Bitcoin (BTC) reveals indicators of potential turnaround regardless of latest volatility. It’s because essential on-chain indicators and institutional flows recommend that feelings enhance. The Mayer a number of stays beneath 1, suggesting an underestimation.

In the meantime, institutional confidence seems to be returning, with BlackRock's latest 2,660 BTC purchases marking the largest influx into Bitcoin ETFs in six weeks. As markets stabilize and adapt to macroeconomic pressures, Bitcoin's path to a brand new highest is starting to take form.

BTC Mayer a number of remains to be lower than 1

Bitcoin's Mayer a number of is at the moment sitting at 0.98, barely above the latest low of 0.94 recorded on March tenth.

This studying means that Bitcoin remains to be undervalued in comparison with historic norms, because it continues to fall beneath the 200-day transferring common.

The indicator has hovered beneath the 1.0 mark for many of the latest integration interval, elevating questions on when BTC will regain sufficient momentum to push in the direction of the brand new excessive.

Bitcoin Mayer twice. Supply: GlassNode.

Mayer A number of measures the ratio of Bitcoin's present value to the 200-day transferring common and offers perception into whether or not property are overexpanded or undervalued.

Traditionally, values beneath 0.8 have a tendency to point that Bitcoin is considerably discounted and could also be within the long-term accumulation zone, whereas ranges above 2.4 typically point out an overheated euphoria.

The present studying is 0.98, and Bitcoin is approaching a fierce threshold from impartial.

When Mayer final soaked in 0.84, Bitcoin rapidly rallied between $54,000 and $65,000 in simply two weeks. It then stabilized between 1.2 and 1.4 after which lastly surged past $100,000 for the primary time.

Historical past isn't essentially repeated, however this present setup might be an early indication that Bitcoin is laying the inspiration for the following main leg.

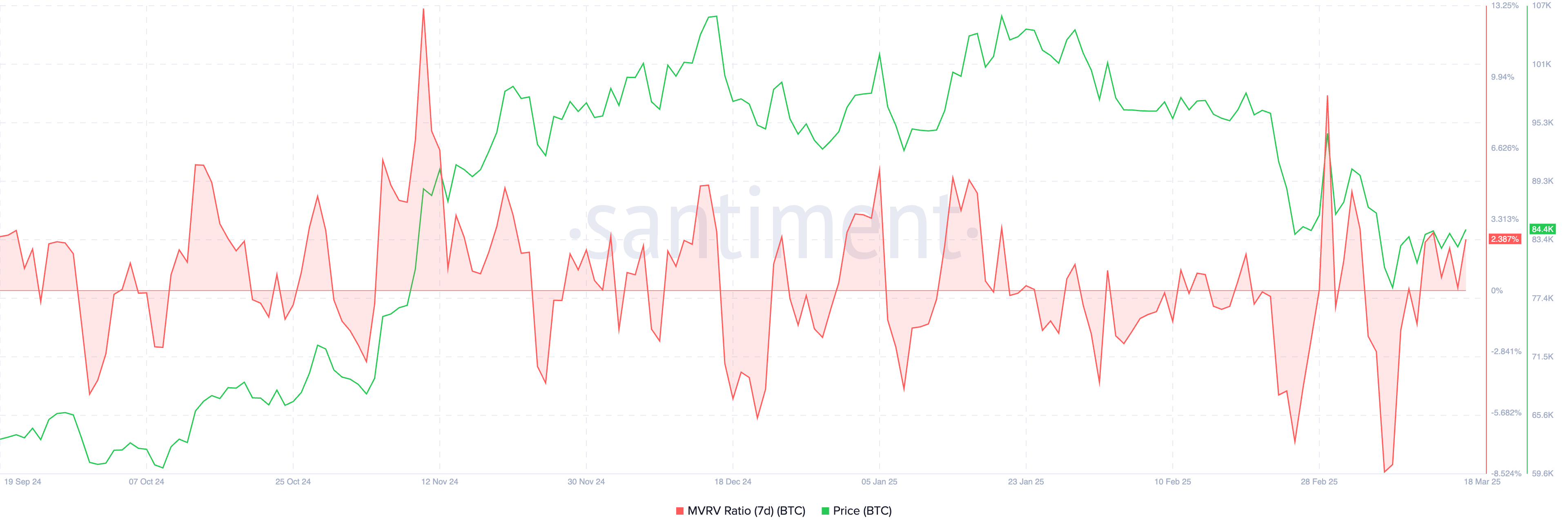

Bitcoin MVRV brings a essential threshold

Bitcoin's seven-day MVRV (realized worth from market worth) ratio rose to 2.38%, recovering from its latest low of -8.44% on March eighth.

This rebound signifies that short-term holders are starting to see modest earnings, however the historic sample means that stronger value momentum will usually final because the 7D MVRV exceeds the 5% mark.

On the present degree, BTC seems to be in transition. The feelings are altering, however they don’t seem to be fully inverted right into a bullish breakout state of affairs.

BTC 7D MVRV. Supply: Santiment.

7D MVRV measures the ratio of Bitcoin's market worth to the common value paid by short-term holders (normally those that have acquired BTC previously 7 days). A detrimental ratio signifies that these holders are underwater, whereas a constructive measure implies that they’re sitting on revenue.

Traditionally, BTC tends to realize upward momentum when the 7D MVRV strikes above +5%. On condition that BTC remains to be beneath this threshold, additional accumulation or integration could also be required earlier than pushing convincingly to create a brand new excessive.

If the ratio continues to rise and go above 5%, it might result in new bullish actions and potential breakouts to recent, top-highs.

Will Bitcoin (BTC) create a brand new excessive quickly?

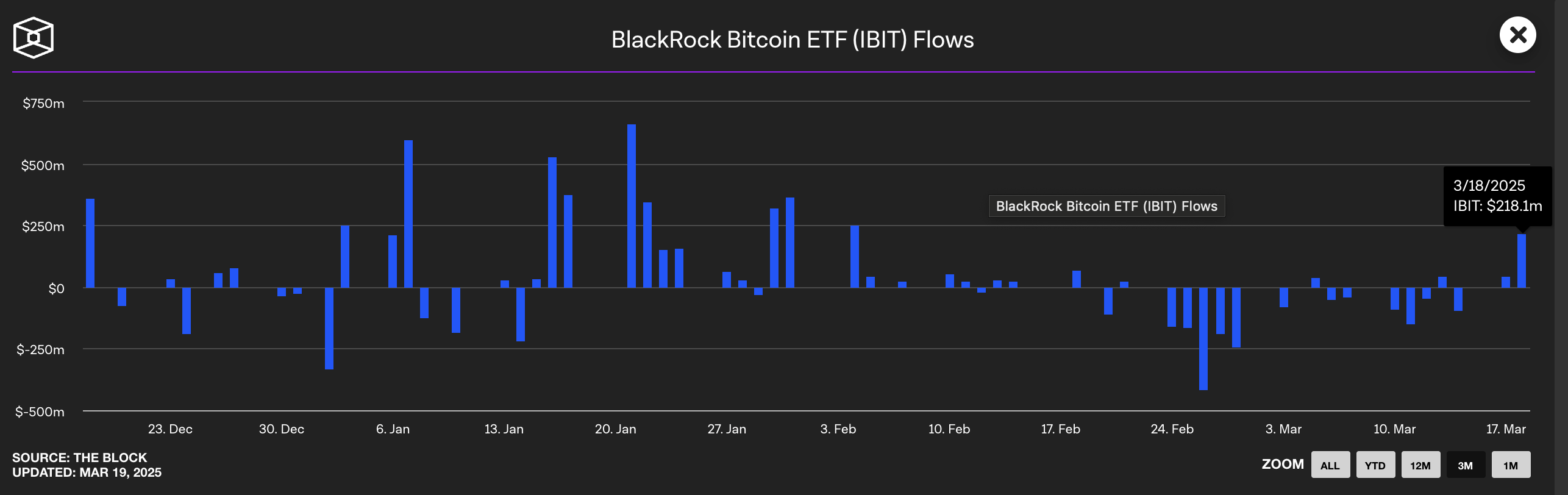

Regardless of Bitcoin's 11.4% decline within the final 30 days, BlackRock seems to have returned the bullish sentiment of the system as its belief has been renewed in BTC.

The world's largest asset supervisor not too long ago added 2,660 bitcoins to iShares Bitcoin Belief (IBIT), marking the most important influx into the fund previously six weeks.

This essential buy happens after a interval of uncertainty in IBIT flows since early February, suggesting that as market circumstances evolve, establishments are as soon as once more positioned for potential rises.

BlackRock Bitcoin ETF circulation. Supply: TheBlock.

BlackRock's newest purchases might present a broader shift in sentiment as they refocus with short-term volatility on Bitcoin's long-term worth.

Whereas institutional pursuits are being picked up once more, the market is slowly adapting to macro pressures like Trump's proposed tariffs.

Regardless of the lingering uncertainty, the brand new greatest Bitcoin pricing is getting stronger as confidence returns. As soon as the macro circumstances are steady, Bitcoin could also be prepared for an additional push quickly.