As Bitcoin (BTC) tries to regain its $120,000 resistance zone, insights from the synthetic intelligence (AI) platform present that there are acceptable circumstances for the biggest cryptocurrency to rise to $135,000 by October 1, 2025.

The push to $135,000 represents an virtually 17% enhance from the press-time worth of the $115,511 asset.

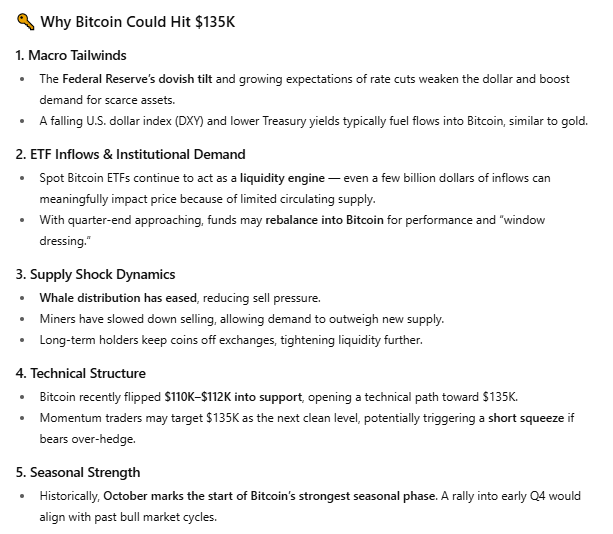

Bitcoin's highway to $135,000

ChatGpt's forecast reveals that the highway to $135,000 stays dangerous, however is supported by a mix of macroeconomic tailwinds, institutional demand, and a good market construction.

ChatGpt highlighted that the federal Reserve's unbelievable stance and expectations for rate of interest cuts have weakened the US greenback and elevated demand for uncommon property like Bitcoin. Traditionally, softer {dollars} and decrease Treasury yields have leaked capital to valued alternate options, giving Bitcoin a gold-like tailwind.

He additionally identified discovering Bitcoin ETFs as the principle liquidity driver. The mannequin has famous that even a modest influx can transfer costs given the restricted provide of Bitcoin, and that future quarter-end rebalancing might add much more institutional demand.

On the provision facet, Bitcoin reveals indicators of a tightening market. ChatGpt noticed that whales have slowed distribution, miners have lowered gross sales and long-term holders proceed to keep away from exchanges. Due to this fact, this reduces out there liquidity and will increase the influence of progressive demand.

From a technical standpoint, Bitcoin supported the $110,000 to $112,000 zone within the brief time period. This paves the best way for $135,000, defined ChatGpt.

To this finish, momentum merchants can speed up their motion, particularly when brief sellers increase excessively. Seasonality might additionally play a job, as October has traditionally been one in every of Bitcoin's strongest months.

Bitcoin dangers are heading in direction of October

Nevertheless, ChatGpt warned that dangers remained, together with potential ETF spills, Hawkish FED alerts, or geopolitical shocks that permit traders to level to safer property. Giant gross sales from whales and miners, extreme leverage resulting in liquidation, and regulatory setbacks may also assist to curb Bitcoin rallies.

In conclusion, CHATGPT highlighted that Bitcoin's macrotail winding, provide dynamics and seasonal power mixture might attain $135,000 inside a couple of weeks, however adverse ETF flows, central financial institution shifts, or on-chain gross sales might halt rallies below $130,000 or set off a pullback to assist of $110,000.

Featured Photographs by way of ShutterStock