The Federal Reserve's 25 foundation level (BP) charge lower has sparked a essential transfer throughout the biggest whales within the crypto market.

From giant Ethereum (ETH) purchases to facility solana (SOL) withdrawals and shifts within the dynamics of XRP provide, this response displays how macropolicies form the cryptographic circulation.

Eth Whale deploys $112 million post-feeding cuts

Hours after the Fed introduced its quarter level lower, on-chain trackers flagged the unbelievable Ethereum buy.

In keeping with lookonchain, the whale's handle 0xd8d0 spent $112.34 million to get 25,000 ETH for $4,493.

After FRB is diminished by 25bps, OTC whale 0xd8d0 spends 112.34m $usdc to purchase 25,000 $eth at 4,493.https://t.co/7euzqpgfro pic.twitter.com/vf55m9te9e

– lookonchain (@lookonchain) September 18, 2025

Aggressive accumulation displays new confidence that borrowing prices and smooth {dollars} can lead liquidity to dangerous property.

Already decreasing demand and hoping for upgrades to scale, Ethereum noticed an instantaneous enhance in whale exercise. This implies that the company is on the forefront of wider gatherings.

One other whale, handle 0x96F4, individually withdrawn 15,200 ETH, price about $70.44 million from the Binance trade inside two hours. This provides to hypothesis that the buildup is intensifying amongst deep gamers.

The establishment continues to stack Solana

Solana isn’t that energetic. Company dealer Falconx has withdrawn 118,190 Sol, price $28.39 million from Binance, marking yet one more indication of institutional belief.

LookOnChain knowledge exhibits that six strategic reserve entities every have over 1 million SOLs.

The ahead trade is taking the lead, incomes an enormous 682 million Sol portfolio price $1.58 billion with a mean value of $232.

Presently there are six strategic $SOL reserve entities every holding over $1 million.

Amongst them, the ahead trade has an enormous $6,822,000 Sol ($158 million), with a mean buy value of $232. pic.twitter.com/yxs6azmfdr

– lookonchain (@lookonchain) September 16, 2025

The quantity of Solana Futures has reached $22.3 billion in latest weeks, and it seems that SOL at present has a stronger demand from each establishments and whales amongst property lined by the ETF record based mostly on the SEC's new generic commonplace.

XRP Whale strikes $50 million to Coinbase

XRP actions took a unique type. The Whale has shifted its $16.4 million XRP to Coinbse Trade, which is greater than $50 million.

The transfer coincided with one other XRP milestone. The XRP reached 6.99 million holder bases in September 2025, making it the brand new ATH (ATH).

XRP holders will skyrocket to ATH. Supply: Santiment

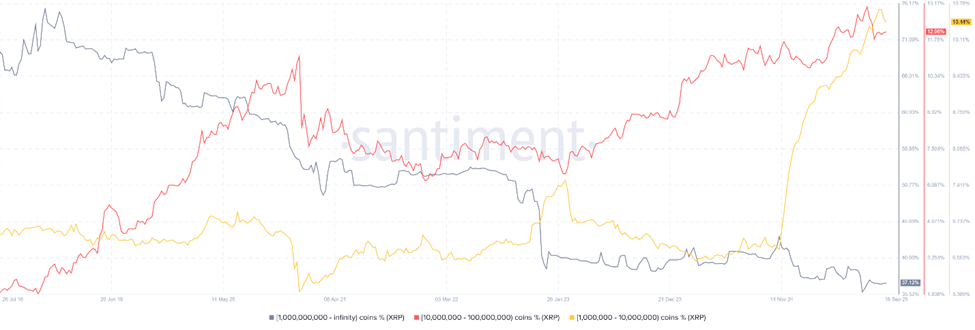

Nonetheless, below the floor the distribution is altering. The provision share of wallets with XRP exceeding 10 billion has declined, however the variety of mid-sized holders of XRP to 1 billion has skyrocketed.

XRP holder distribution. Supply: Santiment

This means a structural shift from enriched whale holdings to wider retail participation.

XRP's Increasing Establishment Profile

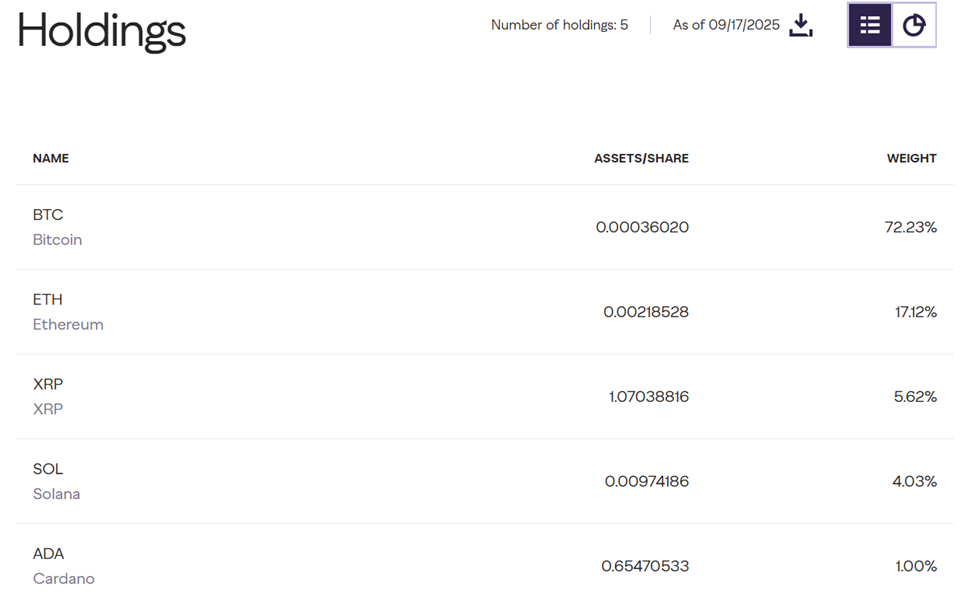

However, XRP continues to punch past the ability's market weight. It at present holds the third largest allocation in Grayscale's Digital Massive Cap Fund, which was lately accepted by the SEC generic ETF record commonplace.

GDLC Holdings from Grayscale. Supply: Grayscale Investments

“The Grayscale Digital Massive Cap Fund $GDLC has been accepted for buying and selling together with generic record requirements. The Grayscale group is working rapidly to ship the primary multicrypt property ETP to the market together with Bitcoin, Ethereum, XRP, Solana and Cardano.”

On the similar time, CME is planning to launch futures on XRP, with the choice debuting on October thirteenth with regulatory approval.

Falconx and DRW are one of many corporations supporting launches, permitting them to unlock new demand from deeper hedging instruments and establishments. Already, XRP futures have reached $1 billion of public income, highlighting robust liquidity.

Accessing whale rearrangement convergence, shifting provide distributions, and prolonged derivatives paint bullish mid-term work.

Whereas XRP's short-term costs stay low, the market construction means that the inspiration is laid for wider adoption and investor belief.

What ETH, SOL and XRP whales did is what they did after the Fed's 0.25% rate of interest lower first appeared in Beincrypto.