Bitcoin (BTC) seems to be knocking on a monster's short-squeezing door.

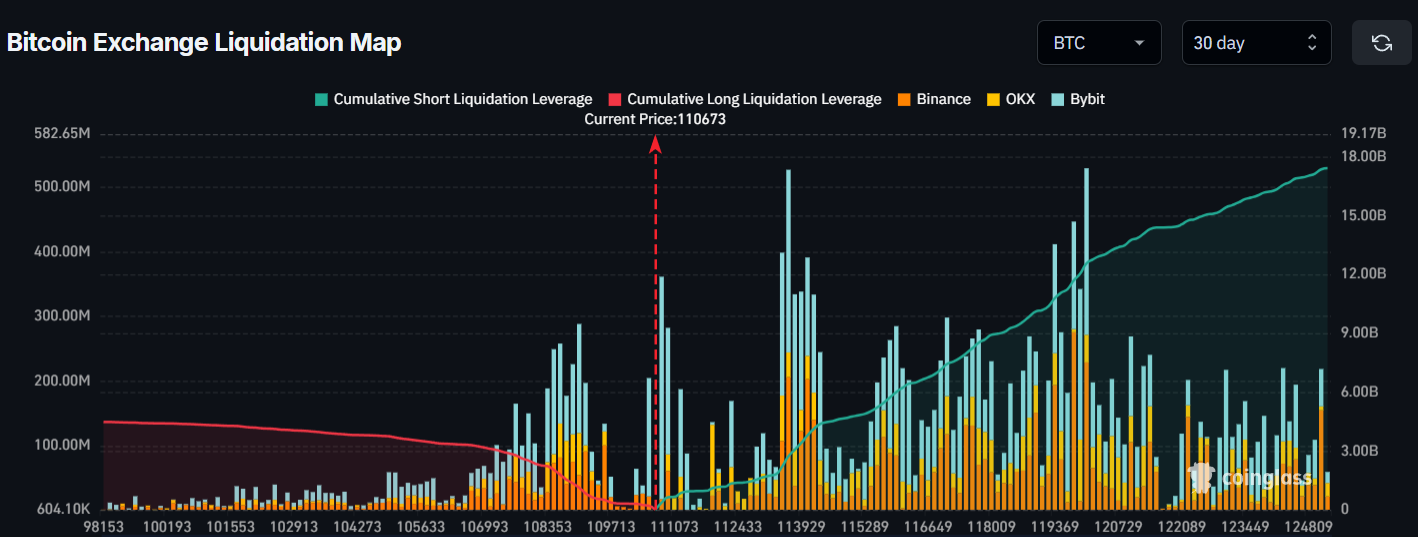

In accordance with Bitcoin Warmth Map, if belongings surge past $125,000, main exchanges comparable to Binance, Bybit, and OKX might liquidate a $17 billion brief place. Coinglass Knowledge obtained by Finbold on August twenty ninth.

Within the chart under, the rising inexperienced curve on the proper shortens the brief liquidation leverage, steadily growing, suggesting mounting stress.

It strikes additional upwards from the danger of round $113,000, inflicting a cascade of pressured liquidation, trapping the late vendor and outweighing costs.

Will Bitcoin rebound?

The world's greatest cryptocurrency has slipped at this time, buying and selling at $110,673 on the time of writing, and merchants are hoping for extra downsides after not receiving crucial help.

Analyst Michael Van de Poppe stated on Thursday, August twenty eighth that liquidity ranges within the vary of $110,000 to $108,000 might then be examined if gross sales stress continues. The subsequent day, Bitcoin truly fell to the extent at round $110,000.

Nonetheless, analysts additional hinted that the rebound would observe the correction.

“If Bitcoin can't exceed $112K, we're most likely dealing with a really ugly correction throughout the board. It's most likely the final correction, and it's solely occurring for the following interval.”

#bitcoin can't maintain $112K and continues to fall.

I believe we'll see some low numbers. It can deliver $ETH again to impartial and supply an excellent alternative for the market. pic.twitter.com/iaabrm9j4d

– Mycal Van de Poppe (@cryptomichnl) August 29, 2025

It's nonetheless tough to inform what the close to future holds, however the subsequent few days have gotten extra essential for BTC as buyers await the discharge of their Private Consumption Expense (PCE) index.

Knowledge might have a significant affect on Bitcoin within the subsequent few weeks, particularly because of issues that President Donald Trump would possibly encourage central banks to handle US debt extra proactively.

Featured Photographs through ShutterStock