Since final month, Bitcoin worth has fallen from $97,389 to $69,271, marking a 29% loss. This pullback is primarily pushed by extended large-scale liquidations, macroeconomic uncertainty, and geopolitical tensions.

Nevertheless, from a technical perspective, the coin worth has made a decisive breakdown from a significant bearish continuation sample referred to as the reverse flag. The chart setup is characterised by a downward pole indicating a prevailing downtrend, adopted by a quick pullback with two slopes indicating a reduction rally.

After the completion of this sample, Bitcoin worth is chasing a pre-set goal.

$BTC/USDT -1 day chart

If the bearish momentum continues, $BTC Worth is poised to increase one other 20% correction and retest long-standing help at $54,941.