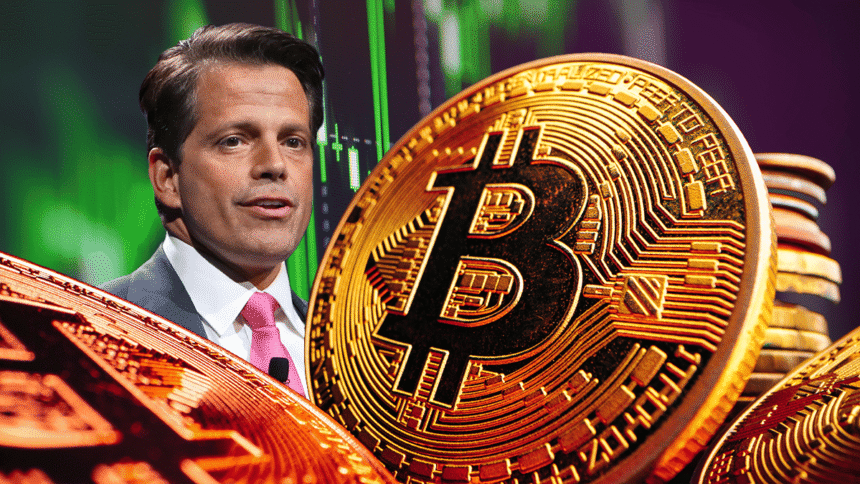

The way forward for Bitcoin (BTC) continues to draw consideration from traders and analysts. Skybridge Capital founder Anthony Scaramucci shared his optimistic imaginative and prescient for forex.

Scaramucci maintains a forecasting firm: Bitcoin may attain $180,000-$200,000 by the tip of 2025.

“It is a cautious value goal,” he mentioned, emphasizing that different forecasts are above these ranges. Due to this fact, the businessman exhibits that he’s not anxious about current revisions.

In accordance with Scaramucci, each day emissions of 450 BTC are restricted, and the rising demand helps that optimism.

In accordance with entrepreneurs, the important thing behind this upward cycle lies in establishment adoption. “Three years in the past, Bitcoin conferences had been dominated by retail traders and companies within the cryptocurrency sector. At the moment, institutional traders are reaching the plenty,” he mentioned.

A transparent instance is BlackRock's iShares Bitcoin Belief (IBIT), the world's largest Bitcoin ETF, with 747,423 BTC value $840 million. The fund displays a rising curiosity in superior establishments to combine recruitment traits..

Regardless of the growth, the market is just not exempt from volatility. Scaramucci highlighted that some whales with over 1,000 BTC (models with over 1,000 BTC) are promoting a considerable amount of BTC, akin to once they settled 80,000 BTC final month.

“There's a historical past of property integration and alter,” he defined, however he argued. Demand is widespread past out there provide, and costs rise.

ETF vs. company technique

When evaluating funding choices, Scaramucci highlighted the relevance of Bitcoin ETFs in money as an IBit known as the “pure bond with Bitcoin.”

He additionally praised Michael Saylor's technique. The strategic firm has gathered 629,376 BTC, urging different firms to problem debt to accumulate not solely Bitcoin, but in addition cryptocurrencies akin to ethher (ETH), Ethereum, Solana (SOL) and avalanche (avax) to accumulate digital property (ETH).

“Sailor is doing extraordinary issues and imitators are displaying it,” he mentioned. however, He admitted that ETFs are most popular choices by establishments that can’t instantly carry Bitcoin.others select shares within the firm akin to technique.

Voices of opposition

Analyst Willie Wu can also be on the rise, guaranteeing that Bitcoin is effectively positioned to proceed climbing, offered the market liquidity stays robust. Nevertheless, he warns of the opportunity of a significant fall as soon as the brand new most is reached, as reported by the encryption.

On his half, SwissBlock's chief economist Henrik Zeberg provides a extra cautious perspective. Contemplating Bitcoin, a extremely dangerous asset that correlates with Nasdaq, Warn that inventory market corrections may trigger a major drop.

Turning to the Jackson Gap symposium, Federal Reserve President Jerome Powell speaks this Friday. The market expects alerts that might have an effect on the Bitcoin trajectory. In the meantime, Scaramucci's forecasts and institutional advantages, led by funds akin to IBIT, should not exempt from danger, however they hold the upward narrative alive.

(tagstotranslate)bitcoin(btc)