Bitcoin costs skyrocketed above the $95,000 mark on April 25, 2025.

The rally was facilitated by restoring the foundations of sturdy market momentum and networks.

Analysts emphasised that if BTC exceeds $95,500, it might unleash a breakout at $113,800.

Primarily based on the improved MVRV band and capital influx, BTC value forecasts present additional rise regardless of the potential for short-term cooling.

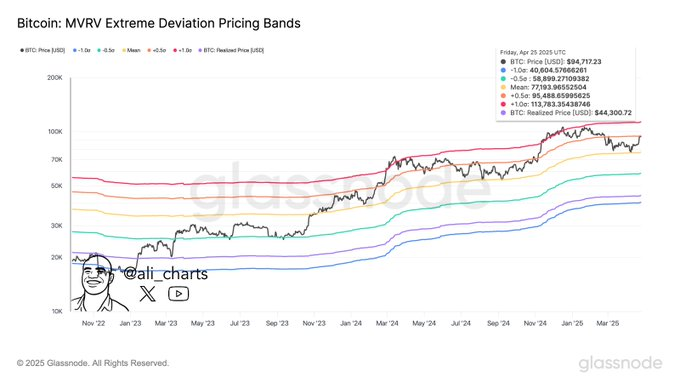

MVRV Band reveals potential Bitcoin value breakout

Crypto analyst Ali Martinez has recognized Bitcoin's present motion by means of the MVRV value vary as a significant bull sign.

In response to Ali, Bitcoin costs have entered a traditionally highly effective zone after regaining the $95,500 stage, much like the earlier Bull Cycle.

Supply: Ali Martinez, X

The MVRV (Market Worth to Realized Worth to Worth) mannequin tracks when Bitcoin's value is overvalued or undervalued in comparison with its historic value habits.

Ali Martinez defined that navigating larger deviation bands usually triggers main gatherings.

His BTC value forecast means that if Bitcoin stays sturdy above $95,500, it might collect in direction of its $113,800 goal within the coming months.

Ali's newest chart highlighted the deviation band that concludes favorably with Bitcoin costs.

Traditionally, such circumstances precede a powerful discovery section, reinforcing the bullish view that the following main transfer might coincide with the $113,800 mark.

Analysts level to capital inflows and decrease threat ranges

Analyst Willie Wu reported that the community's fundamentals have been resolutely bullish, strengthening its constructive outlook for Bitcoin costs.

Woo stated it’s informing us that capital flows getting into the Bitcoin community can be strengthened and accumulation will enhance throughout key addresses.

The speculative move metrics that seize short-term buyers' habits have additionally run out of inventory, in keeping with WOO.

This mix normally reveals a decreased draw back threat and enhanced liquidity.

This raised the BTC value forecast estimate with an intermediate goal of $103,000 and the final word purpose of $108,000.

Moreover, Woo highlighted that the Bitcoin threat mannequin, which beforehand decided the most important cycle swing, has launched its first development in months.

Low-risk measurements sometimes preceded main value expansions throughout earlier Bitcoin Bull run.

Quick-term volatility is earlier than the upper stage

Regardless of the broader bullish setup, Wu warned that Bitcoin costs might expertise short-term volatility.

He noticed that the on-chain VWAP (quantity weighted common value) indicator rose to +3 normal deviation.

Wu defined that such overexpansion was not normally sharp discount, however fairly led to lateral integration or slowing upward motion.

He stated that even when Bitcoin costs are suspended or barely soaked, they’re more likely to signify a wholesome reset inside the ongoing bull construction.

On the time of writing, the BTC value was traded at $94,438.08. This is a rise of 0.06% over the previous 24 hours.

Woo stated minor pullbacks are regular within the BTC market, so long as there’s a risk of enhancing liquidity developments to justify BTC value forecasts.

Vital Bitcoin Value Ranges to Monitor

Moreover, Reed Carson noticed that Bitcoin costs have utterly retested long-term uptrend assist throughout current pullbacks.

His evaluation confirmed that ETF inflow would return to ranges in late 2024, boosting Bitcoin's macro bullish setup.

In response to Carson's charts, Bitcoin costs remained firmly inside parallel upward channels of month-to-month time frames.

Costs recovered sharply from the low channel boundary, almost $77,000, confirming the energy of the construction.

Traditionally, the restoration of Bitcoin from the same place has resulted in a congregation prolonged in direction of higher channel resistance.

Supply: Reed Carson, X

Carson predicted that if the channel development continues, Bitcoin value forecasts might attain between $115,000 and $120,000 by June or July.

Whereas scripting this report, the Higher Trendline was near $118,000, offering a pure goal for Bitcoin's subsequent main gathering.