Ethereum, a serious altcoin, skilled a difficult month in March.

Nonetheless, as markets start to indicate indicators of restoration, key questions from April stay. Will Ethereum be capable to regain bullish momentum?

Ethereum's March catastrophe: value crashes, exercise droop, provide pressures develop

On March 11, Ethereum plunged to its two-year low of $1,759. This led merchants to “purchase dip” and by March twenty fourth it led to a rally of $2,104.

Nonetheless, market members resumed earnings and the value of the coin fell sharply for the rest of the month. On March thirty first, ETH fell under the important thing value degree of $2,000 at $1,822.

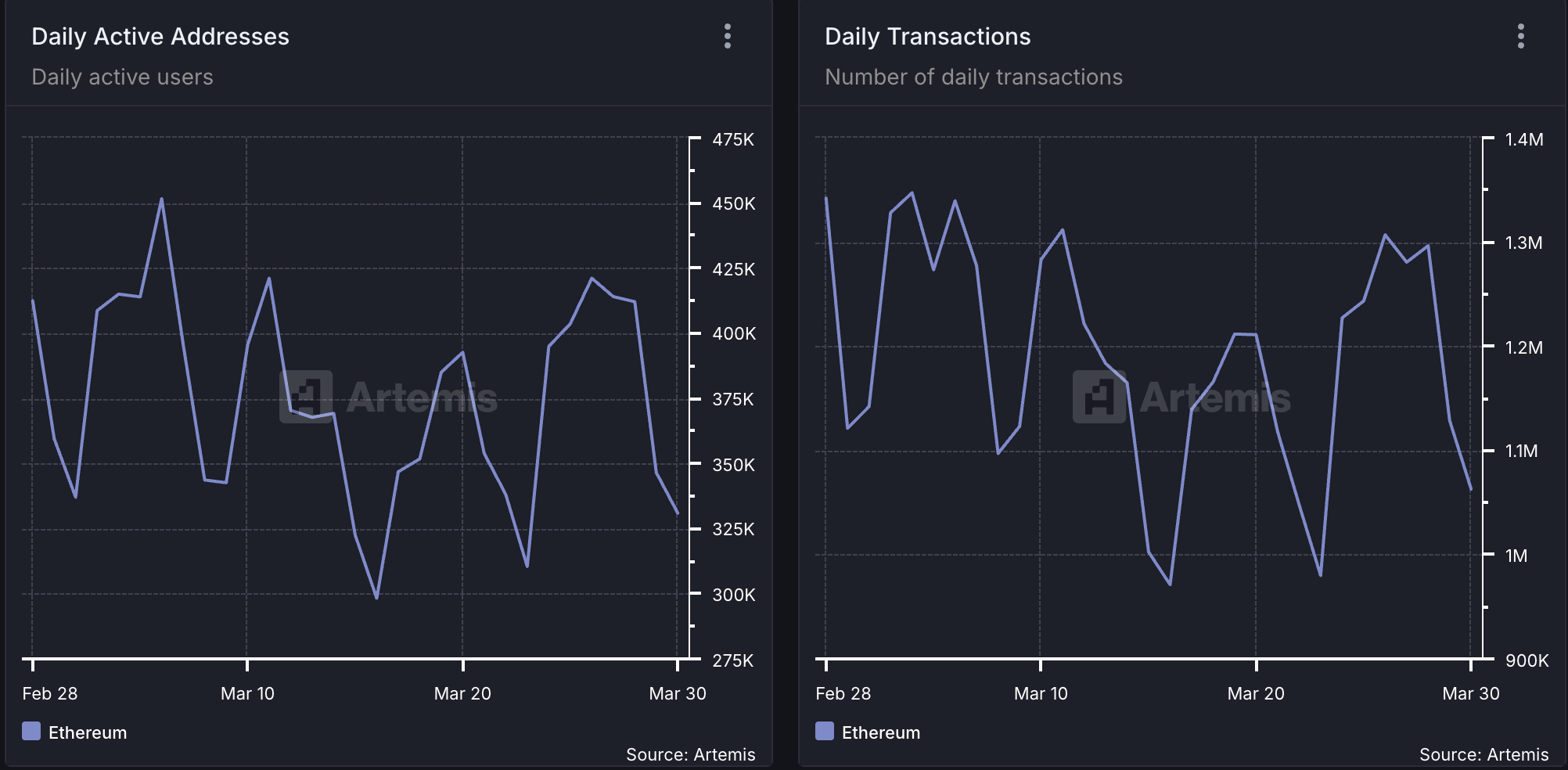

Amidst the value concern at ETH, Ethereum Community additionally skilled a extreme decline in exercise in March. In accordance with Artemis, the day by day variety of energetic addresses that accomplished no less than one ETH transaction fell 20% in March.

In consequence, the community's month-to-month transaction rely additionally plummeted. The variety of transactions accomplished with Ethereum fell 21% in March, totaling 1.06 million throughout the 31-day interval of critiques.

Ethereum Community Exercise. Supply: Artemis

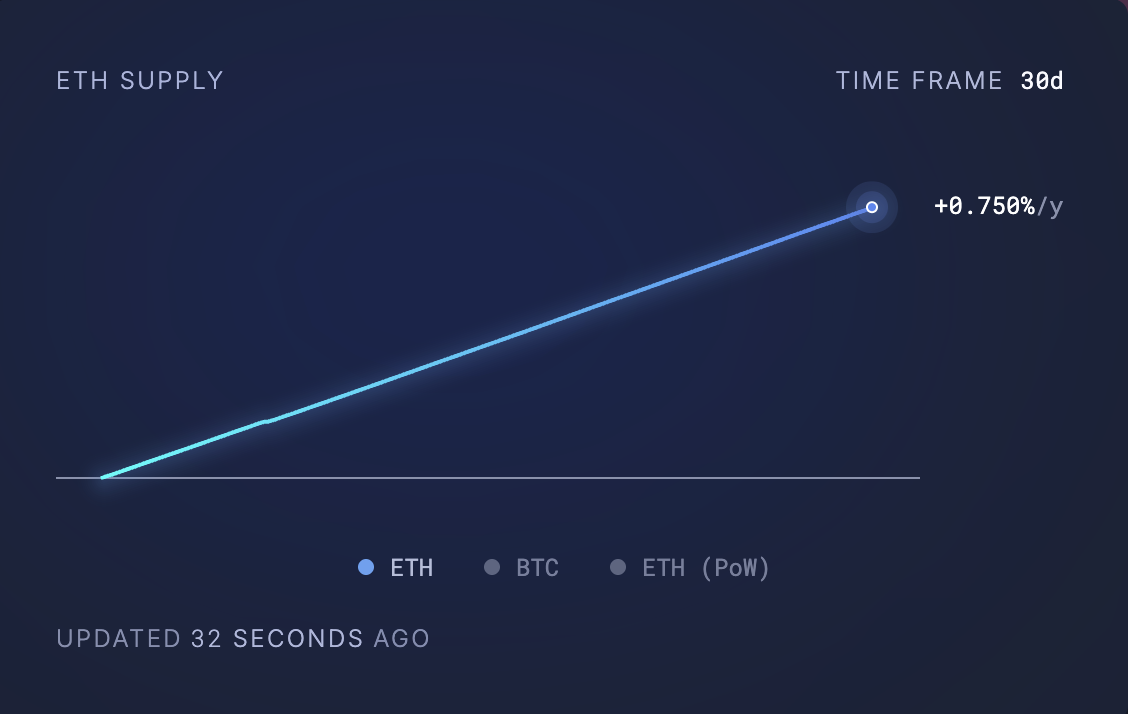

Usually, as extra customers commerce and interact in Ethereum, the burn charge (a measure of ETH tokens completely faraway from circulation) will increase, and a dynamic contribution to the deflationary provide of ether. Nonetheless, when person exercise decreases, ETH burn charges lower, and plenty of cash are circulated, growing circulation provide.

This was the case with ETH in March, when the surge in circulation was circulating. Ultrasound Gold information exhibits that 74,322.37 cash have been added to the circulation provide of ETH over the previous 30 days.

Circulating Ethereum provide. Supply: Ultrasonic Cash

Usually, a surge within the provide of such belongings with out absorbing the corresponding demand will increase downward strain on costs. This dangers ETH to increase its decline in April.

What's subsequent for Ethereum? Consultants say inflation is probably not a serious concern

In an unique interview with Beincrypto, Intotheblock analysis analyst Gabriel Halm mentioned ETH's present inflation developments “is probably not a serious purple flag” needs to be cautious in April.

Halm mentioned:

“Though Ethereum's provide has lately stopped being deflationary, the annual inflation charge was 0.73% final month, dramatically decrease than Bitcoin, and for buyers this medium degree of inflation is conditional on the duty of community customers' actions, developer recruitment and implementing companies.”

Moreover, as as to if Ethereum's decline performed a key function in Ethereum's latest value battle, Halm advised that its influence may very well be exaggerated.

“Traditionally, Ethereum provide remained deflationary from September 2022 to early 2024, however the ETH/BTC pair continues to be declining. This implies that macroeconomic, broader market forces can play a way more essential function than simply altering token provide.”

Comparability of ETH/BTC market capitalizations. Supply: IntotheBlock

Halm mentioned what ETH house owners ought to anticipate this month:

“In the long run, whether or not the decline in Ethereum and rallies in April are more likely to rely extra on market sentiment and macro developments than on short-term provide dynamics. Nonetheless, it’s important to have a look at community developments that would promote up to date actions and strengthen ETH's key place within the broader crypto panorama.”